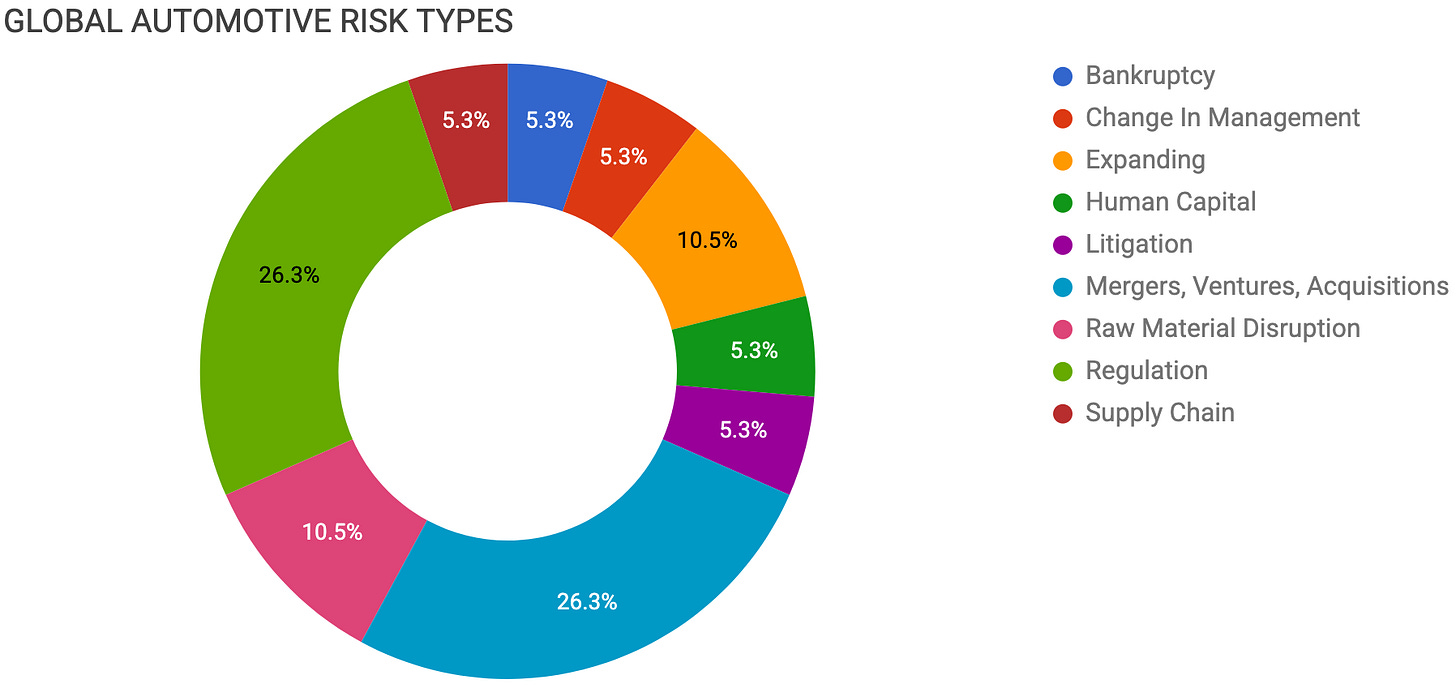

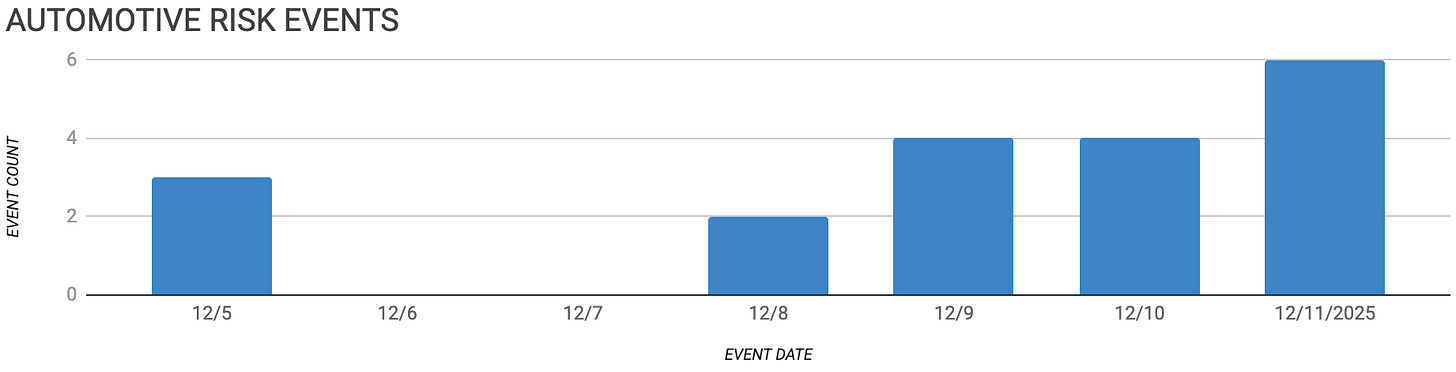

Automotive Supply Chain Risk Digest #460

December 5 - 11, 2025, by Elm Analytics

Contents

BANKRUPTCY

Luminar debt distress threatens sensor continuity

CHANGE IN MANAGEMENT

BMW appoints production chief as chairman

EXPANDING

Aisin Canada adds Lexus sunroof line

Coficab opens second Durango cable plant

HUMAN CAPITAL

Avancez cuts shift after sudden cancellation

Auto Industry’s Talent War

LITIGATION

Stellantis supplier pricing dispute risks shutdowns

MERGERS, VENTURES, ACQUISITIONS

Ford & SK On end battery joint venture

Ford & Renault partner on small EVs

Audi sells majority Italdesign stake

Tianyouwei buys insolvent German supplier

RAW MATERIAL DISRUPTION

China eases rare earth export licensing

US backs Congo cobalt copper supply

REGULATION

Mexico imposes steep Asian import tariffs

Indian automakers hit by Mexico tariffs

USMCA future uncertainty alarms automakers

EU tariffs shift Chinese sales mix

US warns against China-linked EV entry

SUPPLY CHAIN

Nexperia governance fight tightens chip supply

Bankruptcy

Luminar Technologies has missed several interest payments and hired a chief restructuring officer as it tries to reorganize its debt. Lenders are holding off on enforcement for now, but pressure is building.

The situation is also complicated by a dispute with Volvo, where Luminar is claiming “significant damages.” Volvo has decided to stop using Luminar LiDAR on the EX90 and ES90 starting in April 2026 and has already begun production without Luminar sensors.

Luminar, which also supplies Tesla, reported a large operating loss in Q3, and its stock is down 85% this year.

Financial distress at a LiDAR supplier that is tied to key OEM programs raises continuity risk for ADAS and autonomy sensor sourcing, potential last-minute revalidation costs, and knock-on exposure for connected Tier-1 and electronics supply chains.

Change In Management

BMW has chosen Milan Nedeljković as its next chairman, effective after the annual meeting in May, replacing Oliver Zipse. Nedeljković, who currently leads production, will be responsible for steering BMW through trade tensions, new tariffs, and ongoing supply chain issues.

The company depends heavily on factories in the US and China, which makes it vulnerable to tariff changes, higher duties on EVs from China in Europe, and shortages of rare earths and semiconductors. BMW has also seen its sales in China decline amid intense competition from local EV makers.

This leadership change comes as BMW faces rising geopolitical and supply chain risks that could reshape its cost base, production footprint, and sourcing strategies.

Expanding

Aisin Canada plans to expand its Stratford, Ontario, facility by adding a new panoramic sunroof production line for Toyota’s Lexus NX. Production is expected to begin in December 2026. The project includes about $8M in new equipment and programs.

According to Aisin, the new line will shift sunroof production from Japan to Canada and help sustain the plant as it faces higher tariffs and logistics costs this year, while deepening North American content for the Lexus NX program.

Coficab has opened Coficab II, a second facility making automotive electrical cables at the Durango Industrial Logistics Center in Mexico, and the plant is already operating. The company said it has invested $60M in the new phase, and employment is now over 1.4k across the two sites.

Human Capital

Avancez is permanently laying off 143 workers at its Hazel Park, Michigan, facility after a customer abruptly canceled production, likely GM Factory Zero.

Avancez specializes in just-in-time manufacturing, suspension modules, sequencing, and tire and wheel assembly. The move underscores how quickly OEM or Tier-1 schedule changes can ripple into supplier employment and capacity decisions.

Litigation

Stellantis has accused Woodstock, Ontario, brake rotor supplier Peterson Springs of threatening to halt shipments to Michigan plants unless it was paid double the previously agreed price.

A judge has appointed an independent supervisor to review the supplier’s finances and operations after Stellantis said the proposed increase would add about $55M in costs and risk the shutdown of two Michigan assembly plants.

Peterson Springs said it was sometimes losing money under legacy pricing set by the prior owner, while Stellantis said it was honoring existing purchase orders.

Disputes over pricing and supplier financial health can quickly escalate into production-stopping risks, highlighting the growing strain on supplier-OEM relationships.

Mergers, Ventures, Acquisitions

Ford and SK On are ending their $11.4B BlueOval SK joint venture and will split ownership of the three US battery plants covered by the deal.

Ford will assume full control of both Kentucky battery plants, one already in operation and the other still under construction.

SK On will own the Tennessee plant and plans to use it to serve a broader customer base, including energy storage projects. The company said the change reduces its reliance on Ford’s volatile EV demand and lets it focus more on the faster-growing energy storage segment.

Ending the joint venture before all plants are fully online signals less confidence in Ford’s future EV production and introduces new uncertainty around battery supply, capacity, and sourcing for upcoming EV programs in North America.

Ford and Renault will co-develop small, affordable Ford-badged EVs for Europe, using Renault’s AmpR Small platform to reduce development time and cost. Production of the first model is targeted for a Renault plant in northern France, with launch planned in 2028. The partnership fills a gap in Ford’s European EV lineup and counters increasing Chinese competition.

The challenge is timing. A 2028 launch puts Ford at risk of arriving after rivals have already established volume in the budget EV segment. That matters because Ford’s European business is already under pressure.

Explorer and Capri EV sales have been weak, and its underutilized Cologne, Germany, plant could face repurposing or closure if Ford cannot feed it with new products.

The partnership also includes joint van development, reinforcing the broader industry shift toward shared platforms and joint production.

Renault’s scalable architecture gives Ford a cost-effective entry point, but a partner-led strategy adds execution, timing, and supply chain risk. That includes questions about plant utilization, supplier capacity reservations, and long-lead commitments, especially if competitors lock in volume earlier.

Suppliers should expect tougher pricing conversations, more platform commonality across nameplates, and more frequent sourcing resets. Standardized EV architectures can shift which suppliers win high-value content that carries across multiple models, and which suppliers get squeezed on price as OEMs defend cost positions in Europe.

Volkswagen-Audi will sell a majority stake in Italdesign to US-based technology firm UST as part of its broader restructuring and focus on EVs and core technologies.

Lamborghini and Audi will retain minority stakes under the deal, and Audi will remain a long-term strategic customer, preserving existing program relationships.

UST plans to combine Italdesign’s automotive design and engineering capabilities with its strengths in digital systems, software-defined vehicles, and AI, and has committed to protecting jobs and keeping sites open for four years.

The change in ownership at this major European engineering and design supplier introduces medium-term uncertainty around capabilities, talent retention, and strategic direction, even as continuity with key OEM customers continues.

China’s Tianyouwei will buy insolvent German supplier Krämer for $1.1M, aiming to pair its product lineup with Krämer’s European customer relationships. The deal could preserve continuity for cockpit and infotainment programs, but it carries integration and financial stability risks.

Raw Material Disruption

Ford reported that some of its Chinese rare-earth magnet suppliers have received Beijing’s first batch of new “general” export licenses. These permits allow larger shipments to specific customers for one year and require fewer approvals per shipment.

The change, which follows a meeting between Xi and Trump, is intended to ease shortages caused by China’s April shift to shipment-by-shipment licensing, which disrupted parts of the auto supply chain.

Germany’s foreign minister noted that German automakers were not included in this initial round. In response, BMW is monitoring the situation, while VW said its supply remains stable as suppliers continue working to obtain licenses.

Even if access improves for some manufacturers, the selective licensing approach keeps rare-earth magnets a key chokepoint and leaves supply risks uneven across automakers and suppliers.

The US Development Finance Corporation is planning an investment in a new joint venture between Congo’s state miner Gecamines and Swiss commodities trader Mercuria. The aim is to secure supplies of cobalt and copper.

The proposed agreement would give US manufacturers first rights to buy some of the output. It would also help fund export-enabling infrastructure, such as the Dilolo-Sakania rail link, to improve logistics out of the region.

For automakers and battery makers, the upside is a more reliable and traceable source of cobalt, which could gradually reduce dependence on China’s processing ecosystem.

However, in the near term, volatility is likely to persist, as supply remains tight. Price swings will likely continue until Congo’s export quota framework and new trade rules are finalized, even as new capacity and logistics investments ramp up.

Regulation

Effective January 1, Mexico will impose new import tariffs of up to 50% on vehicles and auto parts from countries without a free trade agreement, including China, South Korea, India, Thailand, and Indonesia.

Most auto- and parts-related tariff lines will rise to 35%, while select auto parts and specialty vehicles will hit the 50% ceiling.

The move is widely seen as an effort to ease US pressure over China-linked content entering North American supply chains ahead of the 2026 USMCA review.

For automakers and suppliers, these higher landed costs could accelerate sourcing shifts, disrupt Mexico-based production footprints that rely on Asian inputs, and increase both cost and compliance risks across North American vehicle programs.

The tariff hike hits roughly $1B in Indian vehicle exports, with Volkswagen, Hyundai, Nissan, and Maruti Suzuki among the most exposed.

This comes despite lobbying that Indian vehicles account for only a small share of Mexico’s market and are not focused on US re-exports. The higher tariffs increase utilization and scale risks for India-based plants that depend on Mexico-bound volumes.

Automakers and suppliers are urging the Trump administration to preserve the USMCA as a trilateral agreement, warning that a shift to separate bilateral deals with Canada and Mexico would disrupt deeply integrated North American supply chains.

Industry groups told US trade officials that vehicle and parts programs have been built and optimized in accordance with USMCA rules, and that replacing them would require costly supply chain redesigns and add significant uncertainty.

Trade officials have confirmed that the administration is considering revising or even exiting the agreement ahead of its 2026 review, despite companies having invested billions of dollars on the assumption of long-term continuity.

Rising uncertainty around USMCA raises near-term risk for sourcing decisions, rules-of-origin compliance, and capital planning across North American vehicle and parts supply chains.

EU tariffs aimed at Chinese EVs have pushed Chinese automakers to shift toward hybrids and ICE models, driving a sharp rise in overall European sales. The result is higher import penetration without meaningful local production, raising costs and increasing competitive pressure on European supply chains.

US automakers are warning that Chinese-backed automakers and battery makers pose significant risks to US EV and battery supply chains, urging Washington to prevent their entry, codify effective import restrictions, and address subsidy-driven dumping.

These concerns highlight the possibility of policy-driven shifts in sourcing, localization requirements, and cost structure.

If US restrictions tighten, suppliers could see faster regionalization of battery and EV sourcing, higher compliance costs, and a reshuffling of long-term capacity, pricing, and customer strategies tied to China-linked content.

Supply Chain

Wingtech, the Chinese parent of Netherlands-based Nexperia, has invited the court-appointed custodians overseeing Nexperia’s shares to talks.

This signals a possible step toward easing a governance dispute that intensified after Dutch intervention and the court-ordered removal of Wingtech’s founder as CEO.

Nexperia said it is aware of the invitation but claims it has not seen a willingness to engage on its priority: restoring normal operations and supply chain flows.

Wingtech insists that “lawful control” must be addressed first.

The standoff is already disrupting chip availability. Automakers face production issues, dwindling inventories, and warnings that shortages could re-emerge in January.

Europe-China wafer shipments remain halted amid payment and substitution disputes.

This governance fight is directly tightening semiconductor supply, raising short-term allocation risk and potential line-down exposure for OEMs and Tier-1s if wafer and packaging flows do not normalize quickly.