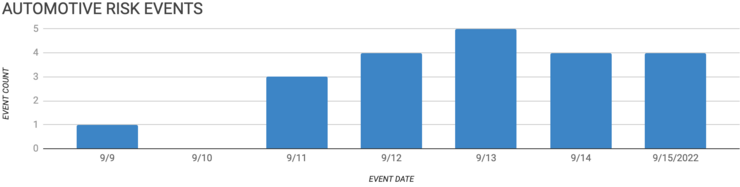

Elm Analytics - Automotive Supply Chain Risk Digest #292 - September 9 - 15, 2022

CLOSING

Valeo is shutting down its plant in East Liberty, Ohio, by the end of October. The closing will affect 104 employees at the plant.

DISASTER

A string of plant vehicle thefts has police looking for suspects in Michigan. Twelve to 15 new Ford Mustangs were stolen from a Flat Rock Assembly Plant parking lot. And two Jeep Wagoneers were stolen from the Stellantis Warren Truck Assembly Plant.

EXPANDING

GM is investing $491M into its Marion Metal Center plant in Marion, Indiana, to support EV production. The facility will be expanded by 6,000sf and receive two new press lines and other equipment upgrades.

EV supplier Hyundai Mobis introduced a plan to expand its operations in North America this week rapidly. The project includes a new EV components plant and new technology, including an electric complete chassis platform module, virtual displays, lightning grilles, and swivel displays.

INDUSTRY DIRECTIONS

Automakers and suppliers are moving forward with automated purchasing and sourcing processes. Industry experts believe that the trend will begin with non-production or small commodity items.

"Automakers will welcome this quite a bit because sourcing those commodities just isn't fun, But if they put these automated processes into place, they still have to think about the relationships with their suppliers, and put mechanisms into place where they can still have a conversation with them." - Carla Bailo, Former CEO of CAR

"There are very different levels of trust throughout the value chain. As we get more and more into sourcing for the future, what you're going to see is an effort by all to improve that level of trust, no matter the starting point they're at." - Julie Fream, CEO of OESA

LMC: Who will win India's EV battle?

Tesla's stockpile of zero-emission vehicle (ZEV) credits may continue to be a source of significant revenue. It made over $2B in the past year, selling them to automakers that didn't meet requirements for ZEV states.

LABOR DISPUTE

Freight companies and rail workers reached a tentative agreement on Thursday, averting an imminent strike. Workers have gained an additional paid day off, voluntary assigned days off, guaranteed time off for medical visits, and wage increases.

After going on strike last weekend, workers at Stellantis' Kokomo, Indiana, casting plant reached and ratified a new labor contract earlier this week.

Workers at VW's Puebla plant in Mexico voted to approve a 9% wage increase.

LITIGATION

Thailand's Supreme Court ruled that Toyota owed $272M in taxes for importing parts that did not qualify for a reduced tariff.

MERGERS, VENTURES, ACQUISITIONS

Aptiv is acquiring Intercable Automotive Solutions for $600M. Intercable manufactures busbar and battery cells and will operate as a standalone unit.

Stellantis will buy back over $900M shares from GM. The shares were originally from the sale of Opel-Vauxhall.

OPENING

Chinese EV battery maker Svolt is planning to build a new battery plant in Brandenburg, Germany. The plant will have a capacity of 16GWh/year, and production will start in 2025.

Piedmont Lithium has selected Etowah, Tennessee, as the site for a new lithium hydroxide processing facility. The plant will start production in 2025.

Tesla is reportedly reconsidering its plans to make EV cells in Germany. Domestic production may qualify the company for US tax credits under the Inflation Reduction Act.

PRODUCTION DECREASE

Global automotive production continues to experience cuts. This week 22k vehicles were dropped in North America and 34k from Europe due to short supplies of semiconductors.

PRODUCTION INCREASE

Tesla is ramping up production of its Model Y at its plant near Berlin.

REGULATION

The Biden administration announced $900M to invest in 500k charging stations across the US. The funding is part of the infrastructure law signed last year to promote EV use.

RISK ANALYTICS

Facing soaring costs and uncertainty, Stellantis is considering producing its own energy at its European plants.

SHUTDOWN

Nissan extended the shutdown at its St. Petersberg, Russia, plant until late December.