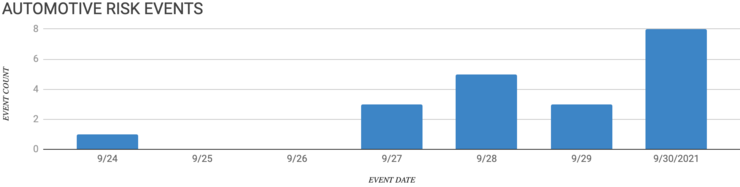

Elm Analytics - Automotive Supply Chain Risk Digest #242 - September 24 - 30, 2021

CHANGE IN MANAGEMENT

Genesis Motor North America appointed Claudia Marquez its COO. Marquez is taking over daily operations of Hyundai's luxury brand as CEO Mark Del Rosso is leaving the company after a 3-month hiatus for personal reasons. She was named Hyundai Mexico CEO in 2019.

EARNING DIP

Both Faurecia and Hella cut sales forecasts in the wake of IHS Markit's September report. Faurecia launched its public takeover offer of Hella earlier this week.

OPENING

Production will restart next week at the following plants affected by the semiconductor crisis:

Ford Oakville Assembly in Ontario, Canada

GM Lansing Grand River in Lansing, Michigan

GM Delta Township Assembly in Lansing, Michigan

Stellantis Saltillo Truck Assembly Plant in Mexico

Stellantis Jefferson North Assembly in Detroit, Michigan

Ford and SK Innovation will build three battery plants and an F-150 EV assembly plant in the US. The companies will base the plants in Stanton, Tennessee, and Glendale, Kentucky. The $11B investment is sizeable, and Ford's $7B portions will be its most significant investment ever made.

LABOR

These new battery plants will be watched as indicators of the future of union organization. The strength of UAW drives, the pull of lawmakers, and the union resistance of southern states will all be competing forces at play.

MERGERS, VENTURES, ACQUISITIONS

Lordstown Motors has reached an agreement in principle to work with Foxconn to produce its electric truck. The company is struggling to launch its pickup and burned through much of the cash it raised while going public.

Lordstown Motors may ultimately sell its Lordstown, Ohio plant to Foxconn. The company currently uses only 30% of the plant's 6.2M sq ft. Foxconn has been considering sites to build EVs in the US. It is co-developing a low-cost vehicle with Fisker that it will manufacture.

CATL is buying the Canadian mining company Millennial Lithium for $297M. The Chinese battery maker aims to secure a long-term lithium supply. CATL has recently purchased stakes in other companies that provide raw EV battery materials.

Dana and Bosch have partnered to develop and produce metallic bipolar plates for fuel cell stacks.

Mercedes-Benz joined Stellantis and Total Energies' partnership, Automotive Cells Company (ACC). ACC will develop and produce 120 GWh of EV battery cells in Europe by 2030.

Continental will restructure after it spun off Vitesco, its powertrain unit, in September. Its Automotive Technologies unit will split into five business areas, while its rubber technology unit will separate its tire business from ContiTech.

Toyota's Woven Planet is acquiring Renovo Motors, an automotive operating system developer. Renovo brings a team of engineers and will extend Woven Planet's open vehicle dev platform.

PRODUCTION INCREASE

Production on the Corolla Cross has reportedly started at the Mazda Toyota plant in Huntsville, Alabama.

Lucid's first EV, the Air sedan, rolled off the production line this week.

RAW MATERIALS

The auto industry traditionally used silicon semiconductors due to cost. However, material advances in silicon carbide and gallium nitride allow higher current and better temperature handling. In an EV, these advances equate to longer ranges and shorter charging times.

RECALLS

Hyundai and Kia recalled 550k Sonata and Sedona models. Turn signals can flash in the opposite direction of what the driver intended.

VW recalled 200K T6 multivans in Germany due to ice blocking the door locking mechanism causing unexpected opening while driving.

SHUTDOWN

Shut down due to the semiconductor shortage:

Ford Flat Rock Assembly in Michigan

Ford Transit production at Kansas City Assembly Plant in Missouri

Ford Kentucky Truck plant down to one shift from three

GM Ramos Assembly in Mexico

Opel closed Grandland X production in Eisenach, Germany

VW down to one assembly line in Wolfsburg, Germany

SUPPLY CHAIN

We know tight vehicle inventory and supply chain disruptions have taken their toll on new vehicle sales.

"Things are getting worse, and they're not going to get better, at least through the end of this year."