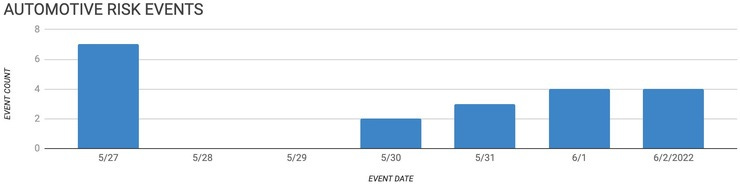

Elm Analytics - Automotive Supply Chain Risk Digest #277 - May 27 - June 2, 2022

CHANGE IN MANAGEMENT

Stellantis has named Marlo Vitous as its new VP of purchasing and supply chain for North America. Vitous replaces Martin Horneck, who is retiring.

GM named former Amazon exec Marcus Purty as its new VP of Global Workplace Safety. Purty is replacing Jim Glynn, retiring after 40 years with GM.

DISASTER

Last Saturday, a fire broke out at Rivian's plant in Normal, Illinois, after a battery pack caught fire in the testing area. There were no injuries, and production at the plant resumed on Sunday.

HUMAN CAPITAL

Leaked Tesla emails show that CEO Elon Musk will not tolerate office employees working solely from home. He said that employees who wanted to remote work:

"...must be in the office for a minimum...of 40 hours per week or depart Tesla."

INDUSTRY DIRECTIONS

EV startups have been struggling lately, from Rivian losing its chief manufacturing engineer to turnover at the Apple Car team.

While market conditions have slowed mergers and acquisitions, the shift to EVs is bringing a wave of consolidations with ICE-heavy suppliers.

Jim Farley, Ford's CEO, expects expansive industry consolidation through mergers due to the shift to EVs:

"There's a shakeout coming. I feel like that shakeout is going to favor many of the Chinese new players."

LABOR DISPUTE

The UAW is moving forward with plans to unionize the GM/LG joint venture plant Ultium Cells in Warren, Ohio. The plant is opening for production in August.

LITIGATION

Glencore, a cobalt supplier, will pay $1.2B to settle US, UK, and Brazilian probes. The company pleads guilty to:

"a list of charges that range from bribery and corruption in South America and Africa, to price manipulation in US fuel-oil markets."

Glencore supplies GM with cobalt for its EVs.

MERGERS, VENTURES, ACQUISITIONS

Ford announced this week that they are investing $3.7B and adding 6.2k union jobs in Michigan, Ohio, and Missouri as part of their EV expansion plans.

Korea's Posco Chemical has signed a deal with GM to build a $327M cathode materials plant in Quebec, Canada. The plant will reach completion by the second half of 2024.

Bosch is partnering with WeRide to develop autonomous driving software for passenger vehicle makers in China. The software will allow vehicles to perform Level 2-3 advanced intelligent driving experiences.

EV battery maker CATL has signed an agreement with BMW to supply them with cylindrical battery cells starting in 2025.

PRODUCTION DECREASE

Late last week, Toyota cut its June production forecast by another 150k units due to parts shortages and the ongoing lockdown in Shanghai.

PRODUCTION INCREASE

FAW/VW's recently reopened plant in Changchun, China, has increased to almost total capacity after a prolonged shutdown.

REGULATION

Tucked into the US Ukraine aid bill was $500M for critical battery materials. The funding adds to the $750M available through the Defense Production Act from March.

RISK ANALYTICS

Analysts are pointing to difficulty sourcing traditional wiring harnesses accelerating the transition to EVs.

SHUTDOWN

Stellantis halted production at two North American plants due to the semiconductor shortage:

Chrysler Pacifica minivan plant in Windsor, Ontario

Jeep Compass plant in Toluca, Mexico.

Stellantis is also halting production at its plant in Melfi, Italy, through next week due to shortages of semiconductors and other parts.

SUPPLY CHAIN

Supply Chain Dive: 'Ripple effect': How Shanghai's lockdown is dampening Port of Oakland volumes