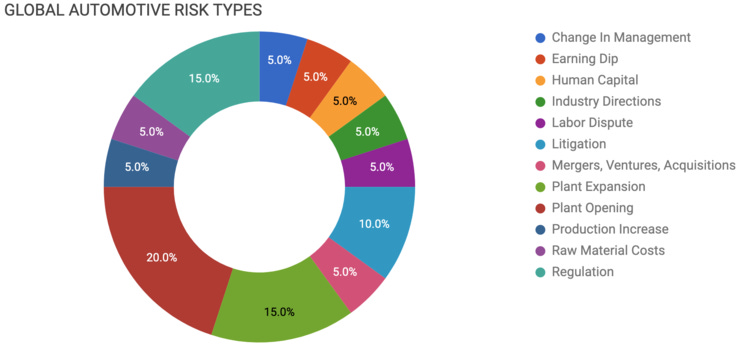

Elm Analytics - Automotive Supply Chain Risk Digest #144 - November 8 - 14, 2019

CHANGE IN MANAGEMENT

Daimler plans to cut every tenth managerial position, among other cost-saving measures aimed at saving $1.5B.

EARNING DIP

Nissan reported a 70% drop in quarterly profit this week, cutting its full-year forecast to an 11-year low.

INDUSTRY DIRECTIONS

Ford may produce electric motors at its Van Dyke plant proposed in its tentative agreement with the UAW. Few automakers build electric motors in-house.

LABOR DISPUTE

The UAW and Ford have revised their tentative deal to give some 10K UAW workers more significant raises than were expected if the agreement is approved. The change allows the union to synchronize the worker pay raise schedule and would give newer workers retroactive pay to catch up to the proposed contract's improved pay scale.

UAW members are expected to ratify the four-year contract with Ford today.

LITIGATION

Two former VW management board members and two current managers have been charged by German prosecutors with overpaying labor representatives. The unidentified men are accused of breach of trust for overpaying several members of the automaker's works council from May 2011 to May 2016.

The U.S. Justice Department has issued civil subpoenas to Ford, Honda, BMW, and VW. The subpoenas reportedly demand that they disclose details on a deal struck with California emissions standards.

MERGERS, VENTURES, ACQUISITIONS

German supplier Hella is planning to sell its relay business in Xiamen, China, to local Chinese supplier Hongfa Electroacoustic Co. The $11M sale will include the transfer of the facility and its 280 employees to Hongfa.

PLANT EXPANSION

GM is investing $750M into its plant in Changwon, South Korea, to retool and refurbish it. The investment is being made to accommodate production of a new crossover model at the facility starting in 2022.

Hyundai will invest $400M into an expansion of its assembly plant in Montgomery, Alabama. The development, which is aimed to be completed by 2021, will add 230K sq ft to the facility and bring the addition of a new vehicle and 200 jobs.

Topre America is adding 51 new jobs at its automotive stamping plant in Smyrna, Tennessee. The jobs are part of a $63M investment to expand the facility.

PLANT OPENING

A new 198K sq ft EV battery pack assembly plant was announced at VW's Chattanooga, Tennessee, expansion ground-breaking.

Tesla CEO Elon Musk said this week that the automaker would build "Gigafactory 4" in the "Berlin area" in Germany. He also said that Tesla would create an engineering and design center in the city.

Canadian auto supplier Axiom Group is building its first US plant in Toledo, Ohio. The plant will produce plastic-injection molded parts, create at least 250 new jobs, and will open sometime next year.

China's Great Wall Motor has started building its new $1.1B assembly plant in Taizhou, China. The plant is expected to start output by Dec 2020 and will produce both EVs and traditional vehicles.

PRODUCTION INCREASE

In the race to target China's new energy vehicle (NEV) market, VW has begun trial production at its Shanghai EV factory.

RAW MATERIALS

The global supply of battery-grade lithium exceeds current demand by 5%. Prices are down more than 50% since Jan 2018.

REGULATION

The Trump administration delayed a Thursday deadline to impose tariffs. The "Section 232" national security tariffs on imported vehicles and parts could have been as high as 25%.

The Dutch government is lowering the top speed limit on its highways from 130 km/h (81 mph) to 100 km/h to cut down on nitrogen oxide pollution. The law comes after a Dutch Supreme Court decision in May that found the government's rules for granting permits for projects that emit nitrogen oxide breach EU environmental law.

Engineering.com: "The Impact of Brexit on UK Manufacturing"