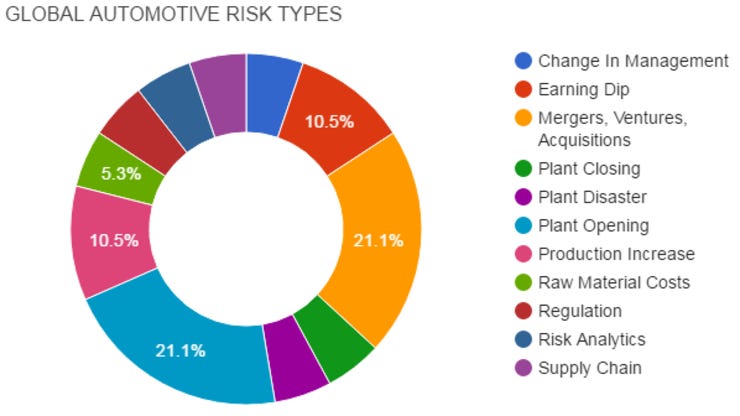

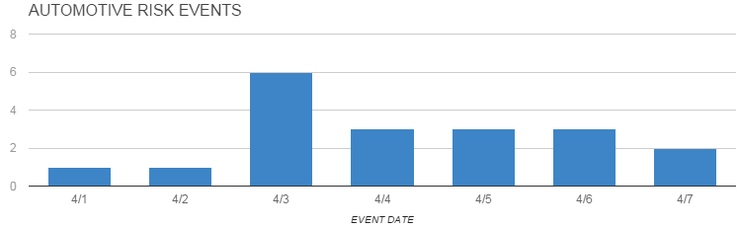

Elm Analytics - Supply Chain Risk Digest #8 - April 1 -7, 2017

CHANGE IN MANAGEMENT

Bentley Motors Inc. CEO Michael Winkler is stepping down and will be succeeded by Audi of America's COO Mark Del Rosso.

EARNINGS DIP

Overall automotive industry sales have fallen 1.6% in March compared to a year ago. This marks the third straight month of slipping sales as automakers come off a record 2016.

Hyundai and Kia's sales in China halved compared to March 2016. It is one of the latest South Korean multinations affected by a Chinese boycott. The Chinese government orchestrated boycott is in retaliation for a planned installation of a US missile defense system on South Korean soil.

MERGERS, VENTURES, ACQUISITIONS

Daimler announced a partnership with Bosch to work on autonomous vehicles. Both companies' press releases mention shared vehicles, which may leverage Daimler and Uber's partnership.

The increasing cost and complexity of advanced parts in new vehicles are driving auto suppliers to invest, divest or be ingested. A new era of MegaMergers may be on its way to support the new technology needed.

American Axle completed its $3.3B acquisition of Metaldyne.

Delphi announced partnerships to streamline data and connectivity with their electrical systems. Partnerships include: Otonomo (monetization through 3rd party data), Valens (HDBaseT -chip to chip communication), Rosenberger (vehicle ethernet connections).

PLANT DISASTER

A fire at Anderton Castings destroyed 1/2 of the 142,000 sf facility, causing $5m in damage. The die casting plant expects to be working in 2-4 weeks. No injuries reported.

PLANT OPENING

Topre America, a Japanese owned supplier to Honda North America, will open a new plant in Springfield, Ohio. Set to open near the end of this year, the plant will employ around 85 and produce parts for the Acura MDX.

Minda's KTSN Plastic Solutions has opened a new facility in Mexico. The plant makes interior components such as glove box and panel parts for Volkswagen.

Filling a void? Chinese automaker, Great Wall Motor is considering building a plant in two Mexican states affected by Trump's drive for American investment. This comes after a February 2017 plan for a Hidalgo plant from China' JAC Motor.

PRODUCTION INCREASE

CAFE standards are fueling growth with suppliers who make lighter parts. Aluminum parts producer, UACJ Automotive Whitehall Industries, is expanding its Paducah, Kentucky plant. The plant will grow to 156,000 sf and bring an 50 more jobs, to a total of 196.

Outokumpu, a producer of stainless steel bars, has announce increased investment at its Richburg, South Carolina plant. The investment increases their steel bar production capacity by more than 15,000 tonnes annually.

RAW MATERIAL DISRUPTION

H.B. Fuller is increasing the price for its adhesives 5-10% in all regions. The increase is necessitated due to recent cost changes and supply constraints to feedstocks.

REGULATION

A growing Chinese economy is a spotlight of growth for US automakers. This growth is happening while the US trade deficit with China is growing daily. Any changes to the economic relationship between the two countries needs careful consideration.

RISK ANALYTICS

Japan will encourage companies to share big data they collect. They will be encouraged to share all collected data other than trade secrets, so that parts makers and other companies can use the data to develop future products.

SUPPLY CHAIN

Hyundai Motor Co. and Kia Motors Corp. will recall 1.5m vehicles in the US and South Korea to an engine defect that could cause them to stall.