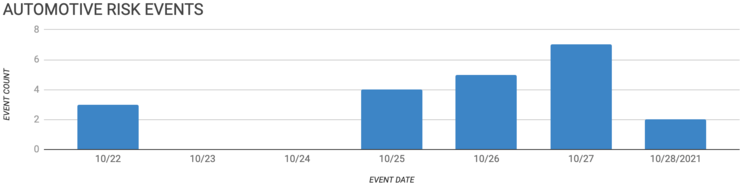

Elm Analytics - Automotive Supply Chain Risk Digest #246 - October 22 - 28, 2021

EXPANDING

Faurecia will add 100k sq ft to its Spring Hill, Tennessee facility. The expansion will boost door panel production for nearby GM.

Vernicolor is expanding its plant in Coahuila, Mexico. The investment will increase the production of injection-molded interior trim components.

INDUSTRY DIRECTIONS

Ford and GM are walking a fine line of prices increases, consumer demand, supply chain disruptions, and EV market share.

LITIGATION

FCA is reportedly close to a plea deal in its Ram and Jeep diesel emissions probe.

MERGERS, VENTURES, ACQUISITIONS

Ouster is acquiring Sense Photonics to continue developing LiDAR technologies. It will combine the company into a new subsidiary, Ouster Automotive.

South Korean EV battery maker SK Innovation is investing $30M into Ford-backed solid-state battery developer Solid Power, Inc. The plan is for the two to produce batteries jointly.

BASF and SVolt formed a partnership to develop cathode active materials for EV batteries.

OPENING

Novelis opened a new automotive aluminum finishing plant in Guthrie, Kentucky, this week. The 400k sq ft plant employs over 150 people and makes aluminum sheets for body panels.

Stellantis is teaming with Samsung SDI to build a second new battery plant in North America. The plant will have an initial annual capacity of 23 GWh and will start production in 2025.

Rock Tech Lithium will build a lithium hydroxide production plant in Guben, Brandenburg, Germany. The facility will open in 2024 and is near Tesla's Berlin Gigafactory.

Handtmann inaugurated its new production die-casting plant in Kechnec, Slovakia. The plant will produce clutch and transmission housings for hybrid vehicles.

PRODUCTION DECREASE

JLR will decrease production at its plants in Nitra, Slovakia, and Solihull, UK. Magna Steyr, its production partner, will shut down on October 25 and 26 and November 1 and 2.

GM confirmed that it would suspend its second production shift at its São José dos Campos plant in Brazil. The production decrease will last almost six months and is due to the semiconductor crisis.

PRODUCTION INCREASE

As chip supplies have increased, GM reinstated overtime shifts at six of its North American assembly plants.

GM restarted Bolt assembly at its Orion, Michigan plant this week. Production halted August 23 due to defects in batteries leading to fires.

RAW MATERIALS

Canadian transistor maker GaN Systems think its gallium nitride transistors could lead to smaller and lighter EV batteries with improved charging performance and extended range. Transistors currently used in EVs are typically made from silicon.

REGULATION

Canada sent a letter to the US late last week warning that proposed EV tax credits may hurt the North American auto industry and breach trade agreements. The proposed credits would go up to as much as $12.5k / car, though $4.5k of that would only go towards cars made at unionized plants in the US.

The Italian government is extending its "Ecobonus" subsidies, adding $117M for low emission vehicles.

RISK ANALYTICS

Delivery times for chips posted their smallest gain in nine months during October - could it mean that shortages have peaked?

SUPPLY CHAIN

Mercedes is moving to more modern semiconductors as a strategy to address chip supply issues.

Customers of German supplier Eberspacher are monitoring the company after they were hit by an "organized cyberattack" this week. A statement on their website says they are working at "full speed" to counter the attack.