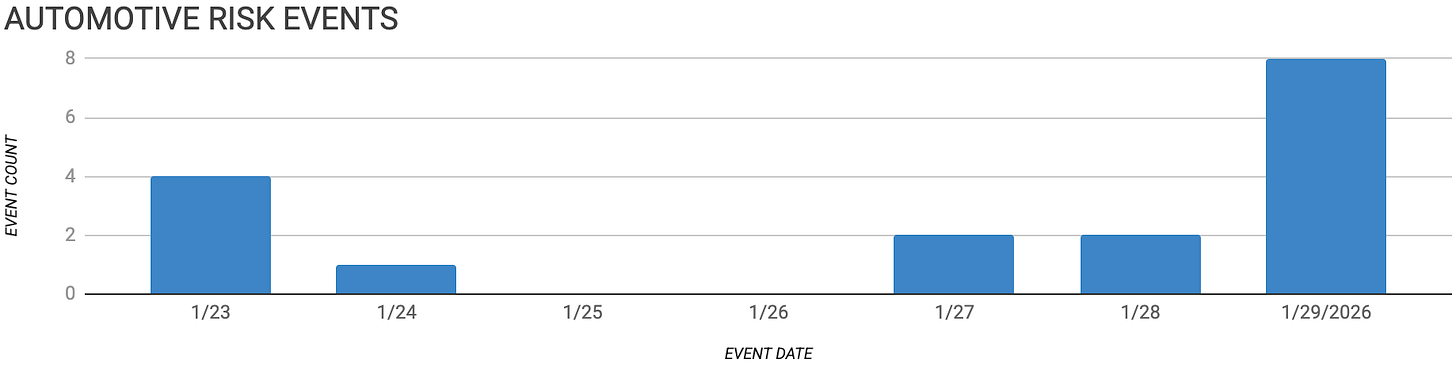

Automotive Supply Chain Risk Digest #467

January 23 - 29, 2026, by Elm Analytics

Contents

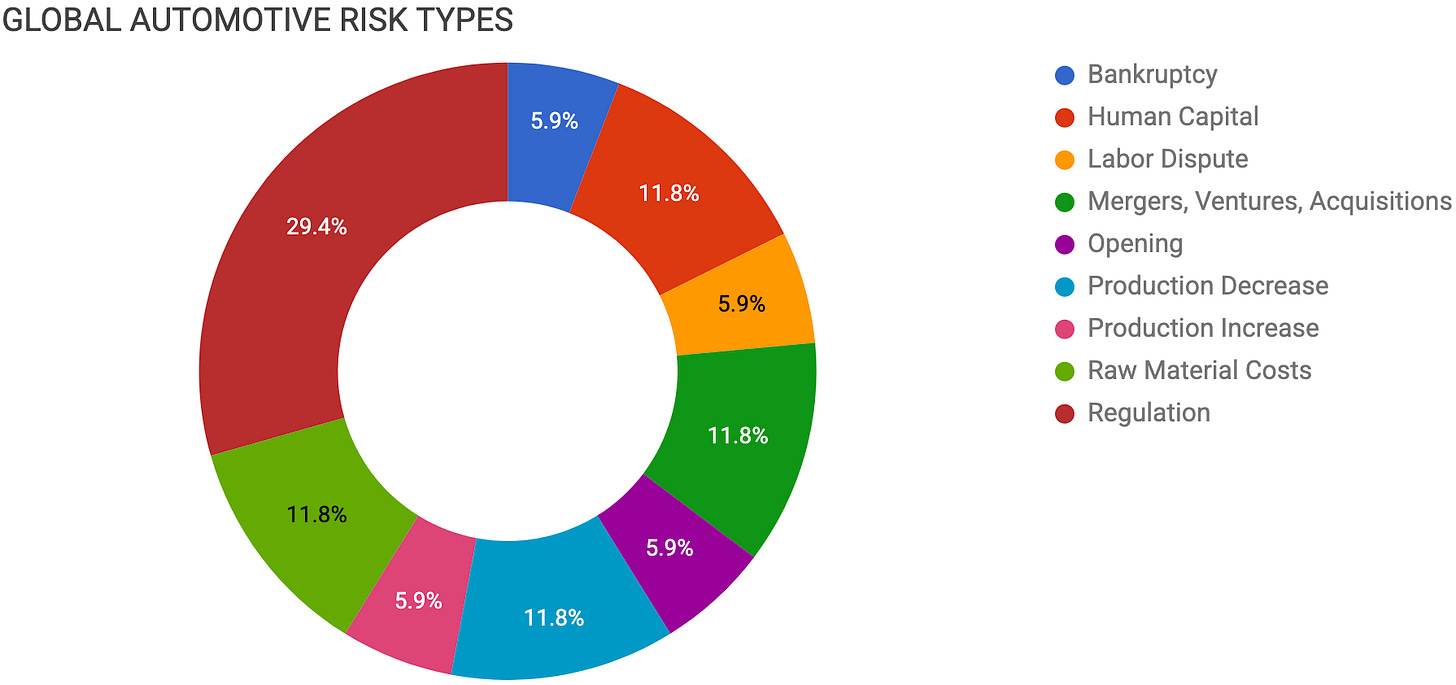

BANKRUPTCY

First Brands fraud indictment fallout

HUMAN CAPITAL

Aumovio cuts 4k jobs globally

GM Oshawa shift cut layoffs

LABOR

IG Metall signals tougher wage talks

MERGERS, VENTURES, ACQUISITIONS

Supplier consolidation wave expected 2026

Mazda seen as Japan's consolidation trigger

OPENING

Toyota Idemitsu solid-state battery pilot

PRODUCTION DECREASE

Tesla pivots spending away from EVs

ZF ends EV projects early

PRODUCTION INCREASE

Toyota posts record global sales

RAW MATERIAL COSTS

Kia hit by precious metals surge

Sodium-ion batteries accelerate as lithium rises

REGULATION

Canada opens door to Chinese vehicles

Korea-Canada auto manufacturing talks

Ottawa hedges USMCA with Asia ties

Washington softens stance on China

India EU auto tariffs slashed

Bankruptcy

First Brands founder Patrick James was indicted on fraud and conspiracy charges related to alleged schemes to conceal billions in liabilities ahead of the supplier’s bankruptcy last September. First Brands has begun shutting down its Brake Parts, Cardone aftermarket parts, and Autolite spark-plug units, affecting 4k jobs in total.

The collapse disrupted parts supply for many manufacturers, including Ford and GM. Both are now providing $48M in short-term prepayments to keep operations running. The case is a reminder of heightened legal and continuity risk around financially distressed Tier-1 suppliers.

Human Capital

Aumovio will cut up to 4k jobs (~5%) as it restructures R&D to cut costs, mostly by year-end, across sites in Germany, Romania, Serbia, Singapore, India, and Mexico. Spun off from Continental last year, it cites high costs, weak European demand, and tougher competition from China.

GM Canada is cutting a shift at its Oshawa plant, affecting about 500 GM workers and up to 1.2k jobs across the supply chain. The move follows US tariffs and weak demand, even as GM adds jobs at a parallel pickup plant in Indiana.

Labor

IG Metall is signaling potential escalation ahead of wage talks this autumn as German automakers face mounting pressure from Chinese rivals, tariffs, and soft EV demand. With unions exerting strong governance influence, labor tensions could heighten supply chain and production risks amid ongoing restructuring.

Mergers, Ventures, Acquisitions

Analysts and executives expect a new wave of automotive supplier consolidation in 2026. High costs, labor shortages, tariffs, and volatile production schedules continue to squeeze supplier balance sheets.

Many suppliers held off on M&A in 2025. Trade policy shifts, geopolitical developments, and changes in automakers’ EV strategies created excessive uncertainty. Now, as conditions look more stable, more deals could move off the sidelines.

Financial stress is still widespread. In a recent read on the market, 61% of supplier executives said they are concerned about distress in their supply chains. Suppliers also cut at least 60k jobs across North America and Europe in 2025, alongside multiple bankruptcies.

For many, consolidation is becoming the most practical lever to pull. It can cut costs, reduce geopolitical exposure, and help stabilize supply chains, even as auto manufacturers continue to face policy and demand uncertainty.

Opening

Idemitsu Kosan and Toyota have started building a pilot plant in Chiba, Japan, to make solid electrolyte for all-solid-state lithium-ion batteries. The plant is expected to be finished in 2027.

This project moves Idemitsu from making lab samples to commercial production and helps Toyota work toward launching electric vehicles with these batteries by 2027 or 2028. The new facility will also guide plans to increase production to several hundred tons per year in the future.

Production Decrease

Tesla plans to spend about $20B in 2026, more than doubling its capital spending as it shifts from a traditional electric vehicle focus to robotics, driverless technology, and AI infrastructure.

The company will stop making the Model S and Model X, convert its Fremont plant to produce Optimus humanoid robots, and increase investment in robotaxis, AI computing, and battery facilities.

In 2025, Tesla’s automotive revenue dropped by 10%, and total revenue fell for the first time, showing the impact of global EV competition and slower model updates. For automotive supply chains, this shift means slower long-term vehicle growth and more uncertainty for suppliers focused on EVs.

Germany’s ZF Friedrichshafen is ending some EV projects earlier than planned as demand ramps more slowly than expected. The company also expects a 2025 loss tied to an e-mobility charge. The pullback raises near-term risk of program resets and supplier reallocation across EV components.

Production Increase

In 2025, Toyota sold a record 11.3M vehicles, a 4.6% increase that kept the company at the top of global sales. Strong demand in the US and Japan led this growth. Hybrids accounted for 42% of Toyota’s sales, while battery-electric vehicles accounted for 1.9%.

Raw Material Costs

Kia said price increases in platinum, palladium, and rhodium are materially affecting its costs. The update points to renewed metal-driven cost pressures in the automotive supply chain.

As lithium prices climb, CATL, BYD, and other Chinese battery makers are accelerating production and investment in sodium-ion batteries. CATL aims to deploy sodium-ion batteries in passenger cars by 2026.

Meanwhile, BYD and others are ramping up output as global shipments of sodium-ion batteries rose sharply in 2025. The shift could help entry-level EV supply chains rely less on lithium. It also introduces fresh execution risk as suppliers scale a newer chemistry and manufacturing footprint.

Regulation

After bilateral talks, Canada will allow limited imports of Chinese-made vehicles after US tariffs and EV policy changes disrupted its auto sector and reduced OEM investment. GM, Ford, and Stellantis have already scaled back production in Canada.

At the same time, Chinese OEMs are gaining a symbolic but strategic foothold. The change could add fresh competitive pressure across North American supply chains as Chinese automakers gain more regional access.

Building on its pivot to China, Canada signed a preliminary agreement with South Korea to explore establishing Korean vehicle manufacturing in Canada, as Prime Minister Mark Carney seeks to diversify away from a US-dependent auto trade following tariffs and EV policy shifts that destabilized the sector.

The accord is light on details but comes as US automakers continue pulling back in Canada. The push to attract non-US OEM investment introduces another structural shift risk to North American supply chains, potentially altering where vehicles and key components are sourced and built over time.

Canada’s new arrangements with China and South Korea give it modest leverage and a bit more diversification heading into the 2026 USMCA review.

“There’s a reasonable chance that we could end up in 2026 without a meaningful, workable trade deal with the United States ... and Canada needs to be prepared.”

- Eric Miller, Rideau Potomac Strategy Group

The flip side: they could also trigger US concerns over EVs, steel and aluminum, and perceived “backdoor” Asian access to the North American market.

For automakers and suppliers, the moves cut both ways.

They can hedge against a hostile USMCA outcome, but they may also raise the odds that Washington pushes for tighter rules or side letters covering China-linked and Asian content.

That backdrop is now colliding with a sharp policy turn in Washington.

The Trump administration has pushed out Elizabeth “Liz” Cannon, the career official whose ICTS office wrote the rules that effectively barred most Chinese-connected vehicles from the US market on national security grounds.

The removal of the rules’ architect, plus the decision to shelve additional measures (a drone ban and Nvidia compute), signals a softer line on China-related auto-tech risks.

President Trump has also publicly invited Chinese automakers to build plants in the US. Speaking to a Detroit audience, he said that if they “build a plant and hire you and hire your friends and your neighbors, that’s great, I love that ... let China come in.”

For North American automakers and suppliers, that mix is destabilizing.

Canada is testing limited Chinese and Korean auto production as a hedge against USMCA uncertainty. Meanwhile, Washington appears more open to China-based companies that localize production.

The risk is that US policymakers respond to Canada’s moves not only with tariff threats, but also with stricter rules of origin, tighter content requirements, or new security provisions targeting vehicles and components tied to Chinese platforms. Even if those vehicles count as “North American” under current rules.

Not to be left out, India and the EU have finally struck a trade agreement that will slash or remove tariffs on almost all goods moving between them. This pact aims to boost trade and give both sides more independence from the US in a tense global market.

India’s auto tariffs, which have been as high as 110%, will gradually drop to 10%. In the short term, tariffs will fall to 30%-35% on up to 250,000 EU cars annually, which is good news for brands like Volkswagen, BMW, Mercedes-Benz, and Renault.

For carmakers and suppliers as a whole, the deal cracks open India’s tightly controlled market and helps them build more resilient global supply chains.

Canada is at War!

Canadian auto workers have been laid off by their American Masters.