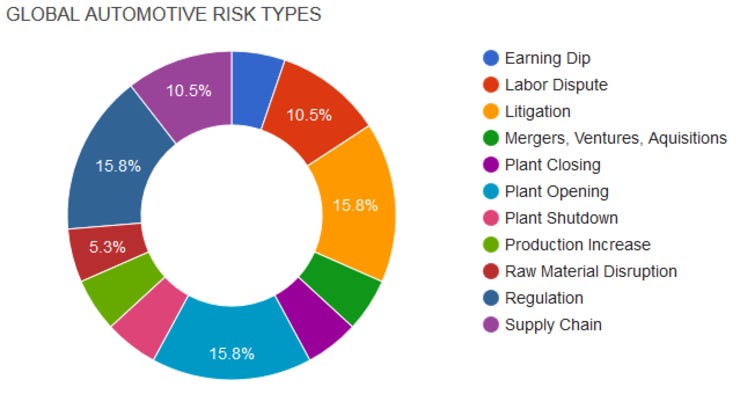

Elm Analytics - Supply Chain Risk Digest #4 - March 4 - 10, 2017

EARNINGS DIP

BMW reported its weakest profitability since 2010, capping a negative year after the brand lost the industry sales crown to arch-rival Mercedes-Benz.

LABOR DISPUTE

The Spanish government's attempt to alter laws on labor and ports governance has led local stevedores' unions to organize strikes at the Port of Algeciras

Workers plan to protest Nissan's alleged anti-UAW intimidation tactics. They will enlist Bernie Sanders and Danny Glover for their march.

LITIGATION

The European Commission has fined Behr, Calsonic, Denso, Panasonic, Sanden and Valeo a total of 155 million euros for taking part in one or more of four cartels concerning suppliers of A/C and engine cooling components.

Kiekert AG admitted that it conspired to eliminate competition for the side-door latches and latch mini-modules that were sold to Ford Motor Co. and its subsidiaries in the US.

VW pleads guilty to 3 counts to settle criminal charges over emissions violations and agreed to pay $4.3B.

MERGERS, VENTURES, AQUISITIONS

PSA Group will pay GM $1.9 billion for Opel, it's U.K. sister brand Vauxhall and a stake in the local financing business. The deal reinstates PSA as Europe's second-biggest auto manufacturer.

PLANT CLOSINGS & OPENINGS

General Motors has revealed plans of shuttering its first ever plant in India located at Halol, Gujarat by April 2017.

Plastic Omnium is building new plants in Greer, South Carolina and Tennessee. The SC plant will make body parts for BMW and the TN plant will make fuel systems for a Japanese automaker.

Start-up Rivian Automotive is re-purposing the 2.4 million square foot former home of Mitsubishi Motors in Normal, IL and will receive $49.5 million in tax credits.

Faurecia Clean Mobility will open a new plant in 2018. The Fort Wayne, Indiana facility will manufacture automotive emission control systems.

Many car factories in Egypt halted production at the end of last week. Sources confirmed it is due to the market situation and the lack of vision for companies.

PRODUCTION INCREASE

Exxon Mobil will invest $20 billion through 2022 to expand its chemical and oil refining plants on the U.S. Gulf Coast.

RAW MATERIAL DISRUPTION

Ukrainian coal producer idles 3 large coal mines due to blockade of shipments from rebel held areas. The shortage will likely cause rolling blackouts and affect steelmaking.

REGULATION

China will cut steel capacity by 50 million tonnes and coal output by more than 150 million tonnes this year.

Ford of Europe president Jim Farley: barrier-free trade was essential to protecting the firm's more than 14,000 british workers

Buying businesses in the US may help Chinese companies if trade regulations change. Wanfeng, a wheel hub manufacturer, may make new acquisitions for US facilities.

SUPPLY CHAIN

Dropping costs of processors and inexpensive cameras may leave traditional automotive suppliers of mirror modules behind.

Shortages in electronic components, low inventory, and reduced investment in semiconductors are creating issues for Electrical Engineers.