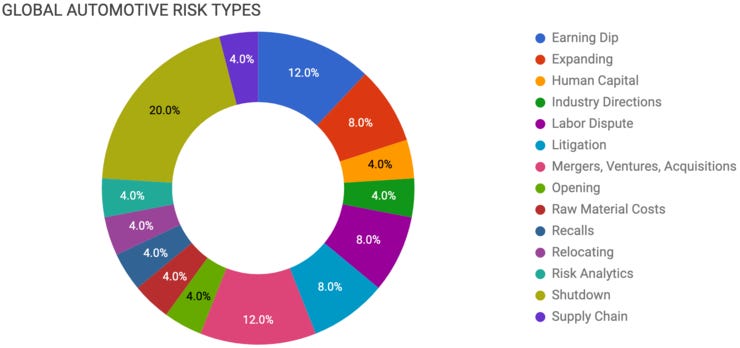

Elm Analytics - Automotive Supply Chain Risk Digest #243 - October 1 - 7, 2021

EARNING DIP

Volvo's monthly sales fell by 30% in September to 47k vehicles. The automaker says the decline is due to the chip shortage.

French auto sales dropped by 21% last month compared to September 2020.

New car sales in Britain dropped by 34% last month compared to September 2020. It marks their weakest September in at least 23 years.

EXPANDING

Northvolt is expanding its R&D campus in Vasteras, Sweden. With a target of 25% of EV battery production, it wants to take on Asian EV battery makers. Its headcount will increase from 400 to 1k engineers, adding 5k within five years.

Stellantis will retool its three Kokomo plants in Indiana to produce EV transmissions.

HUMAN CAPITAL

Mercedes will add 300 jobs at its plant in Vance, Alabama is it prepares to start producing EVs there next year.

INDUSTRY DIRECTIONS

GM is releasing its Ultra Cruise self-driving system that will allow hands-free driving "in 95 percent of all scenarios". The tech will appear first in Cadillac vehicles starting in 2023.

LABOR DISPUTE

The National Union of Metalworkers of South Africa launched a strike seeking wage increases. Auto industry officials expect supply disruptions would occur if the strike lasted more than a week.

Stellantis is considering moving its Opel plants in Russelsheim and Eisenach to Stellantis. Union officials accused Stellantis of taking advantage of Germany's furlough plan to move production out of the country. The plants will shut down next week due to the semiconductor shortage.

LITIGATION

Tesla will pay a former worker $137M over harassment and discrimination he experienced while working for the automaker. Berkley law professor David Oppenheimer said, "I believe that's the largest verdict in an individual race discrimination in employment case."

Ford and GM are trying to settle their dispute over the name of Ford's "BlueCruise" automated driving system out of court. They will report back to the court within 60 days if an agreement isn't reached.

MERGERS, VENTURES, ACQUISITIONS

Qualcomm has edged out Magna in its bid to buy Veoneer with an offer of $4.5B compared to Magna's $3.8B. Veoneer will pay Magna a $110M breakup fee as a result of accepting Qualcomm's offer.

EV maker Rivian is planning to build its battery cells. They currently source them from Samsung SDI.

Ouster is buying Sense Photonics. Sense's CEO, Shauna McIntyre, will merge both lidar companies into a new automotive division.

OPENING

Tesla will move its headquarters from Palo Alto, California, to Austin, Texas. The company is building a large assembly plant and battery complex near Austin.

RAW MATERIALS

Lithium prices have doubled in the past year as lithium miners can't keep up with demand.

RECALLS

Volvo recalled over 460k vehicles globally due to potentially faulty airbag inflators.

RISK ANALYTICS

"The current U.S. battery capacity is far short of meeting demand. Building a factory to meet demand requires a lead time of 30 months, and I see a battery shortage continuing at least until 2025."

- Kim Jun, chief executive of SK Innovation

SHUTDOWN

Ford will shut down its Hermosillo plant October 11-12. The plant, in Sonora, Mexico, produces the Bronco Sport and Maverick. The company cites a material shortage as the cause.

Stellantis suspended production from October 18, 2021 - January 2, 2022, at its plant in Vienna, Austria, due to the Covid-19 pandemic.

Nissan will halt its Aguascalientes and CIVAC plants in Mexico for a little over a week due to the chip shortage.

VW extended its shutdown of the Jetta segment of its Puebla, Mexico plant until October 15.

Skoda will cut or halt production at its Czech factory from October 18 through the end of the year. One-quarter of the country's industrial output comes from the company.

SUPPLY CHAIN

Reuter's overview: Factbox: How COVID-19 in Southeast Asia is threatening global supply chains