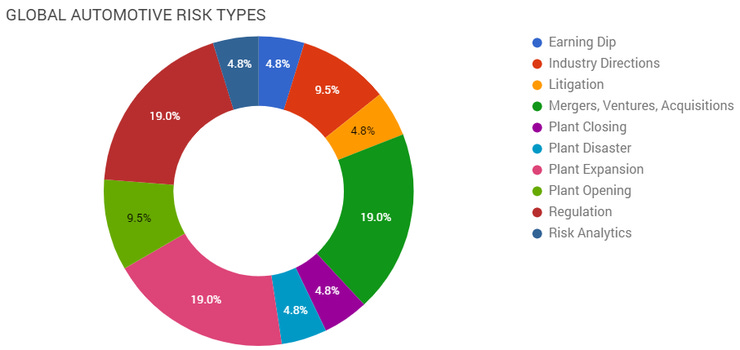

Elm Analytics - Automotive Supply Chain Risk Digest #73 - June 29 - July 5, 2018

EARNING DIP

After a 2.8% decline in May, car sales in Italy declined another 7.3% in June. According to Dataforce, the sales drop is due to a fall in self-registrations by carmakers and a 28% decline in short-term rentals.

INDUSTRY DIRECTIONS

While Tesla finally reached its goal producing 5k Model 3 sedans a week, many are concerned about Elon Musk's management practices, long term.

Bloomberg: Detroit Spinning Out Fuels China’s Auto Dreams

LITIGATION

The American Institute for International Steel has filed a lawsuit in New York court challenging the constitutionality of the statute under which President Trump imposed a 25% tariff on imported steel. They argue that Section 232 of the 1962 Trade Expansion Act is unconstitutional because it grants the president unlimited power to restrict trade on national security grounds.

MERGERS, VENTURES, ACQUISITIONS

Nissan has a canceled a planned $1b sale of its electric car battery business to China's GSR Capital. The automaker said that GSR lacked the funds to make the purchase.

Cooper-Standard is acquiring Lauren Manufacturing and Lauren Plastics sites in New Philadelphia and Kent, Ohio, respectively. Both units specialize in industrial and specialty automotive sealing solutions.

Intel's Mobileye is partnering with Baidu's Apollo, a autonomous driving consortium.

Connected Car startup Mojio will collaborate with Bosch on vehicle communication and diagnostics. Bosch had provided Series B funding in November 2017.

PLANT CLOSING

Magna is shutting down its Grenville Castings plant in Perth, Ontario, Canada by June of 2019. The closing will put 380 people out of work.

PLANT DISASTER

Honda halted production at their plant in Celaya, Guanajuato, Mexico late last week after flooding made the facility impossible to enter. The full extent of the damage hasn't yet been assessed and no timeline has been set for resuming operations.

PLANT EXPANSION

Big River Steel is investing $1.2b into the expansion of its steel mill in Osceola, Arkansas. The expansion will double production and result in around 500 new jobs.

Magna subsidiary, Bowling Green Metalforming will expand its facility at the Kentucky Transpark. The factory manufactures structural frame assemblies.

Unipres will expand its Steele, Alabama facility. The new hot stamping capabilities will supply Honda and Nissan.

South African supplier KLT Automotive is investing around $300,000 into the expansion of its chassis frame plant in Hammanskraal. The expansion will increase production from 500 to 630 chassis frames per day and create about 100 jobs.

PLANT OPENING

Lear Corporation is opening a new plant in Flint, Michigan and GM is opening a new parts processing center in Burton, Michigan. The Lear plant will occupy 156,000sf and employ 600 workers while the GM processing center will take up 1.1m sf and employ around 700 workers.

French seating supplier Faurecia and Chinese EV maker BYD have launched a new JV in Shenzhen, China. The plant is expected to produce more than 700,000 seats per year by 2022.

REGULATION

U.S. levied tariffs on $34 billion worth of Chinese imports.

The European Union is warning Trump that they could take countermeasures against $294b worth of US exports if he follows through with a 20% tariff on cars imported from the EU.

Bloomberg: How Car Companies Are Blasting Trump's Import Investigation

Jaguar Land Rover CEO Ralph Speth said in an email this week that a "bad Brexit" would jeopardize $106b in investment by the automaker over the next five years.

In a response to an offer from Washington to abandon threatened tariffs on European car imports in exchange for concessions, German Chancellor Angela Merkel said she would back lowering EU tariffs on imported American cars.

RISK ANALYTICS

The Wall Street Journal considers potential paths tariffs could take.