Automotive Supply Chain Risk Digest #383

May 31 - June 6, 2024, by Elm Analytics

Contents

INFAC investing $6M in Coahuila

Nissan invests $545M in Sunderland

Teklas announces $8M Aguascalientes expansion

Toyota expands Huntsville factory

Canadian border agents may strike

MERGERS, VENTURES, ACQUISITIONS

Renault and Geely form JV

Svolt cancels second Europe plant

Automakers deepen ties with China

FengMei investing $15.6M in Aguascalientes

Audi cancels shifts due to flooding

GM Canada reassesses EV motor production

ACC halts Italian and German factories

EU tariffs could cost China $4B

Japanese automakers face testing scandal

NEV quality problems increase in China

Tesla halts Berlin plant production

VW Puebla stops Taos production

Maersk faces global port congestion

Stellantis may in-source to cut costs

Expanding

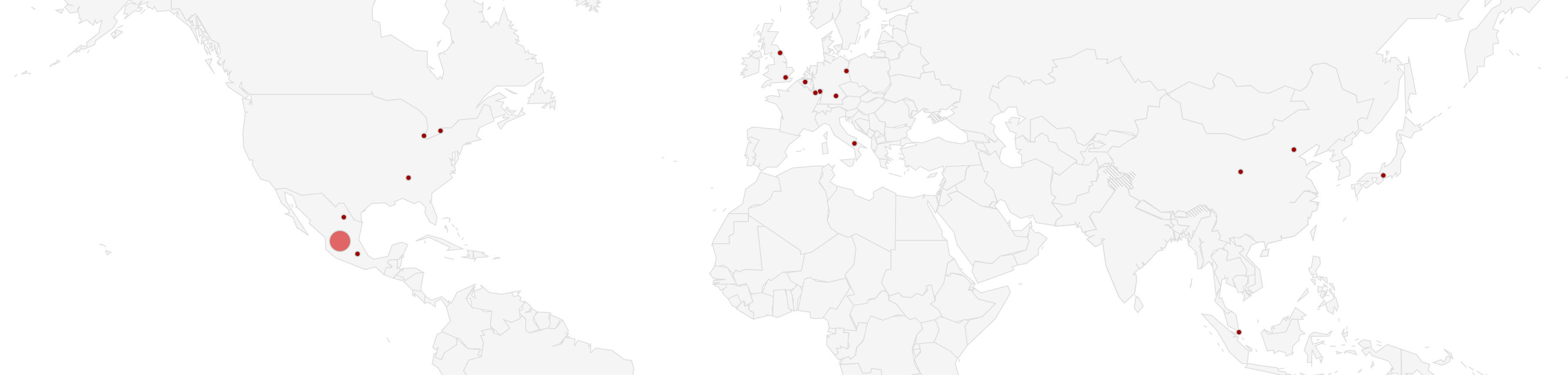

South Korea's INFAC is investing $6M to expand its Monclova, Coahuila plant. By 2025, the company will shift its focus from harnesses to producing battery parts for EVs. The expansion starts this month, with completion expected by April 2025 and operations beginning in the last quarter of 2025.

Nissan is investing $545M to upgrade its Sunderland factory $ in preparation for the production of the next-generation electric Leaf, with an annual target of 100k units. The upgraded plant will integrate advanced assembly lines for the new Leaf alongside existing models like the Juke and Qashqai. Pilot production starts in August, with full production expected next year. Enhancements include a new battery pack installation system and adjustments for the new CMF-EV platform.

Teklas, a manufacturer of fluid systems for automotive heating and cooling lines, announced an $8M investment to expand its Aguascalientes plant in Mexico.

Toyota is investing $282M to expand its engine factory in Huntsville, Alabama. This will create 350 new jobs and bring the total investment at the plant to $1.7 billion. The expansion aims to enhance production capabilities and provide engines for models like the Corolla and Tacoma to Toyota's North American plants.

Labor

Canadian border agents are preparing for potential job action on June 7, raising concerns in the auto industry about delays at US land crossings. Over 9k Canada Border Services Agency workers seek improved wages, better retirement benefits, and more flexibility in remote work.

Although 90% of these workers are deemed essential, working to rule could significantly slow down border operations.

"A strike is obviously of significant concern to our manufacturing members given their exposure to cross border parts and components supply."

- David Adams, CEO of Global Automakers of Canada

Delays could disrupt the just-in-time delivery systems crucial for automakers.

Mergers, Ventures, Acquisitions

Renault and Geely announced a JV to develop efficient gasoline engines and hybrid systems to enhance their legacy auto businesses. The HORSE Powertrain venture will be headquartered in London and targets an annual revenue of approximately $17.6B with a production capacity of about 5M powertrain units.

This collaboration allows Renault to focus on EVs while Geely expands globally. The JV is a strategic move to stay competitive as automakers invest in low-emission technologies amid slowing EV sales.

Chinese battery maker Svolt has announced the cancellation of its plans to build a second battery cell plant in Europe. The company attributes the decision to the volatile EV market and the cancellation of a significant customer project.

Due to planning issues, the company also indicated uncertainty about the completion date for its primary battery cell manufacturing facility in Überherrn, Germany. The second factory was intended to be near Berlin. However, Svolt will open a battery module and pack assembly plant in Heusweiler, Germany, in July.

The canceled project, speculated by German public broadcaster SR Fernsehen to involve BMW, was initially slated to start pilot production in 2025. The halted plans reflect the broader instability and rapid strategic shifts within the global automotive market due to the transition to EVs, impacting the supply chain and production timelines.

Automakers are forging stronger ties with Chinese companies, capitalizing on their technological and manufacturing expertise, even in the face of mounting tariffs and trade barriers.

Stellantis' recent joint venture with Leapmotor is a shining example, highlighting the benefits of vertical integration and ADAS technology in Chinese EVs. Leapmotor's ambitious plan is to tap into Stellantis' dealer network for European market entry, sidestepping trade barriers through local production.

"We have to execute and make money first."

- Carlos Tavares, CEO of Stellantis

Other automakers like Volkswagen and Toyota are also seeking collaborations with Chinese tech firms to stay competitive.

Opening

China's FengMei announced a $15.6M million investment to establish a production plant in Aguascalientes' Finsa Industrial Park. Construction begins this year, with operations expected by the end of 2025. The plant will produce high-voltage power distribution products for BMW, Volvo, Tesla, and Nissan.

Production Decrease

Audi has canceled several production shifts at its Ingolstadt headquarters due to the severe flooding in southern Germany. This decision has significantly impacted the production of its A3 and Q2 models. The electric Q6 E-Tron production was already paused to coincide with the Bavarian holiday period.

The situation has been further exacerbated by disruptions in transport and utilities, with sections of the Rhine River closed to cargo shipping and Deutsche Bahn advising against travel in the region. Hydroelectric plants along the Neckar River are running at reduced capacity or are shut down due to floating debris.

General Motors Canada is reconsidering the timing of its transition to produce EV motors at the propulsion plant in St. Catharines, Ontario, Canada. The retooling process for the V-6 engine and 6-speed transmission lines is ongoing, but the company is evaluating its schedule amid fluctuating EV demand in Canada.

"We are assessing the timing for that transition," said Natalie Nankil, GM Canada's director of corporate and internal communications. Jordan Lennox, president of Unifor Local 199, noted that 300 members would be laid off during retooling. The reassessment of GM's EV production timeline could impact supply chain planning and labor stability in the automotive sector.

ACC, a battery JV between Stellantis, Mercedes, and TotalEnergies, has decided to stop building its factories in Termoli, Italy, and Kaiserslautern, Germany. This decision is due to the need to create more affordable batteries as Europe's demand for EVs is slowing down. ACC will announce a new timeline for these projects in late 2024 or early 2025.

ACC is currently increasing production at its first factory in northern France. Stellantis CEO Carlos Tavares mentioned that the company would modify its EV investments based on market growth rates. The pause in factory construction emphasizes the challenges European automakers face in lowering costs and adjusting to changing EV market demands, which will impact future supply chain and production strategies.

Regulation

If the European Union proceeded with its plan to impose a 20% import tariff on Chinese EVs, the consequences could be significant. A study by Germany's Kiel Institute for the World Economy suggests that Chinese EV imports to the EU could drop by a quarter, resulting in a nearly $4B trade loss for Beijing.

This decision could also exacerbate trade tensions as the EU investigates Chinese anti-dumping and subsidy practices. German Foreign Minister Annalena Baerbock has stressed the importance of protecting EU interests. The potential increase in EV prices in Europe due to higher tariffs could hinder the transition to EVs. However, Chinese manufacturers such as BYD might counter this by establishing local production facilities.

Toyota Motor and other Japanese automakers, including Mazda, Honda, Suzuki, and Yamaha, have admitted to testing irregularities, which has led to the halted deliveries of six models. Government inspections have revealed that Toyota used improper testing data for certification, including adjusting the engine control system and using stricter conditions than required.

Tokyo Metropolitan University professor Ken Shiraishi has stressed the need to identify the cause of this scandal and develop an improvement plan. The automotive industry is facing increased competition from new EV manufacturers. In this competitive landscape, companies must strengthen their governance practices and ensure compliance to avoid incidents that could harm their reputation, erode consumer trust, and negatively impact their relationships.

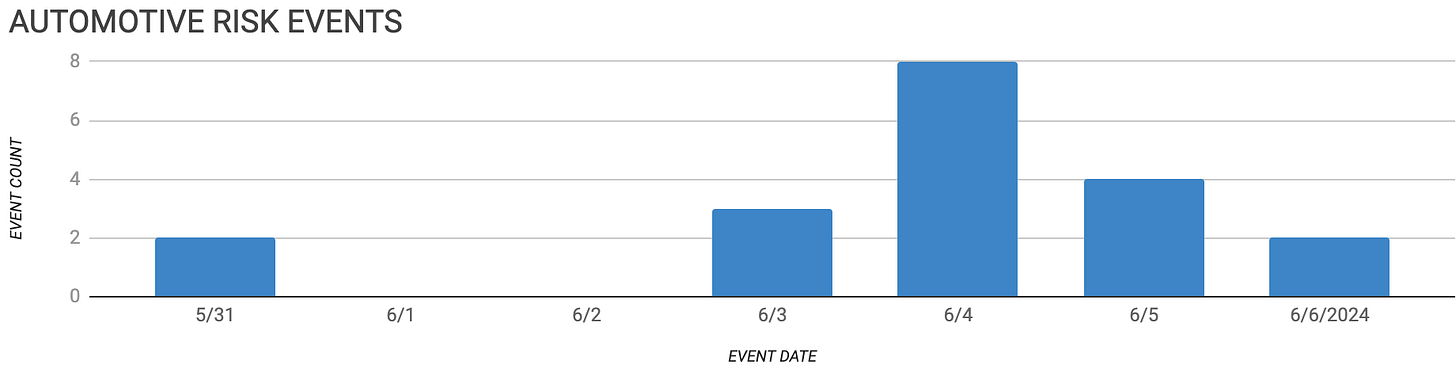

Risk Analytics

According to JD Power's latest survey, the average number of quality problems experienced by buyers of new-energy vehicles (NEVs) in China has increased to 210 per 100 vehicles this year. However, there is a glimmer of hope as Chinese NEV startups, despite the challenges, reported the fewest quality problems at 201 per 100 vehicles.

"The competition in the NEV market is intensifying, with automakers constantly launching new models to capture market share," said Elvis Yang, general manager of auto product practice at JD Power China. The survey, conducted from December 2023 to March 2024, attributes the increase mainly to design-related problems, which rose by 35 per 100 vehicles. Global brands had the highest at 218 per 100.

Shutdown

According to a company spokesperson, Tesla will halt production at its Gruenheide plant near Berlin for five days in June to improve factory processes. Production will pause in the vehicle production and powertrain areas on June 7, 14, 17, 27, and 28. This follows previous shutdowns at the site, including a planned one-day shutdown in May and a disruption caused by an arson attack in March.

Volkswagen's plant in Cuautlancingo, Puebla, has initiated a three-week production stoppage for the Taos model due to component shortages. The stoppage began on May 27 and will continue on June 3 and June 10. Production of other models, such as the Jetta and Tiguan, will proceed as scheduled, contingent on component availability.

Supply Chain

Maersk is facing substantial delays, primarily due to terminal congestion in Mediterranean and Asian ports. This has resulted in the unfortunate cancellation of two westbound sailings from China and South Korea in early July.

The congestion, which is not limited to a specific region but is a global issue, has been further exacerbated by Houthi militant attacks near the Suez Canal. Many carriers, including Maersk, have had to reroute ships around Africa, leading to significant congestion in ports across the globe, including Singapore, China, Dubai, Spain, and the United States, due to high cargo demand and ongoing disruptions.

In the US, Charleston, South Carolina, is experiencing congestion due to infrastructure projects, while Savannah, Georgia, is dealing with a recent software malfunction.

Stellantis is considering reducing its reliance on particular suppliers and producing components in-house to cut costs amid the shift to electrification. CEO Carlos Tavares emphasized the need for suppliers to match Stellantis' pace, stating, "When suppliers are not racing at the same speed of our teams, our teams see a big benefit to in-source."

European automakers, including Stellantis, are grappling with the challenges of slowing EV demand and increased competition from cheaper Chinese models, underscoring the situation's urgency. Additionally, Stellantis and its partners are reassessing investment levels for EV batteries, with plans to produce lower-cost cells in Germany possibly.

Stellantis' strategy to reduce costs by in-sourcing $ may impact the supply chain and supplier relationships, reflecting broader industry pressures to remain competitive in the evolving EV market.