Automotive Supply Chain Risk Digest #390

July 19 - 25, 2024, by Elm Analytics

Contents

Honda to close China plant

Microsoft cloud outage impacts automakers

Toyota considers 4-day workweek

Tesla to use humanoid robots

North American EV battery capacity surge

Ford revises Europe EV goal

UAW, Lear end strike

MERGERS, VENTURES, ACQUISITIONS

Alphabet invests $5B in Waymo

GM invests $500M in Lansing

Ultium Cells halts Michigan plant construction

BYD and Forvia open Thai plant

Windrose plans U.S. electric truck assembly

GM delays Orion EV plant restart

Chile, U.S. sign lithium deal

Porsche hit by aluminum alloy shortage

Closing

Honda will close its JV plant with Guangzhou Automobile in China in October and halt production at another plant with Dongfeng in November. The closures are part of Honda's strategy to increase EV production amidst intense competition from Chinese brands. This decision reflects the challenges faced by Japanese automakers like Honda and Nissan in the Chinese market.

Cyber Security

On July 19, a significant disruption in Microsoft’s cloud services, triggered by a software update from cybersecurity firm CrowdStrike, caused temporary outages affecting 8.5 million Windows devices worldwide.

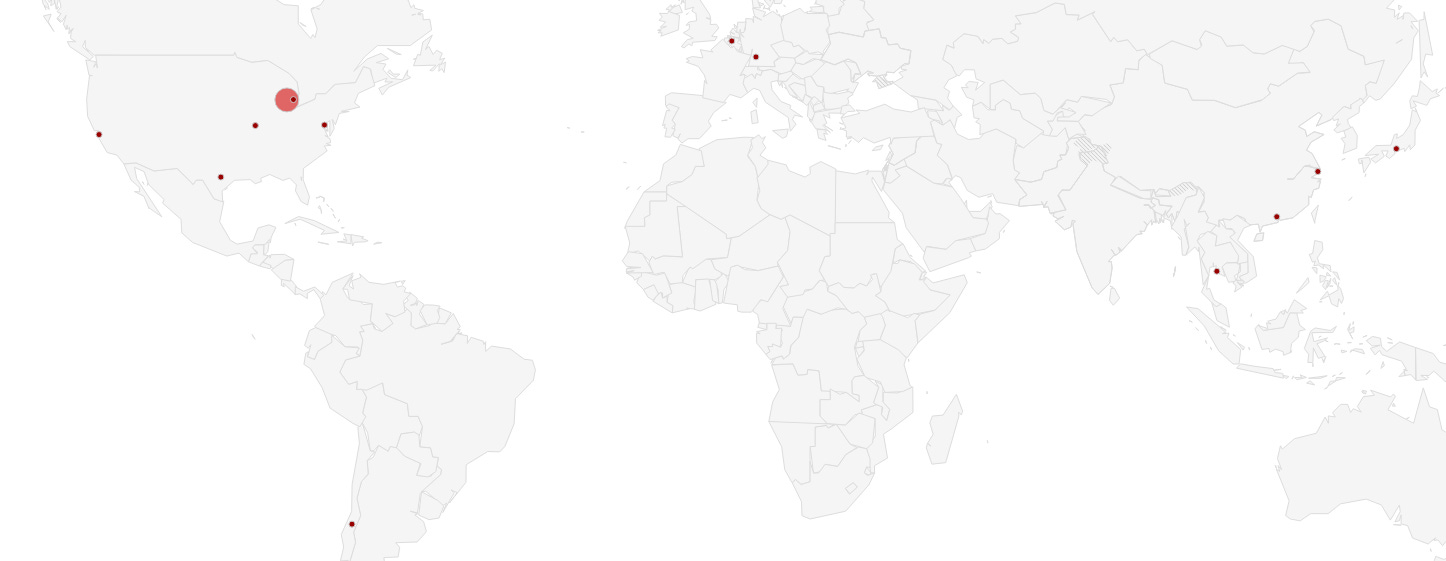

The outage impacted major organizations, including Tesla, which halted production in Texas and Nevada. Other automakers, such as Magna International, Toyota, Nissan, and Ford, experienced varying degrees of disruption. Microsoft is collaborating with Google Cloud and AWS to mitigate the issue and improve future resilience.

Human Capital

Toyota is considering implementing a four-day workweek $ in Japan as part of broader efforts to streamline workflows and improve work-life balance. This potential change is being discussed with the Japanese labor union amid a company-wide review initiated by CEO Koji Sato to address overwork, supplier strain, and quality issues following record sales and production levels.

The review aims to create a more flexible and efficient working environment, with the possibility of rolling out changes over the next decade. The initiative mainly targets office and engineering staff, with different applications across departments.

Elon Musk recently said that Tesla will begin producing and using humanoid robots starting next year, with plans to sell them by 2026. Musk's comments come as Tesla faces cost-cutting pressures due to weakening car demand. In Q2, Tesla's profits fell by nearly half, from $2.7B to less than $1.5B, despite efforts to boost sales through price cuts and incentives.

The new robots, named Optimus, are expected to perform repetitive and unsafe tasks and aim to cost less than $20,000 each.

Industry Directions

The U.S. Department of Energy reports that planned annual EV battery capacity in North America has increased over tenfold $ since early 2021 and is expected to reach 1,400 gigawatt-hours by 2030, enough to power about 14 million light-duty EVs annually. This surge is driven by incentives from the 2022 Inflation Reduction Act and the 2021 Bipartisan Infrastructure Law, which encourage local production of EVs and batteries.

Nevada, Michigan, Georgia, Kentucky, and Tennessee are key states for battery production capacity. Despite rapid growth between 2021 and 2023, the expansion pace has slowed in 2024 due to lower-than-expected EV sales, prompting automakers like GM to reassess their electrification strategies. Canada is also playing a significant role, with substantial battery production planned in Ontario and Quebec.

Ford has revised its goal to only sell EVs in Europe by 2030, citing the loss of government incentives and uncertainty over ICE bans as factors impacting EV sales. Ford will keep hybrids like the Puma, Focus, and Kuga in its lineup while expanding its EV offerings, including new electric versions of the Puma and Tourneo Courier van by 2025.

Labor

After a nearly three-day strike, the UAW and Lear Corporation have reached a tentative agreement, ending the strike and enabling GM to resume production at its Wentzville Assembly plant in Missouri. The strike had halted production of GM's midsize pickups and cargo vans due to the disruption in seat supply from Lear's just-in-time production system.

The new agreement includes a wage raise for Lear workers, though details will be provided to workers before the final vote. The resolution also addresses health and safety issues and production standards. GM's Wentzville plant resumed operations on Thursday morning following the agreement.

Mergers, Ventures, Acquisitions

Alphabet is investing $5B in its self-driving car unit, Waymo, to further develop its autonomous driving technology. The investment follows previous funding rounds totaling $4.75B since 2020. The announcement comes as competitors like GM's Cruise and Tesla delay their own autonomous vehicle projects.

General Motors is investing $500M $ in its Lansing Grand River Assembly plant to transition it to EV production, aided by a US Department of Energy grant. The move is part of GM's $12 billion commitment to enhance its EV capabilities in North America.

The Lansing plant will continue producing Cadillac CT4 and CT5 models while aligning with other GM facilities focused on EVs. The investment aims to support GM's strategy to onshore EV raw materials and components production, generating jobs across multiple states.

Ultium Cells, the joint venture between LG and GM, has paused construction of its $2.6 billion EV battery plant in Lansing, Michigan, due to economic pressures such as high interest rates, inflation, and a slowdown in EV demand. The plant, which began construction in 2022, was expected to achieve an annual capacity of 50 gigawatt-hours, sufficient to power around 600,000 high-performance EVs.

This decision reflects a broader trend of automakers adjusting strategies amid the "EV chasm." GM, Ford, and Tesla have also scaled back or delayed their EV production plans. Ultium Cells continues to operate its other plants in Ohio and Tennessee.

Opening

BYD and Forvia opened their first overseas seat assembly plant in Thailand. Opened on July 18, the plant will produce 180,000 automotive seats annually for BYD's Thai manufacturing operations. This marks the first international collaboration between BYD and Forvia, who previously established seven plants in China.

Chinese electric truck startup Windrose is planning to establish a U.S. assembly plant in Georgia for its semi-trucks, aiming to begin deliveries by 2025. The move would challenge Tesla in its home market and signal a potential return of Chinese EV companies to the U.S. The $2.6B facility would assemble parts manufactured in China, with the U.S. accounting for most of Windrose's 6,400 truck orders.

Shutdown

General Motors has postponed the re-opening of its Orion Assembly plant in Michigan, now set to restart in mid-2026 as a battery-electric truck plant. This decision, driven by slower-than-expected EV demand, was announced by CEO Mary Barra during a second-quarter earnings call. GM will utilize the production capacity at its Factory Zero plant to meet interim EV truck demand.

The delay affects the planned production of the Chevrolet Silverado EV, initially set for this year. The Orion plant had been idle since last year, with previous plans to convert it for EV truck production pushed back multiple times.

Supply Chain

Chile has signed an agreement with the U.S. to ensure its lithium products comply with the Inflation Reduction Act (IRA) requirements, making them eligible for U.S. EV tax credits. The agreement stipulates that lithium used in EV battery cathodes will meet U.S. procurement standards, with critical minerals needing to be extracted or processed in the U.S. or a free trade agreement country. The step is hugely important for Chile as they have the largest lithium reserves in the world.

Porsche has revised its sales and profit forecasts downward following an aluminum alloy shortage caused by flooding at a European supplier. This shortage affects all Porsche models, potentially leading to production shutdowns, and has sent Porsche's shares down by 4%. The supply disruption also impacted BMW and Mercedes-Benz, although they have found alternative suppliers.