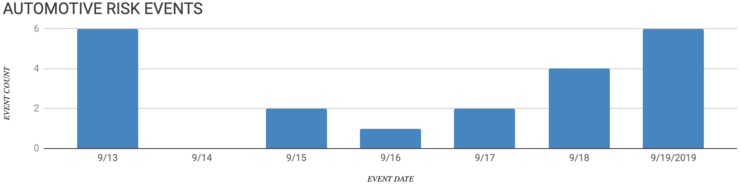

Elm Analytics - Automotive Supply Chain Risk Digest #136 - September 13 - 19, 2019

BANKRUPTCY

Financial help from VW and GM seem to have fallen through at the last minute for German supplier Avir Guss (formerly Neue Halberg Guss). Employees took to protesting on the streets of Leipzig, seeking explanations.

CHANGE IN MANAGEMENT

PSA Group is reportedly recruiting former Mitsubishi head of product strategy, Vincent Cobee. Cobee left Mitsubishi in April.

EARNINGS DIP

Germany's auto industry is experiencing falling sales amid a public relations crisis.

HUMAN CAPITAL

Due to the slowdown at its US plants as a result of the ongoing UAW strike, GM is temporarily laying off around 1,200 workers at its Oshawa, Canada assembly plant. The automaker said that their Canadian plants have to reduce the production of GM pickups by 50% since they can't get the necessary components from the US plants.

LABOR DISPUTE

46,000 GM workers across the US are continuing to strike this week as they fight for higher pay and more significant benefits. GM's latest offer included a 2% wage increase for the first and third year of the new contract, but also reportedly is asking for workers to pay 15% of their health care costs as opposed to the current estimated level of 3%.

Some details of the GM / UAW negotiations have surfaced.

Employees at GM's Silao, Mexico assembly plant are on strike. They are petitioning to have the existing union, the CTM, replaced by an independent union.

Unifor and Nemak reached an agreement, ending the two-week strike in Windsor, Ontario. The plant produces engine blocks for Cadillac and Chevrolet.

LITIGATION

The US Dept. of Labor has charged active UAW executive board member Vance Pearson with money laundering, conspiracy and falsifying reports. An affidavit filed with the criminal charges said that Pearson used legitimate union conferences to disguise the rental of expensive resort accommodations in California.

Ford is recalling over 300,000 2017 Explorers due to seat frames that may have sharp edges. The automaker said it's aware of 31 reports of hand injuries.

PLANT CLOSING

As part of its restructuring plan, struggling Japanese brake supplier Akebono Brake will close six plants at home and abroad. Akebono will shutter its plant in Soja, Japan, three plants in the US, one in France and one in Slovakia by the end of June 2024.

PLANT EXPANSION

Toyota is investing $391m into upgrading its assembly plant in San Antonio, Texas. Also, Toyota's supplier Aisin AW is investing $400m into a new plant in Cibolo, Texas, that will create 900 new jobs by 2023.

Neaton will expand its Eaton, Ohio facility to meet increased customer demand. The supplier produces airbags, steering wheels, and instrument panels for Honda and Nissan.

PLANT OPENING

GM is planning to build a new $175m plant near Dayton, Ohio that would create 100 new jobs. The 251,000sf facility would make truck engines and supply engine blocks and heads to the DMAX plant in Moraine, Ohio.

Volkswagen Group will decide where to build a new EU multi-brand plant by the end of October. Turkey and Bulgaria are expected to be contenders.

UK automaker Ineos Automotive is building a new plant in Bridgend, South Wales for the assembly of its new Grenadier 4x4 vehicles. The new plant will eventually create around 500 new jobs and will begin production in 2021.

PLANT SHUTDOWN

Borealis AG has declared force majeure in two production sites in Kallo, Belgium, and Burghausen, Germany. The polyolefin produced is used in body panels, interior trim, and climate control systems.

PRODUCTION DECREASE

Mexico experienced a sharp drop in vehicle exports of 12.7% in August compared to 2018. Mazda ↓66%, Audi ↓61%, VW ↓38%, FCA ↓32%, Kia ↓31%.

RAW MATERIALS

The Global Platform for Sustainable Natural Rubber is taking steps to define standards. With rubber, vital to the automotive industry, sustainable supply chains will need to consider quality over quantity.

REGULATION

The Trump administration officially moved to revoke California's Federal Waiver to set their own emissions standards this week. President Trump claimed on Twitter that the move would make cars "far less expensive" and "substantially SAFER."

RISK ANALYTICS

Amid the UAW strike, GM reportedly has a 77-day supply of new vehicles on hand according to Cox Automotive. Being that it is above the industry average of a 66-day supply, it will likely take a prolonged strike to dent most vehicle sales.