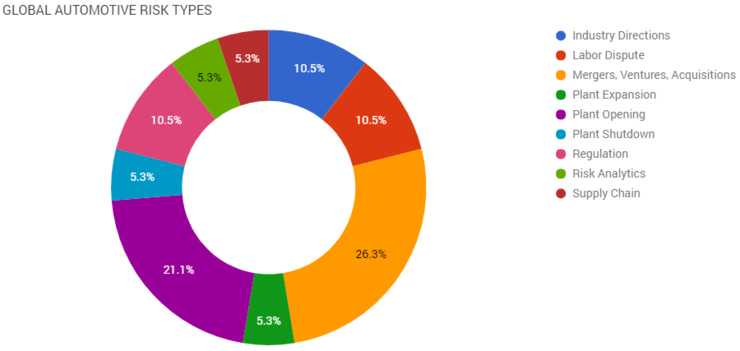

Elm Analytics - Automotive Supply Chain Risk Digest #23 - July 15 - 21, 2017

INDUSTRY DIRECTIONS

Automotive trends for semiconductors point to software defined vehicles, rather than distributed electronic control units. The OEMS will use partnerships and outsource controls to quickly develop autonomous vehicles. These vehicles will demand high performance chips, unlike previous automotive controls.

"Grow, move fast and break things" may work for Silicon Valley, but lives are at stake in Automotive. Harvard Business Review has an interesting write-up on innovation and partnerships.

LABOR DISPUTE

The Korean Metal Workers Union has authorized strike action if necessary for both Kia and Hyundai. The union is demanding wage hikes and other non-wage benefits at a time when both automakers are reeling from plunging sales.

Union workers at over 50 mines in Peru, the world's No. 2 copper producer, have gone on strike to protest parts of a labor reform. Workers say that new laws approved by Peru's president would make it easier for mass layoffs and weaken inspection bodies.

MERGERS, VENTURES, ACQUISITIONS

Graphic processing chip maker NVidia is partnering with Volvo and Autoliv on the development of new self-driving vehicle technology. The tech is aimed to be used in vehicles that will hit the marketplace by 2021.

BorgWarner is acquiring UK electrical engineering company Sevcon for $200m. The deal will bring electric propulsion vehicle tech to BorgWarner's powertrain portfolio.

China is increasing their efforts to invest in the auto industry with eight overseas deals totaling more than $5.5b compared to nine total investments over all of last year. The list includes the takeover of Takata and the acquisition of a sizable stake in Tesla.

Microsoft is teaming up with China's Baidu for a partnership to advance autonomous driving adoption worldwide. Microsoft will use their Azure cloud to provide a global scale for Baidu's Apollo autonomous vehicle platform.

Fisker and Nanotech will not go forward with a joint venture to produce graphene battery cells. Fisker's EMotion electric sedan will instead use LG Chem's cylindrical lithium-ion cells. The sedan is to debut in September 2017.

PLANT EXPANSION

Calsonic Kansei is investing $16.33m into expanding their Madison, Mississippi plant. The plant supplies parts to Nissan's Canton plant and will hire an additional 98 people after the expansion is complete.

PLANT OPENING

Navya, a French company that makes self-driving vehicles, is opening a 20,000sf factory in Saline, MI. They plan to hire 50 workers and make 25 driverless shuttles before the end of this year.

Indian auto supplier Mahindra and Mahindra are set to open a manufacturing plant in Detroit this year to produce off-road utility vehicles. The plant opening will make Mahindra the first Indian supplier to have a plant in the US.

Hyundia has started production at its newest assembly plant in Chongqing, China. The site has an annual capacity of 300,000 and will help increase local production of SUVs, the fastest growing segment in China.

German supplier IFA is investing $69m into a new 234,000sf facility in Summerville, SC. The plant will employ around 120 and produce driveshafts.

PLANT SHUTDOWN

General Motors idled production at its Orion Assembly plant this week to trim stock of the slow-selling Chevrolet Sonic. Analysts say that GM's inventory was at 127 days at the end of June, with 60 to 70 days being considered optimal.

REGULATION

Until Takata proves that new and replacement air bag inflators are safe (post recall), automakers are still at risk. In question is the drying agent added to the inflators to stop moisture from degrading the ammonium nitrate inflators. Last week, Takata's recall involved, for the first time, 2.7m inflators with the drying agent.

US auto suppliers and lobbyists are pushing hard against proposed Congressional border adjustment tax (BAT) changes and updates to NAFTA.

RISK ANALYTICS

A new study from Boston Consulting Group suggests that exiting NAFTA and implementing tariffs or border taxes would drive up US car costs, put thousands of supplier jobs at risk, and cost automakers billions.

SUPPLY CHAIN

The UK Audit Office has warned that the new Customs Declaration Service may not be ready by the time the UK leaves the EU in March 2019. At risk are the intertwined automotive supply chains between the EU and UK.