Elm Analytics - Automotive Supply Chain Risk Digest #30 - September 2-8, 2017

Today's perfect storm in Mexico of a 8.2 Earthquake and Hurricane Katia. Red indicators are clusters of automotive suppliers, timed lines are NOAA wind impact predictions, concentric circles are USGS shock lines:

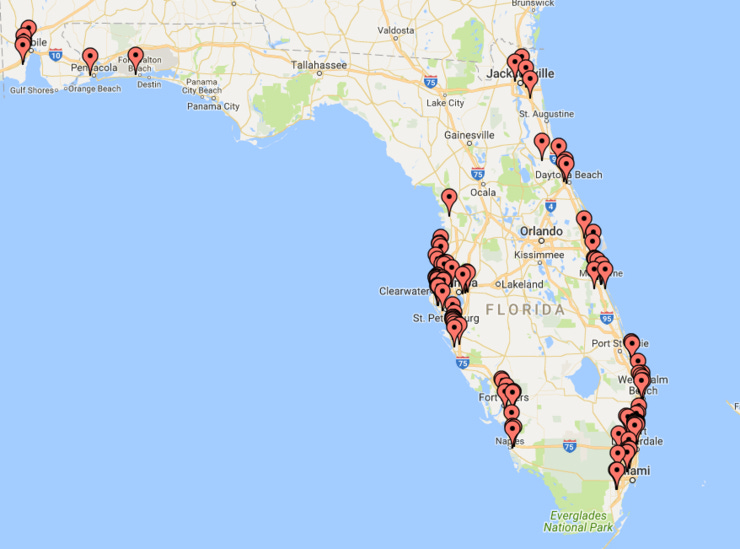

Hurricane Irma will likely impact the facilities outlined below. These facilities are within 10ft of sealevel. The printed circuit board segment of the supply chain will be particularly vulnerable:

Now on to the rest of this week's coverage:

CHANGE IN MANAGEMENT

Anders Gustafsson will replace Lex Kerssemakers as the CEO of Volvo Cars North America later this month. Kerssemakers says that Gustafsson is "very much a retail man" and knows "exactly what is necessary in a market."

Goodyear shifted senior leadership this week. The appointments fill a hole left by EMEA President Jean-Claude Kihn's retirement announcement.

INDUSTRY DIRECTIONS

Intel estimates that self-driving vehicles will generate about 4,000 gigabytes of data daily. How will companies store such massive amounts of data and who will they share it with?

Strategy consultant, Paul Eichenberg, discusses how Europe is shaping electrification and e-mobility. Auto suppliers will need to step up to protect and grow business.

Neil Winton writes about the disconnect between suppliers and automakers in the "Electric Revolution."

MERGERS, VENTURES, ACQUISITIONS

Magna and Delphi invested in the Series B funding of Innoviz this week. The company, based in Israel, is developing a solid-state LiDAR sensor for autonomous vehicles.

In other solid-state LiDAR news, Magneti Marelli and LeddarTech announced they will jointly develop a complete system. Osram recently aquired 25% of LeddarTech. The LiDAR system is expected to be integrated into automotive lighting products.

Suppliers are expected to complete a record $57 billion worth of acquisitions in 2017. This is nearly double the value of deals last year.

EXPANSION

Denso will expand their North American headquarters in Southfield, Michigan.

PLANT OPENING

German heat-resistant plastic pellet producer ALBIS Plastics has opened a new $14m plant in Duncan, SC. The plant has an annual production capacity of 30m lbs of plastic pellets.

Scorpion Automotive has opened a new PCB production plant in Lancashire. The company manufactures vehicle security and telematics systems for Aston Martin, Subaru, Toyota, BMW Motorrad, DAF Trucks, Norton and Triumph Motorcycles.

Magna is investing $60m into a new high pressure aluminum casting facility in Birmingham, Alabama. The 150,000sf facility will employ over 100 and further Magna's abilities in vehicle lightweighting and part reduction solutions.

PLANT SHUTDOWN

A supplier issue and slowing demand for the Chevrolet Cruze will shutter GM's Lordstown plant. The facility will be closed for three weeks in September to October. In March, the plant was down for three weeks. There was a scheduled two-week vacation at the end of June, and three weeks of extended shutdown were added to Lordstown’s schedule in July.

Hyundai halted and then restarted operations at one of its joint venture plants with BAIC in China this week after a supplier refused to provide parts due to payment delays. This comes after a shutdown last week for similar payment issues.

RAW MATERIAL DISRUPTION

AK Steel has announced a price increase of at least $30/ton for all carbon flat-rolled steel products in spot market. This comes after similar price hikes in June and July. AK is citing more volatile than expected pricing due to a flood of imports in the market.

REGULATION

The Environmental Protection Agency held a hearing this past Wednesday. The topic on hand? A Trump administration plan to consider cutbacks to current emissions and fuel economy standards.

Automakers and their suppliers are at odds over the 2021 EPA standards for emissions limits.

The Society of Indian Automobile Manufacturers is calling for a ban on vehicles that are more than 15 years old in order to reduce air pollution.