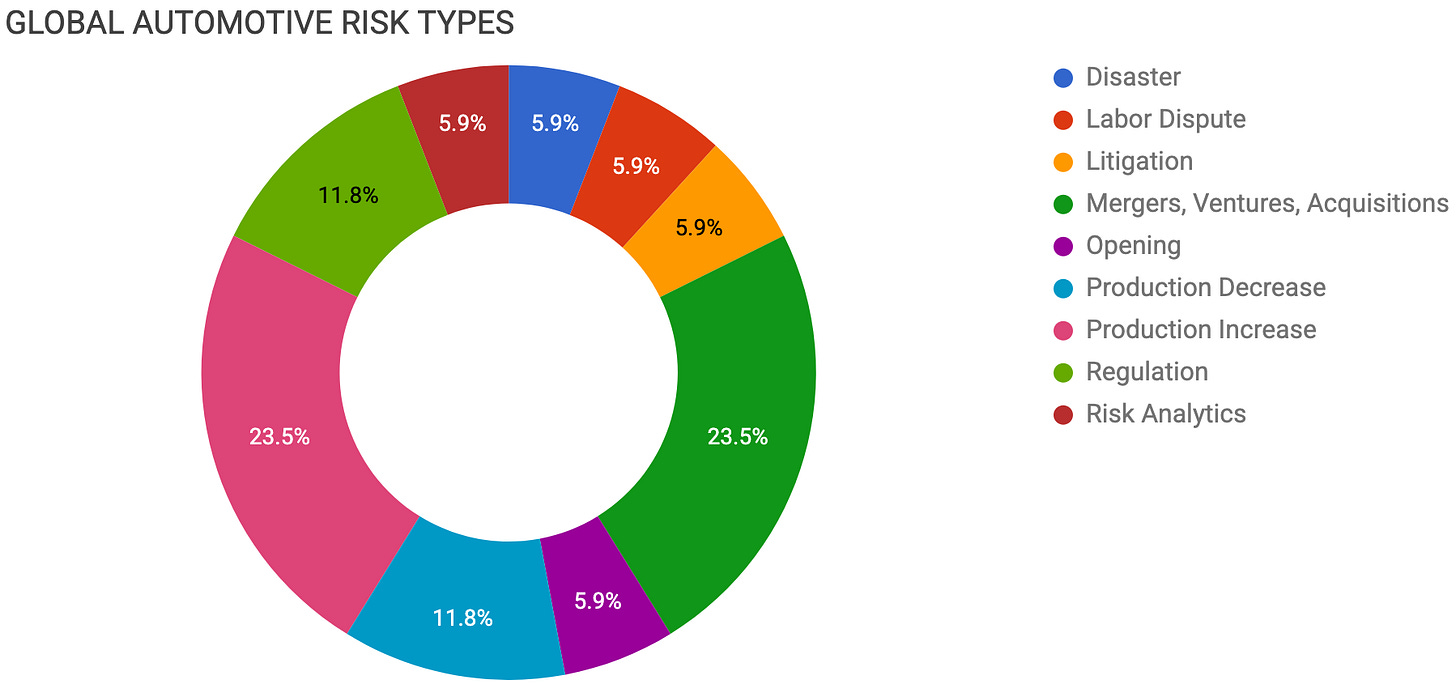

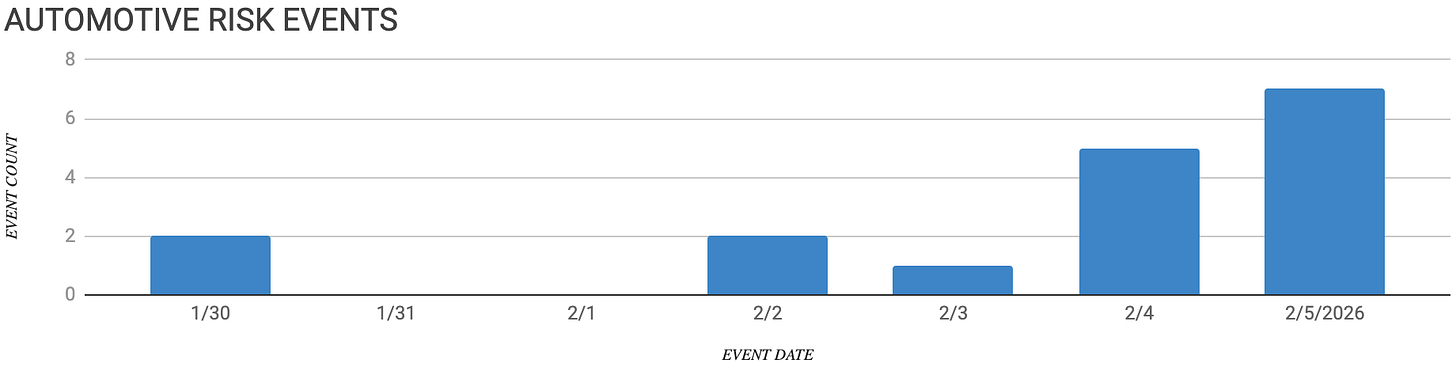

Automotive Supply Chain Risk Digest #468

January 30 - February 5, 2026, by Elm Analytics

Contents

DISASTER

Novelis aluminum output still disrupted

LABOR

Volkswagen UAW reach tentative agreement

LITIGATION

Lear sues Forvia over noncompete

MERGERS, VENTURES, ACQUISITIONS

Ford Geely explore EV partnership strategy

Suzuki Nissan sell plants amid competition

China approves CATL Chery joint venture

Pirelli board blocks Sinochem spin-off

OPENING

Dongwon Autopart builds new Georgia plant

PRODUCTION DECREASE

Stellantis Peugeot EVs delayed by batteries

Hyundai pauses Kona Electric production

PRODUCTION INCREASE

Stellantis boosts Italy output with new models

Factorial launches commercial solid-state program

QuantumScape starts solid-state pilot line

CATL Changan ramp sodium-ion EVs

REGULATION

MEMA warns on proposed CAFE reset

Brazil ends China EV kit tariff break

RISK ANALYTICS

PwC outlines automotive industry outlook 2026

Disaster

Aluminum production at Novelis, a key supplier to Ford, has not fully recovered more than 4 months after a major fire at its New York plant in September. Another fire in November caused more delays.

At the time, Ford lowered its 2025 profit forecast and expected to lose production of up to 100k F-Series trucks with a $2B impact. Ford has been buying aluminum from different Novelis plants while waiting for full recovery.

The company is expected to provide an update during its Q4 earnings call this coming week. This extended outage underscores the risk of relying on a single material source for high-volume vehicles like the F-Series.

Labor

Volkswagen and the UAW have reached a tentative agreement at the Chattanooga plant, covering approximately 3.2k workers. The agreement includes a 20% wage increase and enhanced job security.

This deal follows months of negotiations after workers authorized a potential strike but ultimately did not walk out. It represents a significant labor milestone in the South and reduces production risk at the plant.

Litigation

Lear has sued rival supplier Forvia and its new North American CFO, former Lear executive Christian Alejandro Carreon, alleging that he violated a one-year noncompete agreement by accepting the role months after leaving the company.

The complaint, filed in Michigan, seeks to block Carreon from working at Forvia, claw back a lucrative separation package, and recover any revenue or profits Forvia may have gained from what Lear describes as misuse of its confidential commercial and financial information.

The case highlights how large, competing auto suppliers rely on noncompete and trade secret protections as they battle for market share, even as the broader legality of noncompete agreements remains under pressure in the US.

Mergers, Ventures, Acquisitions

Ford is reportedly discussing a potential EV partnership with Geely. The plan could use Ford’s underused plants in Europe and share advanced vehicle technology.

This deal might help Geely avoid EU import tariffs and give Ford access to stronger EV and software skills. If the agreement goes ahead, it would signal a shift in recent supply chain strategy from going it alone to partnering.

Suzuki and Nissan are exiting plants in Thailand and South Africa, selling these assets to Ford and Chery amid increased competition from Chinese carmakers. Chinese brands have quickly gained ground in emerging markets by offering lower prices and more features.

China has approved a joint venture between CATL and Chery, indicating closer alignment in battery supply. However, the details of the venture are not yet clear.

Pirelli’s board voted against a spin-off proposed by Sinochem, Pirelli’s largest shareholder and a Chinese group, meant to resolve governance tensions and de-risk US expansion. The ongoing dispute keeps regulatory and strategic uncertainty elevated for a key tire supplier.

Opening

Korea’s Dongwon Autopart Technology plans to invest $30M to build a new manufacturing facility near Swainsboro, Georgia. The company produces structural automotive components, including doorframes, seat frames, and battery frames, and says its existing operations in Hogansville, Georgia, will remain open.

Production Decrease

Stellantis is facing delays of up to eight months for full-electric Peugeot models, including the 3008 and 5008, due to manufacturing issues at its battery supplier, Automotive Cells Co (ACC).

The ACC plant in Billy-Berclau, France, is reportedly producing batteries for only about 1k vehicles per month, well below plan, with high scrap rates prompting the use of Chinese experts to stabilize output.

ACC said the ramp-up “is difficult but we are learning every day,” while also exploring cost-cutting measures in France to offset the impact.

In the automotive supply chain, the situation is a reminder of Europe’s ongoing challenges in scaling local battery production, which directly constrains EV output and OEM delivery timelines.

Hyundai will pause Kona Electric production and skip the 2026 model year, saying 2025 inventory is sufficient to meet demand. The automaker expects the model to return for 2027, with production restarting in June 2026. This creates a temporary interruption and restart cycle for Kona EV-related suppliers and inbound materials.

Production Increase

Stellantis will boost production at several Italian plants in 2026 by adding shifts and launching new models, following commitments made to the Italian government after last year’s sharp output decline.

At Melfi, production of the new DS 8 and Jeep Compass is underway, with strong demand prompting the return of a second shift. Additional DS and Lancia models are planned through 2028.

The company will hire about 500 workers in Italy, restart extra shifts at Mirafiori and Atessa, and keep investing in Euro 7-compliant gasoline engines and a new e-DCT gearbox line at Termoli.

This plan should help stabilize Italy’s supplier base in the short term after a steep decline, but recovery will depend on steady demand for new hybrid and electric models.

Three battery technology milestones just moved closer to real-world scale this week:

Factorial Energy launched its first commercial solid-state battery program in the US, partnering with Karma Automotive to power its Kaveya ultra-luxury EVs. Factorial says its cells can deliver 500 to 600-plus miles of range with about 40% weight savings and are compatible with up to 80% of existing lithium-ion manufacturing equipment, reducing retooling risk. The program moves solid-state batteries from lab testing into real production validation, building on prior demonstrations with Mercedes-Benz and Stellantis.

QuantumScape launched its Eagle Line pilot to produce solid-state cells for OEM sampling, testing, and integration. The pilot incorporates its Cobra separator process and is intended to demonstrate scalable, automated production, serving as a meaningful step toward supply chain readiness, provided OEM validation supports commercialization.

CATL and Changan are ramping up production of the first mass-produced passenger EVs powered by sodium-ion batteries, starting with the Nevo A06 in China. CATL says the technology matches LFP energy density, performs better in extreme cold, and reduces exposure to rising lithium prices. If volumes ramp as forecast, sodium-ion could materially change sourcing and cost risks for battery materials across EV supply chains.

Regulation

MEMA’s comments to NHTSA (pdf) state that the proposed SAFE Vehicles Rule III would reset CAFE requirements by aiming for a 34.5 mpg average fleetwide level by 2031. This change would directly affect how suppliers plan products, allocate capital, and schedule time for new technology rollouts.

MEMA stressed that stable regulations are essential because suppliers typically plan on 5- to 10-year cycles, and sudden changes can lead to wasted investments and workforce-planning issues.

The group also warned that slow or weak progress on fuel economy could hurt US supplier competitiveness and shift innovation investments to other regions.

For supply chains, the final rule will affect which technologies get funding, how quickly programs move from development to launch, and how compliance credits are distributed among suppliers.

Brazil has let a temporary tariff exemption on EV and hybrid vehicle kits imported from China expire, forcing companies like BYD and Great Wall Motor to pay up to 35% in import duties again.

The six-month break, capped at $463M, was heavily criticized by Brazil’s auto industry, which argued it favored low-value assembly over local manufacturing and threatened domestic supply chains.

While the move raises costs for China-dependent assembly models, it also reinforces Brazil’s push toward deeper localization over kit-based EV production.