🎃 Automotive Supply Chain Risk Digest #454

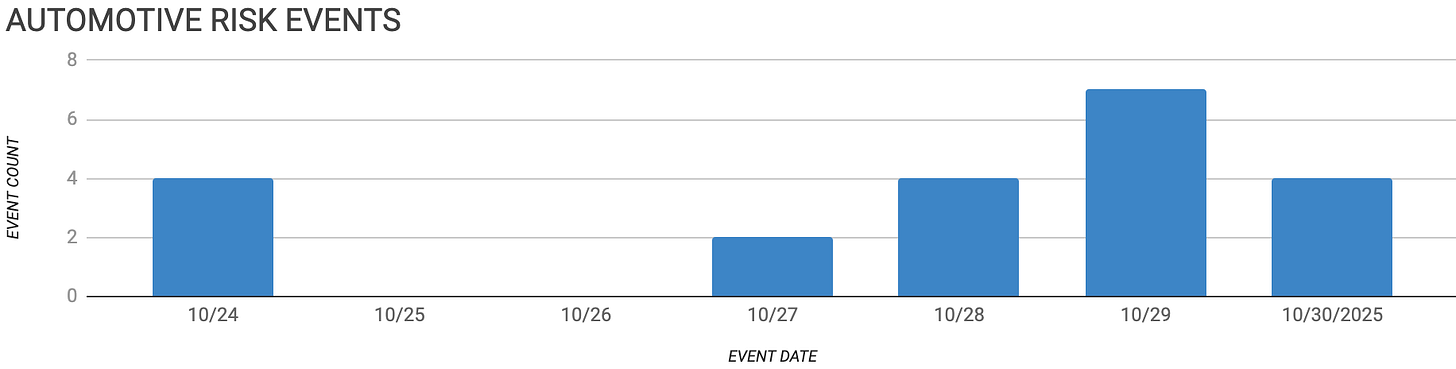

October 24 - 30, 2025, by Elm Analytics

Dear Reader,

Our special segment, Nexperia Deep Dive: A Witches’ Brew of Supply Chain Toil and Trouble, examines how the semiconductor dispute has boiled over into something far larger… a frightening mix of politics, policy, and production pressures now haunting the global automotive sector.

There’s a lot brewing in this week’s issue, so be sure to scroll to the end (or use the index bar on the left in Substack) to catch everything that’s bubbled up.

Warmly,

Nick Gaydos

Contents

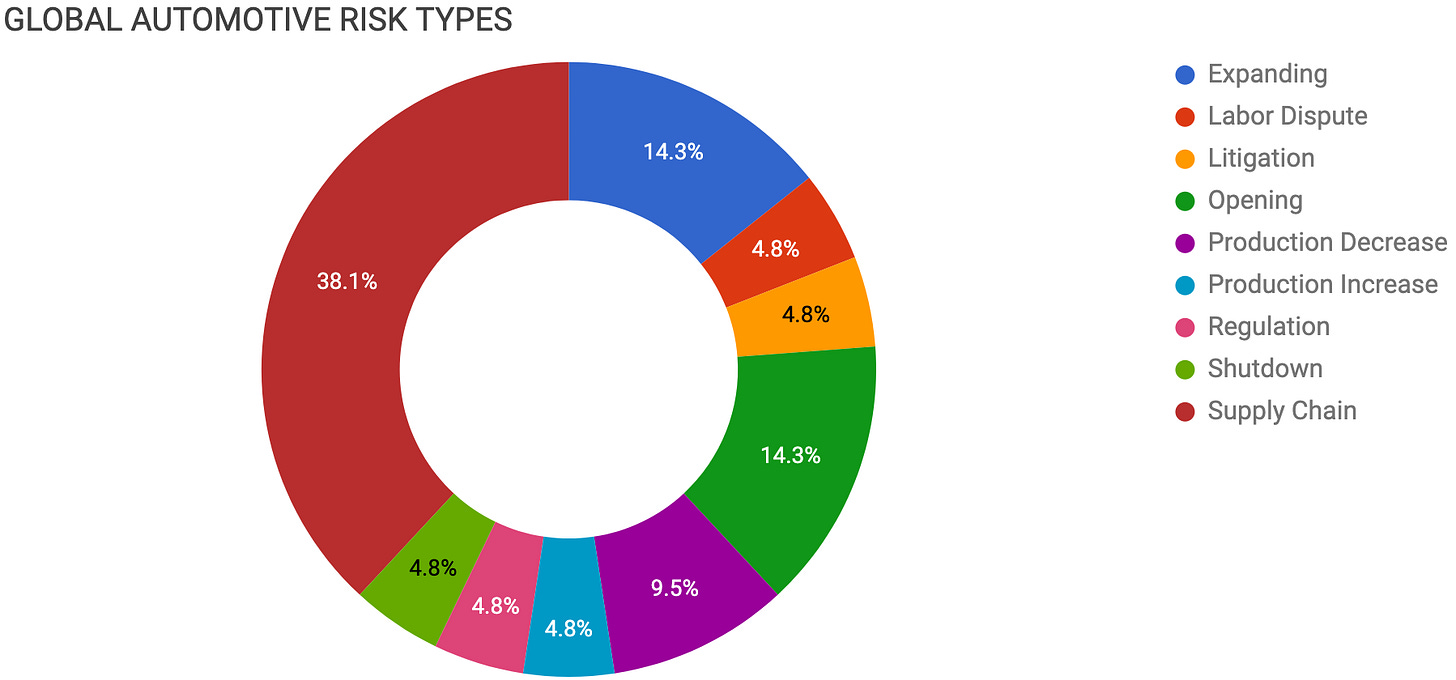

EXPANDING

Suzuki boosts India SUV production

American Axle modernizes Michigan plant

ElringKlinger grows South Carolina site

LABOR DISPUTE

VW Chattanooga workers authorize strike

LITIGATION

Michigan court reviews contract enforceability

OPENING

Doosung builds EV plant in Mexico

VW Ontario battery plant progresses

Steelform opens new Mexico facility

PRODUCTION DECREASE

GM cuts EV output, layoffs follow

Gestamp facility idled after GM pivot

PRODUCTION INCREASE

Stellantis relaunches RAM 1500 production

REGULATION

China ends EV subsidies & reshapes market

Reliance rushes battery gear imports

SHUTDOWN

Nissan halts production after supplier fire

SUPPLY CHAIN

Mexico protest blockades impact logistics

SPECIAL SEGMENT

Nexperia Deep Dive: A Witches’ Brew of Supply Chain Toil and Trouble

Expanding

Suzuki will invest $8B over the next 5 to 6 years to expand production in India to 4M units and launch eight new SUVs to regain its lost market share. The push cements India’s role as Suzuki’s global production hub amid intensifying local competition.

American Axle is investing $133M to modernize its Three Rivers, Michigan, plant as tariffs drive OEMs to favor US production. The project enhances competitiveness “with its ability to secure new OEM contracts” and reflects the growing momentum of onshoring.

Germany’s ElringKlinger will invest $68.5M to expand its Easley, South Carolina facility, adding 294 jobs and new production lines for EV cell contact systems and lightweight components. The site, already the company’s central US battery hub, will begin expanded operations in early 2027.

Labor

Volkswagen’s 3.2k Chattanooga, Tennessee, UAW-represented workers authorized a strike amid stalled contract talks over pay and job security. Union activism at foreign automakers has increased as workers push for Detroit-level labor gains.

Litigation

The Michigan Supreme Court will hear FCA US, LLC v. Kamax Inc., a case that will decide whether purchase orders committing to “approximately 65–100%” of an OEM’s needs create a binding requirements contract.

The ruling will settle conflicting interpretations between state and federal courts and set a uniform rule for Michigan contract law.

A definitive decision could significantly impact risk across OEM-supplier programs, influencing negotiations, contract enforcement, and litigation strategies in Michigan-based supply chains.

Opening

Volkswagen’s $14B PowerCo battery plant in St. Thomas, Ontario, is moving ahead despite regional auto plant shutdowns. Foundations are poured, and hiring has begun for the 3k jobs expected by 2027.

Analysts are divided on the project’s outlook. Some warn that weak EV demand and limited policy support could threaten its long-term success. Others point to strong government incentives, VW’s need for a local battery supply, and the site’s strategic location as reasons for optimism.

As Canada’s largest EV battery investment, the St. Thomas plant is central to building a domestic EV supply chain amid growing uncertainty over North American EV demand and trade policy.

South Korea’s Doosung Tech is investing $27M in a new plant in Monclova, Coahuila, Mexico, to make EV and hybrid components.

Swiss and US-owned Steelform has commenced construction of a $60M automotive components plant in Pesquería, Nuevo León, Mexico. The new facility will produce speaker frames, mufflers, bumpers, and seat and chassis parts using high-strength and dual-phase steel, expanding the company’s North American manufacturing footprint following the merger of Steel Warehouse and Forming AG.

Production Decrease

General Motors will idle or scale back several EV and battery plants after the US ended its $7.5k federal EV tax credit, cutting about 3.4k jobs across Michigan, Ohio, and Tennessee. Factory Zero in Detroit will remain closed until January 2026, while Ultium Cells plants in Warren, Ohio, and Spring Hill, Tennessee, face temporary shutdowns.

GM said the move reflects slower EV sales and shifting regulations as it adjusts capacity to match demand. The automaker is taking a $1.6B charge tied to layoffs and canceled contracts. The cuts highlight growing strain in North America’s EV transition, exposing suppliers and signaling a broader pause in electrification investment.

Gestamp’s $390M Michigan expansion is in limbo after GM canceled EV pickup production at its Orion plant, leaving the new Chesterfield facility built to make steel assemblies for those models idle.

Production Increase

Stellantis has restarted production of the RAM 1500 at its modernized Saltillo, Coahuila plant in Mexico, adding advanced automation and in-house seat assembly. The relaunch increases local content and export capacity.

Regulation

China’s new five-year plan drops electric vehicles from its list of strategic industries, ending a decade of heavy subsidies and tightening discipline in an overcrowded sector of more than 150 producers.

Analysts expect slower output and exports, which reached nearly $48 billion in 2025, with Europe and Asia accounting for the majority of shipments. The policy shift could help alleviate global oversupply and create opportunities for rival automakers.

India’s Reliance is expediting shipments of Chinese battery equipment before new export rules take effect on November 8, potentially risking quality issues to avoid delays. The scramble spotlights global exposure to China’s tightening control over critical battery technology.

Shutdown

Nissan paused production at its Smyrna, Tennessee, plant on October 24 and 27 after a fire disrupted aluminum supplies from Novelis in Oswego, New York. The plant, which builds the Rogue, Pathfinder, Murano, and Infiniti QX60, plans to restart on October 28.

Supply Chain

Blockades and road occupations in Mexico have been growing recently, fueled by a combination of groups, including transportation workers protesting fare increases and farmers demanding higher, more sustainable prices for their produce.

This week, widespread highway blockades by these groups have severely disrupted logistics routes, making it impossible for many suppliers to ship parts to their customers, compounding the impact on supply chains and commerce.

Nexperia Deep Dive: A Witches’ Brew of Supply Chain Toil and Trouble

The Nexperia crisis is boiling over... a frightening mix of politics, policy, and production that’s conjuring new disruptions across the automotive world.

Apologies in advance for the seasonal analogy, but the mix of issues swirling around Nexperia right now feels like a witches’ brew of global politics and supply chain disruption.

A Dutch regulatory seizure, Chinese export controls, US trade policy, and automotive production lines are all bubbling in the same cauldron.

The result is a volatile mix that poses a significant threat to a substantial portion of the global automotive industry.

What started as a single policy decision has become a real-time stress test for the auto supply chain, exposing fragile single-source dependencies and limited visibility across tiers.

After weeks of compounding disruptions, Nexperia’s factories in China have cut production again, further exacerbating the shortage of low-cost, high-volume chips used across vehicle systems. These are not advanced processors, but foundational components that control powertrains, sensors, and safety electronics. When they stop moving, so does everything else.

The turning point this week came after a meeting between Xi Jinping and Donald Trump, where Washington agreed to suspend its new export control rule for one year. That rule, announced in late September, expanded US restrictions to any company more than 50% owned by an entity on the trade blacklist, including Nexperia’s Chinese parent, Wingtech Technology. Analysts believe it was no coincidence that the Netherlands seized control of Nexperia shortly after, citing mismanagement and a technology transfer to China.

With the rule now on hold, Beijing is pressing The Hague to return control of the company to Wingtech. Dutch officials are caught between staying consistent with their earlier intervention and aligning with Washington’s sudden policy reversal. This seemingly targeted policy intervention has turned into a geopolitical tug of war, leaving the Netherlands isolated between its most significant ally and its largest trading partner.

China, meanwhile, has suspended its own rare-earth export restrictions, demonstrating that it can utilize raw materials and manufacturing leverage as a counterbalance to US trade policy. For Europe, it’s another reminder that “strategic autonomy” is easier to talk about than to achieve when chips and minerals become political bargaining pieces.

While diplomats trade spells and counterspells, auto manufacturers are left to face the curse in daylight:

Continental’s former electronics division, Aumovio, announced layoffs directly tied to the missing Nexperia components.

Bosch warned that production is at risk and called for coordination between OEMs and suppliers to ration available stock.

Nissan and Mercedes have raised concerns about thinning inventories.

Honda has already reduced shifts at its North American plants.

Stellantis established a “war room” to monitor supply in real-time.

Toyota says it isn’t directly affected yet, but the company is watching the situation closely.

It hasn’t reached the level of a zombie contagion, but the disruption is spreading quickly due to the pervasiveness of these discrete parts.

Automakers in Brazil have warned that they may suspend production if the shortage persists.

In Germany, OEMs are building a temporary chip information platform to share inventory data and reduce bottlenecks.

Volkswagen says it has secured enough supply for another week, but the stop-start pattern is quickly becoming the norm.

Inside Nexperia, the corporate fight continues. Wingtech is demanding reinstatement of its ousted CEO, highlighting the growing split between Chinese ownership and Dutch management. The standoff is slowing decisions that could restore production and complicating negotiations between governments.

But the bigger story isn’t Nexperia.

It’s the system itself.

Global supply chains were built for efficiency, not resilience, and they’re now being reshaped by political and policy choices. When governments weaponize trade, even low-margin chips become strategic assets. The US rule pause may ease tensions for now, but it doesn’t fix the core issue: global automaking still depends on a handful of suppliers caught between Washington and Beijing.

Geopolitical risk has always been a factor in supply chain resilience, but its impact has widened.

Foreign policy now decides who builds, who ships, and who waits, as automakers scramble to manage a crisis that feels less like strategy and more like a curse.

All of this is just another reminder that the ghosts haunting global supply chains still know how to make the living lose sleep.