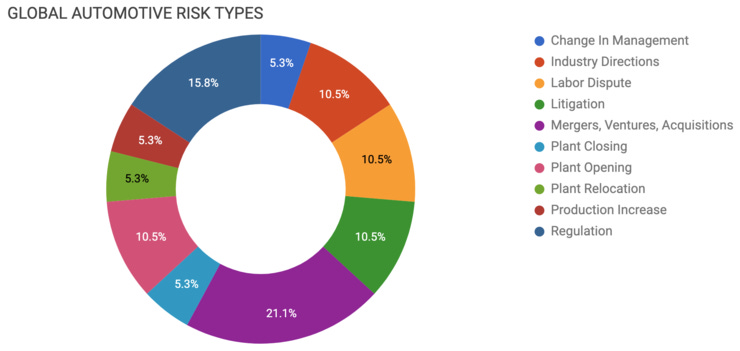

Elm Analytics - Automotive Supply Chain Risk Digest #122 - June 7 - 13, 2019

CHANGE IN MANAGEMENT

Henniges Automotive announced longtime finance exec L. Brooks Mallard is its new CFO. The role has been vacant since 2016 when former CFO Larry Williams was promoted to the position of CEO.

INDUSTRY DIRECTIONS

Yang Jian: The dropped government subsidies have sharply cut EV demand and sales in China. Meanwhile, output and production levels have continued to climb. Unless there are dramatic policy adjustments, the market bubble will burst.

Ford's autonomous driving partner Argo AI started testing its new vehicles in Detroit. In addition to Detroit, Argo is also testing in Pittsburgh, Palo Alto, Miami and Washington, D.C.

LABOR DISPUTE

With six ice-breaking meetings aborted since May 30, GM Korea's Labor Union is preparing to go on strike.

Workers at VW's plant in Chattanooga, Tennessee are voting on whether to unionize with the UAW this week. The last vote in 2014 was shot down by a small margin.

LITIGATION

Audi of America is recalling it's new 2020 e-tron EV to replace a potentially faulty wiring grommet in the battery's wiring assembly. The vehicle has only been available since April.

Ford is recalling over 1.2m select 2011-17 Ford Explorer vehicles due to a risk of fracturing a rear suspension toe link. The affected vehicles were built at the automaker's Chicago Assembly plant from May 17, 2010, to Jan. 25, 2017.

MERGERS, VENTURES, ACQUISITIONS

Ford/VW talks are "going well and are nearly complete." The automakers are looking to extend their partnership to Ford's use of VW's MEB electric vehicle platform.

Hyundai Motor/Kia are investing in autonomous vehicle startup Aurora this week. The companies plant to create a self-driving hydrogen fuel cell crossover. Earlier in the week, FCA announced a similar alliance. But, VW opted not to renew its contract with Aurora to work instead with Ford's partner Argo AI.

Chinese automaker Geely is pairing with LG Chem to form a new $188m JV to build EV batteries. The partnership will be 50/50 between LG Chem and Geely's Shanghai subsidiary, Shanghai Maple Guorun Automobile Co.

PLANT CLOSING

Gear Design & Manufacturing will close its Leeds Avenue, South Carolina site. Production will stop at the transmission assembly plant at the end of June 2019, part of the consolidation of two dozen facilities. Parent company American Axle's Metaldyne division paid $6M for the company in April 2017.

PLANT OPENING

BMW opened a new plant in San Luis Potosi, Mexico. The facility will have the capacity to produce 175k vehicles per year after ramp up. The location's 2.5k workers are initially building the BMW 3 Series.

Chinese-owned startup Indiana Wheel Corp is investing $23m into a new production facility in Plymouth, Indiana. The plant will produce steel wheels and create up to 117 new jobs.

Maxion Wheels and China's Dongfeng Motor Parts have broken ground on a new 236,720sf aluminum wheel plant in Suzhou, China. The plant will have a yearly production capacity of 2m die-cast aluminum wheels and is expected to start operations by the end of 2020.

PLANT RELOCATION

Lear Corporation is closing its plant in Taylor, Michigan and moving the work to a facility in Traverse City, Michigan. The company is offering all 76 affected employees jobs at the new facility.

PRODUCTION INCREASE

GM is investing $150m into its truck plant in Flint, Michigan to boost its output of heavy-duty pickup trucks. GM President Mark Reuss says the plant renovations should be completed by the first half of 2020.

REGULATION

President Trump has rejected an appeal from automakers to restart negotiations with California regarding vehicle emissions. In their petition, automakers warned that the White House's plan to weaken pollution regulation and efficiency standards could produce "untenable" instability.

The office of the U.S. Trade Representative has denied a request from Tesla for tariff relief on EV "brain" components they source from China. Tesla said the tariffs cause "economic harm to Tesla, through the increase of costs and impact to profitability.".

WSJ:

"Unlike automakers that can charge more for vehicles, suppliers—the manufacturers making seats, windows, dashboards and other vehicle components—would likely have to absorb any costs increases, say industry attorneys. That makes them particularly vulnerable to the tariffs."