Automotive Supply Chain Risk Digest #394

August 16 - 22, 2024, by Elm Analytics

Fresh Insights

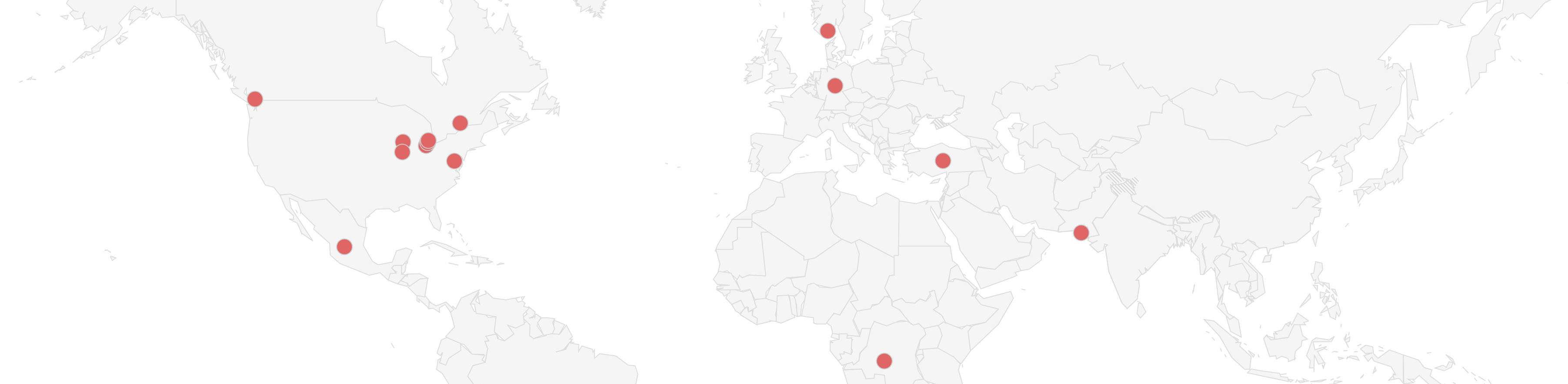

→ Download Elm's supplyAware™ 60 Report (August 2024) for the latest snapshot of the auto industry's financial health.

While financial ratings for leverage and profitability have remained stable, liquidity has significantly dropped across the sector: 52% of companies have seen declines since Q1 2023, with 32% now at critically low levels.

Key factors contributing to this decline include:

Delayed program launches

Increased capital expenditures

Higher debt repayments

Given these findings, it is more critical than ever for manufacturers to closely monitor their suppliers' financial health, particularly liquidity, to mitigate potential supply chain disruptions.

Contents

Stellantis worker dies in assembly line accident

Rivian approved to expand Illinois plant

Automakers' scaled-back EV plans impact suppliers

GM lays off over 1,000 salaried employees

Canadian government orders arbitration to end rail lockout

Stellantis delays Belvidere plant reopening, UAW tension

MERGERS, VENTURES, ACQUISITIONS

BYD to open car plant in Pakistan

Ganfeng Lithium and YİĞİT AKÜ form $500M JV

Continental starts construction on Mexico plant

Morrow Batteries launches Norway's first battery plant

Ford reduces EV spending, shifts to hybrids

Cobalt supply glut highlights market volatility

Canada announces mandatory PFAS reporting rule

US DOT plans nationwide V2X technology deployment

Stellantis shuts down Trenton Engine Complex

Disaster

A fatal workplace accident occurred at the Stellantis Toledo Assembly Complex in Ohio on Wednesday, resulting in the death of 53-year-old Antonio Gaston. According to a Toledo police report, Gaston was tightening undercarriage body bolts when he became trapped under a moving vehicle on the Gladiator assembly line. Stellantis expressed condolences to Gaston's family and announced it is cooperating with authorities to investigate the incident.

Expanding

Rivian has received approval from the town of Normal, Illinois, to significantly expand its manufacturing plant, paving the way for producing its more affordable R2 electric vehicle. The expansion includes a new 1.14M sq ft building and an addition of 208k sq ft to its existing 3.8M sq ft plant. Rivian aims to begin R2 production by early 2026, with a planned output of up to 155k units annually, nearly doubling the capacity of its current R1T and R1S models.

Human Capital

Automakers are scaling back their electric vehicle plans due to slower-than-expected sales growth in North America, leading to ripple effects across the supply chain. Suppliers like Lear, BorgWarner, and Cooper-Standard have responded by cutting jobs and restructuring operations $ to adapt to the reduced demand for EV components.

Lear aims to eliminate about 6% of its workforce in e-systems and 8% in seating, while BorgWarner is cutting headcount and spending in its e-products division to save $100M. Cooper-Standard is also reducing its salaried workforce to save up to $70M through 2025. These adjustments are necessary because suppliers are finding it challenging to fill roles to begin with, making it difficult to get workers back when production volumes rise again.

Suppliers are also concerned that downsizing now could deplete the pool of potential plant managers and other key positions, which are already hard to fill due to a shortage of experienced workers. Competition for labor is intense, with manufacturing jobs competing against roles in healthcare and fast food that offer similar pay and more flexible working conditions.

As a result, suppliers are working to balance current labor needs with future demand, aiming to avoid being understaffed when the EV market eventually recovers. Industry leaders and government officials are urged to invest in training programs to develop a skilled workforce, ensuring that suppliers can remain competitive and meet the evolving needs of the automotive industry.

The shift in automaker EV strategies disrupts the supply chain, forcing suppliers to navigate uncertain labor needs and risking a shortage of experienced workers when EV production eventually increases.

General Motors is laying off over 1k salaried employees globally in its software and services division, including approximately 600 positions at its Warren tech center near Detroit. This decision follows a recent review aimed at streamlining operations to enhance efficiency and speed.

The layoffs, representing about 1.3% of GM's global salaried workforce, come amid broader efforts to cut costs as the company focuses on emerging markets like EVs and software-driven revenue models. The layoffs follow leadership changes in the division earlier this year, including the departure of former Apple executive Mike Abbott.

Labor

Less than 17 hours after a nationwide rail freight shutdown began due to a lockout by Canada's two prominent rail companies, the Canadian government has ordered arbitration to end the dispute.

The shutdown, which involved 10k employees, threatened to disrupt supply chains and the economy, impacting exports and trade with the United States. Canada's Labor Minister, Steve MacKinnon, instructed the Canada Industrial Relations Board to mandate a resumption of services and extend the existing contracts for the involved workers.

This action follows failed contract negotiations focused on scheduling and fatigue management. A prolonged shutdown of Canada's rail freight services could have led to severe disruptions in supply chains, affecting the export of critical commodities and the automotive industry, both within Canada and internationally.

Stellantis confirmed plans to delay, but not cancel, the reopening of the Belvidere Assembly Plant, asserting that the UAW union cannot legally strike over the issue. The company cited market conditions for the delay, emphasizing its commitment to maintaining US manufacturing jobs.

The uncertainty has led to tensions, with UAW President Shawn Fain accusing Stellantis CEO Carlos Tavares of failing to honor commitments made in last year's contract talks. Stellantis, however, maintains that it has adhered to the terms of the 2023 collective bargaining agreement, which allows for adjustments to product investments.

Mergers, Ventures, Acquisitions

Chinese EV manufacturer BYD plans to open a car production plant in Karachi and begin selling three models in Pakistan. The plant, scheduled to start operations in 2026, will be the first to produce BYD's new energy vehicles in the country.

China's Ganfeng Lithium Group's holding unit has signed an agreement with Turkish battery producer YİĞİT AKÜ to set up a $500M JV for the production of lithium batteries in Turkey. The joint venture aims to build a 5 GWh annual production lithium battery plant in Turkey, as outlined in a filing to the Shenzhen Stock Exchange.

Opening

Continental broke ground in Aguascalientes, Mexico, on a new Contitech plant. The plant is set to begin operations in 2025 and will focus on producing automotive components.

Morrow Batteries has launched Norway's first battery cell production site in Arendal, aiming to deliver its initial lithium iron phosphate (LFP) batteries by the end of the year. The plant, Europe's first gigawatt-scale LFP factory, will start with a 1 GWh annual capacity, sufficient to equip around 20k small electric cars.

Production Decrease

Ford is reducing its spending on fully electric powertrains by 25% and shifting its focus toward hybrids and a flexible EV platform. This new platform, led by a team of former Tesla engineers, will underpin a midsize pickup expected in 2027, along with smaller electric crossovers.

The automaker's shift comes amid rising costs, increased competition, and weaker-than-expected customer demand for larger EVs, leading to job cuts and the cancellation of the three-row crossover program.

Despite the strategic pivot costing up to $1.9B, Ford remains committed to achieving long-term profitability in the EV market. Ford's decision to scale back its EV ambitions $ is just one example of the challenges automakers face in balancing profitability with the transition to electric vehicles, potentially impacting the supply chain and market expectations for EV growth.

Raw Material Costs

The cobalt market is experiencing a significant oversupply, highlighted by the recent delivery of 23 metric tons of cobalt to London Metal Exchange (LME) warehouses, the first such delivery since February 2022.

This influx signals a global supply glut driven by increased production from the Democratic Republic of Congo and Indonesia. Despite rising demand for cobalt in electric vehicle batteries, production has outpaced consumption, resulting in a market surplus expected to continue until at least 2027.

The cobalt supply glut highlights the volatility in the raw materials market essential for electric vehicle batteries, potentially impacting pricing and supply chain stability for automakers and battery producers.

Regulation

Canada's Minister of the Environment announced a new mandatory reporting rule for PFAS to gather information to assess these substances' toxicity and potential control measures. This rule requires entities that manufactured, imported, or used any of the 312 specified PFAS above certain thresholds in 2023 to report their activities by January 29, 2025.

Unlike the US EPA's broader TSCA PFAS reporting rule, Canada's rule focuses on specific PFAS and sets a more recent reporting period. Entities have six months to comply, and reporting must be done electronically through the ECCC's online system.

The US Department of Transportation has unveiled the Saving Lives with Connectivity: A Plan to Accelerate V2X Deployment to integrate vehicle-to-everything technology nationwide. This initiative aims to reduce road fatalities by enabling communication between vehicles, infrastructure, and other road users.

With support from the public and private sectors, the plan sets milestones for nationwide deployment, starting with 20% implementation by 2028. V2X technology has proven effective, but regulatory uncertainty has slowed its adoption. The plan's implementation awaits the FCC's finalization of rules for the 5.9 GHz spectrum.

Shutdown

Stellantis NV temporarily shut down its Trenton Engine Complex this week, laying off more than 600 workers to address a surplus of V-6 Pentastar engines, which has reached around 20.7k units. The facility supplies engines for Ram, Chrysler, and Jeep vehicles and aims to balance inventory amid declining US sales, which fell 16% in the first half of the year compared to 2023.