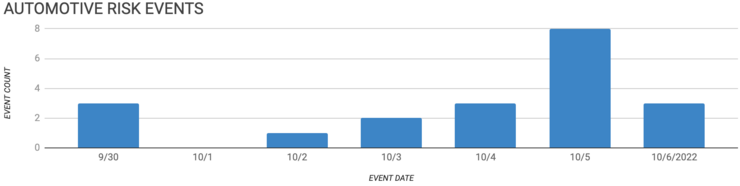

Elm Analytics - Automotive Supply Chain Risk Digest #295 - September 30 - October 6, 2022

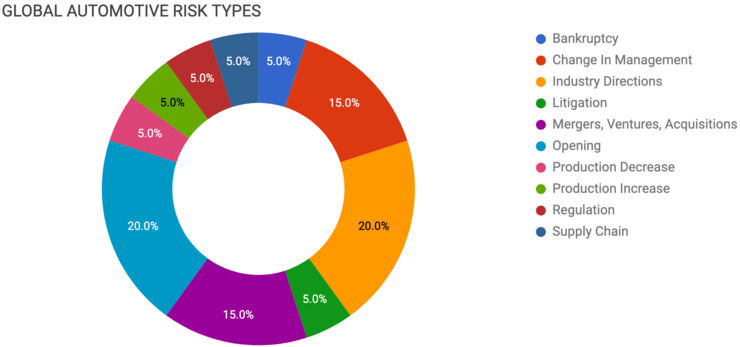

BANKRUPTCY

Lidar sensor maker Ibeo Automotive Systems GmbH has filed for insolvency. The company will restructure its locations in Hamburg, Germany, and Novi, Michigan.

CHANGE IN MANAGEMENT

Three of Faraday Future's board members have resigned due to "threats of physical violence and even death threats." Susan Swenson, its Executive Chair, along with Jordan and Scott Vogel, stepped down in an accelerated transition at the troubled startup.

GM has added former Lyft and tesla executive Jon McNeill to its board of directors. McNeill is currently serving as CEO of venture capital firm DVx Ventures.

Volkswagen Group of America COO Johan de Nysschen is retiring. No replacement has been named.

INDUSTRY DIRECTIONS

While supply chains continue to hamper the automotive industry, consumer demand appears to be holding... for now.

LMC Automotive: Global demand braces for impact

Despite being seen as a viable alternative to EVs by some, new data from Europe's oil lobby suggests that there will only be enough synthetic fuel (e-fuel) to power 2% of all vehicles in Europe by 2035.

With ICE engines expected to be effectively banned by 2035, European automakers have some decisions about what to do with their engine factories.

LITIGATION

A Georgia judge rejected plans to give EV maker Rivian around $1.5B in tax breaks for its planned new plant near Rutledge, Georgia. The judge said that the development authority hadn't proved that the $5B plant was "sound, reasonable and feasible" as is required by state law.

MERGERS, VENTURES, ACQUISITIONS

China's Geely has acquired 8% of Britain's Aston Martin. The Saudi Arabia Public Investment Fund has a 16.7% stake, along with Mercedes-Benz's 10% investment.

Velodyne Lidar is acquiring Bluecity, an AI software firm based in Montreal, Canada.

OPENING

Michigan-based EV battery startup Our Next Energy is planning a new $1.6B battery plant in Van Buren Township, Michigan. The 650k sf plant will employ over 2k and start production later this year.

China's Gotion will build a new EV cathode production plant in Big Rapids, Michigan.

STMicroelectronics will build a new silicon carbide wafer plant in Italy. The plant will take advantage of the EU's new Chips Act and is being constructed to meet automotive and industrial demand.

Micron is planning to build a new chip manufacturing plant in Clay, New York. Micron will invest $20B over the next ten years into chip manufacturing in upstate New York.

PRODUCTION DECREASE

Honda is slashing vehicle output by up to 40% at two of its Japanese plants through October. Production will drop by 20% at their plant in Suzuka, Japan, and 40% at their plant in Saitama.

PRODUCTION INCREASE

Following a record quarter of sales, GM will increase the output of its Chevy Bolt EVs. The automaker wants to increase production from 44k in 2022 to over 70k in 2023.

REGULATION

The EU's transportation committee proposes expanding infrastructure to support EV chargers every 60km and hydrogen filling stations every 100km.

SUPPLY CHAIN

Stellantis CEO Carlos Tavares on the semiconductor supply chain:

"The situation will remain very complicated until the end of 2023, then will ease a little... semiconductor manufacturers have an interest in making business with us again, especially as they're raising prices."