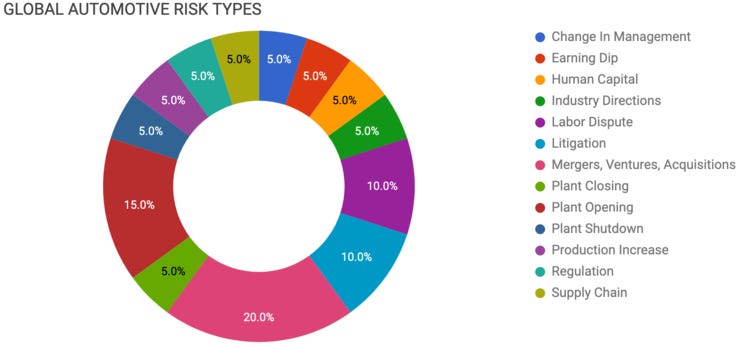

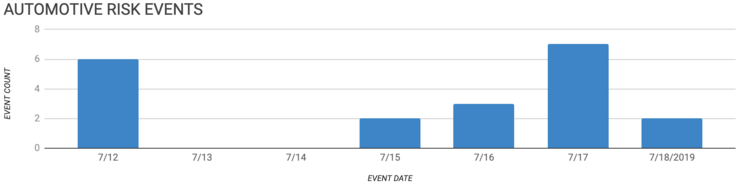

Elm Analytics - Automotive Supply Chain Risk Digest #127 - July 12 - 18, 2019

CHANGE IN MANAGEMENT

Mercedes-Benz USA has named 22-year Daimler veteran Christian Struwe as its new CFO. Struwe will replace Harald Henn, who transferred to Mercedes-Benz U.K.

EARNING DIP

Bearing maker SKF reported a 13% fall in profits for the second quarter of 2019. Reasons cited for the profit dip were restructuring and impairment costs.

HUMAN CAPITAL

Current and former Tesla employees who worked in the automaker's open-air "tent" factory allege that they were pressured to take shortcuts. They stated they were working under harsh conditions to hit aggressive Model 3 production goals.

INDUSTRY DIRECTIONS

Vehicle software and electronic architecture are evolving at an exponential pace. A new report (pdf) from McKinsey explores the impact of these changes.

LABOR DISPUTE

The UAW kicked off negotiations with Ford this week to work towards locking in a new labor contract ahead of the current contract's expiration in September. UAW President Gary Jones said that union members "...expect to share in the profits that their hard work and dedication have made possible".

The UAW also started negotiations for its next four-year agreements with FCA and GM. UAW President Gary Jones said that the union expects to make economic gains with any contracts it might sign this fall.

LITIGATION

The Virginia Automobile Dealers Association is planning to appeal a June court decision that will allow Tesla to continue operating a store in suburban Richmond, Virginia. VADA CEO Don Hall said that Virginia law "prohibits the kind of vertical monopolies that Tesla is seeking to erect."

Nissan recalled over 91k Titan pickup trucks over an electrical short that can cause the engine to stall. The recall covers some 2017-19 Titans and is a result of alternator harnesses damaged during the engine installation process.

MERGERS, VENTURES, ACQUISITIONS

Ford announced that they would license VW's MEB electric vehicle platform to build battery-powered cars at its plant in Cologne, Germany. Also, VW will invest $2.6b in Ford's Argo AI self-driving unit.

Autokinition Global Group will acquire metal and components supplier Tower International for $900m. The deal is expected to close in September or October.

Renault and Jiangling Motors have formed a 50/50 partnership. The joint venture will produce electric vehicles for the Chinese market.

Japan's Akebono Brake Industry will receive $185m from a corporate turnaround fund to restructure. The GM supplier will reduce foreign ventures and ask lenders to forgive much of its debt ($463m).

PLANT CLOSING

Mexican-owned parts supplier Nemak is closing its plant in Windsor, Canada, after losing a Chinese client. The engine block plant will close by mid-2020 and put 270 employees out of work.

PLANT OPENING

Magna Steyr opened a new paint plant in Hoce-Slivnica, Slovenia. The plant will coordinate with Magna Steyr's contract production facility in Graz, Austria.

Volkswagen has picked a site near Izmir, Turkey for a new plant that will build cars for VW, Skoda, and Seat. The site is expected to open in 2022/2023 and have an annual production capacity of 350,000 units.

Interiors supplier Motus Integrated Technologies is investing more than $15m into a new plant in Gadsden, Alabama. The new plant will bring 90 jobs to the area and manufacture interior parts and headliners.

PLANT SHUTDOWN

Chinese EV company, SF Motors, has reportedly halted production of its primary vehicle. SF Motors took over AM General's old plant in Mishawaka, Indiana. The shutdown comes after the automaker laid off several employees at its headquarters in California.

PRODUCTION INCREASE

Ford's South African unit is going to hire an additional 1,200 people for an extra shift at one of its vehicle assembly plants. The planned production increase is a result of a $214.72m investment in 2017.

REGULATION

England is considering changing building regulations, requiring electric car chargepoints in new homes.

SUPPLY CHAIN

Mexican vehicle producers exported a record-breaking 1.74m million vehicles worldwide during the first six months of 2019. 78.5% of the exports were to the U.S., while Canada received 7.1% and Europe and Latin America received 6.4% and 5.9%, respectively.