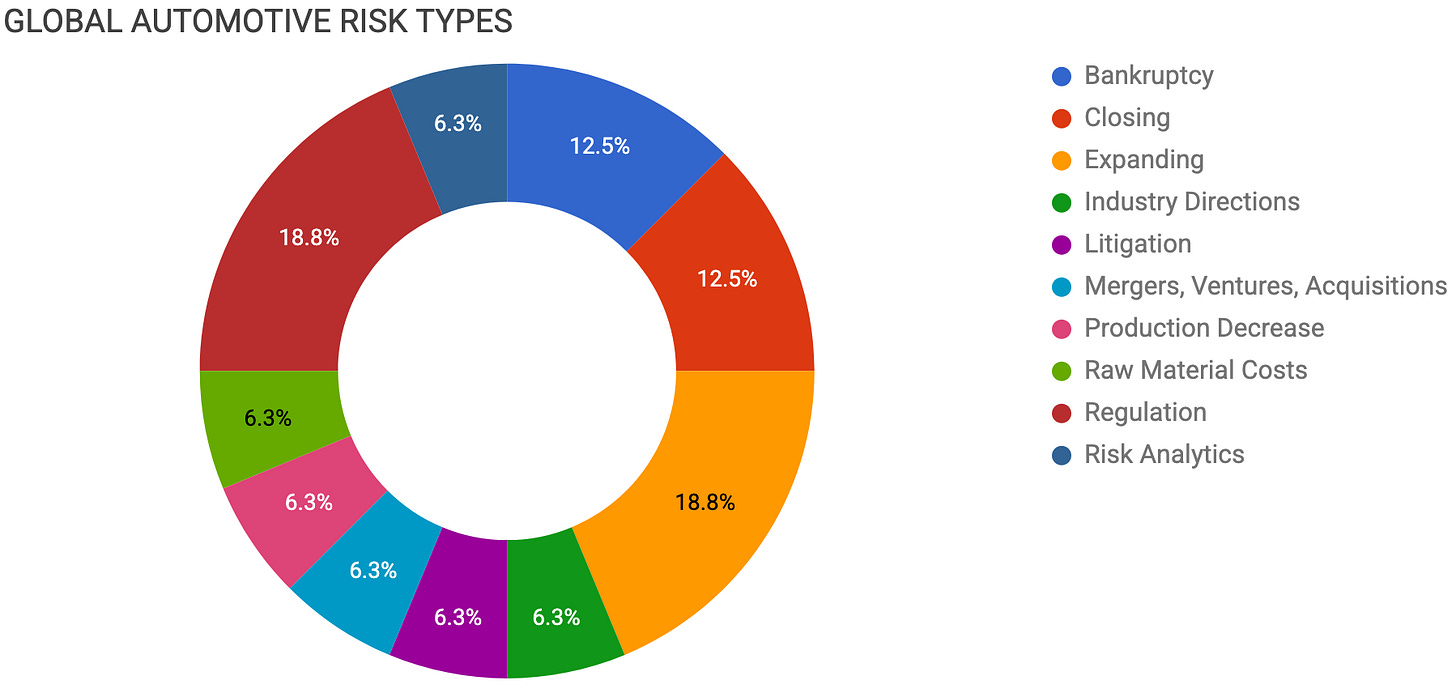

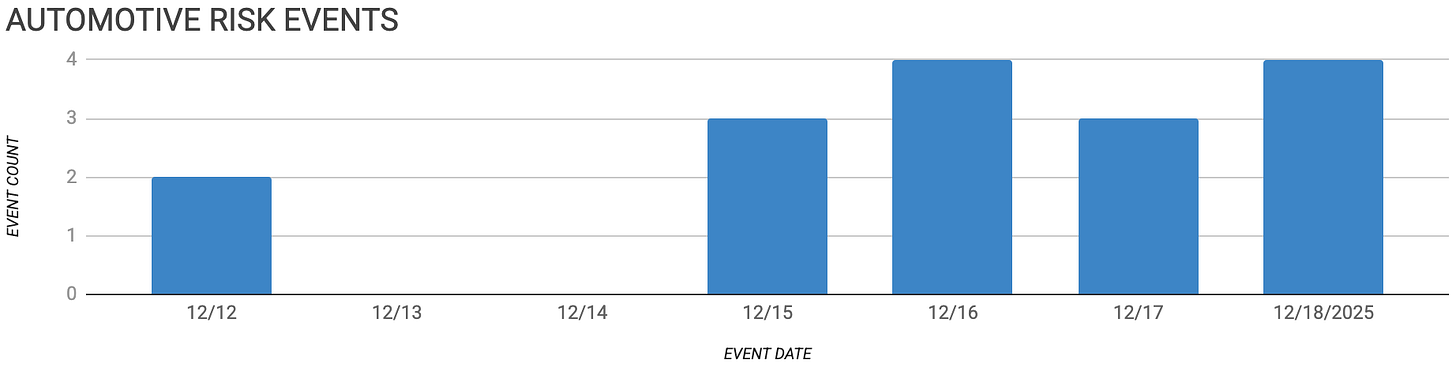

Automotive Supply Chain Risk Digest #461

December 12 - 18, 2025, by Elm Analytics

Contents

BANKRUPTCY

Luminar files Chapter 11, sells chip unit

First Brands seeks $250M customer payments

CLOSING

Renault dissolves Mobilize, refocuses on core sales

Mercedes ends Mexico GLB, exits Nissan JV

EXPANDING

Ford retools Oakville for Super Duty trucks

Tesla expands Germany cell output for 2027

Nissan expands A1 for NP300/Frontier production

INDUSTRY DIRECTIONS

Supplier finances weaken, bankruptcy risk rises

LITIGATION

Hyundai Kia add theft fixes, settle probe

MERGERS, VENTURES, ACQUISITIONS

Xpeng talks Malaysia EV production with EPMB

PRODUCTION DECREASE

Ford pivots from EVs toward hybrids

RAW MATERIAL COSTS

Copper surge raises wiring and EV costs

REGULATION

EU weighs softer 2035 ICE restrictions

China targets below-cost pricing, supply margins

Wanxiang pays $53M to settle duty claims

RISK ANALYTICS

Connected vehicle AI compliance minefield

Bankruptcy

Luminar has filed for Chapter 11 bankruptcy after losing Volvo as a customer. The company plans to sell its chip unit for $110M, restructure its debt, and seek buyers for its LiDAR business.

These actions may create short-term uncertainty for automakers and suppliers relying on Luminar’s LiDAR technology, including potential delays in delivery, support, and future arrangements.

First Brands has asked the bankruptcy court for quick access to about $250M in customer payments for orders it has already delivered, arguing that the restriction is putting unnecessary pressure on its cash flow.

The company says operations remain normal and are backed by $1.1B in DIP financing, but the cash limits are still a red flag for customers watching supply continuity and vendor risk.

Closing

Renault is dissolving Mobilize Beyond Automotive as a standalone unit, pulling back from bets on car-sharing, micro-vehicles, and several digital mobility services that have not shown clear profitability.

Under new CEO François Provost, the group is refocusing on core vehicle sales and near-term returns, shutting down projects such as the Zity car-sharing service and the Mobilize Duo micro-vehicle.

Mercedes will end GLB production at its COMPAS plant in Aguascalientes by May 2026, effectively exiting the Mexican site and closing out its last manufacturing partnership with Nissan, which had already stopped production there.

As the plant winds down and GLB production moves to Hungary, Mexico-based suppliers face uncertainties about contract renewals and continued demand, while cross-border logistics providers tied to this joint venture risk losing significant business volume in the near term.

Expanding

Ford says it still plans to restart production at its Oakville Assembly Complex in Canada in 2026. The company is moving forward with a $2.2B upgrade to build F-Series Super Duty pickups, even as uncertainty over US tariffs persists.

The plant has been idle since spring 2024 and is being converted from a canceled EV program to heavy-duty pickup production. The shift is expected to help ease capacity constraints at Ford’s US Super Duty plants, which are already running near full capacity.

While 25% US tariffs on medium- and heavy-duty trucks complicate the economics, Ford appears willing to absorb higher costs on non-US content, given the Super Duty’s high margins and the potential for trade rules to change during USMCA renewal talks in 2026.

Tesla plans to ramp its Gruenheide, Germany, gigafactory to produce up to 8 GWh of battery cells per year starting in 2027. The company is investing several hundred million more euros, bringing total investment in the cell factory to nearly $1.1B.

By producing everything from battery cells to finished vehicles at a single European site, Tesla aims to deepen vertical integration and, in its view, make its supply chain more resilient.

Nissan Mexico has started expanding its Aguascalientes Plant A1 to move NP300/Frontier pickup production into the facility. The goal is to make this site the company’s largest automotive hub in Latin America.

The project is scheduled to be completed by the end of Nissan’s fiscal year in March 2026 (!) and includes cross-plant upgrades, a new production line, and new chassis manufacturing equipment. Shifting pickup production and adding chassis work could reshape supplier footprints, local content strategies, and logistics flows around the plant.

Industry Directions

Automotive suppliers are heading into 2026 under growing financial pressure. In 2025, they cut more than 60k jobs as orders from automakers declined, rising competition from Chinese parts, high interest rates, and ongoing investment in new technology all squeezed margins.

Industry groups report that 70% of European suppliers expect profits below the 5% level typically needed to sustain investment.

Smaller Tier-3 and Tier-4 suppliers are most exposed, but even midsize companies could face insolvency.

Analysts say automakers’ own profit challenges are being pushed up the supply chain, raising the risk of more bankruptcies and production disruptions. Recent failures at suppliers such as Voit, Marelli, and AE Group underscore these risks.

If suppliers remain financially weak, 2026 could bring sudden bankruptcies, part shortages, and forced re-sourcing, especially in internal combustion engine supply chains and Europe-based networks.

Litigation

Hyundai and Kia plan to install free ignition-cylinder protection on about 7M vehicles in the US and will add immobilizers to all future US models. These steps resolve a 35-state attorney general investigation tied to recent waves of car thefts and highlight ongoing security and liability risk around older vehicle fleets.

Mergers, Ventures, Acquisitions

Xpeng is negotiating with EPMB to launch mass EV production in Malaysia in 2026, using the country as a right-hand-drive base for ASEAN markets.

If the project moves forward, it would signal deeper China-to-ASEAN localization to reduce tariff risk and improve margins, with potential knock-on effects on supplier footprints and regional trade flows.

Production Decrease

Ford expects a $19.5B profit hit as it reduces its focus on fully electric vehicles, shifts toward hybrids, and updates several programs after overestimating short-term EV demand.

The company will convert a planned Tennessee EV pickup plant to produce gasoline models, cancel an electric commercial van program in Ohio in favor of new gasoline and hybrid options, and modify the F-150 Lightning to use an auxiliary gasoline generator once the battery runs out.

CEO Jim Farley said the strategy makes Ford “much more China-proof,” but University of Michigan professor Erik Gordon warned that Ford could face new risks if EV adoption accelerates again.

For suppliers, canceled programs, plant retooling, and battery strategy changes can quickly force shifts in sourcing for powertrains, batteries, and electrical parts, and may lead to inventory and tooling write-downs across the EV supply chain.

Raw Material Costs

Copper prices are up 35% this year and are now approaching $12k per metric ton. US buyers, worried about potential tariffs, are stockpiling copper and pulling material away from other regions, even though a global surplus had been expected.

Combined with mine disruptions and higher premiums outside the US, this is creating near-term cost and availability risk for wiring, power electronics, and EV parts in the automotive industry.

Regulation

The EU is considering changes to its 2035 rules that would drop a full ban on internal combustion engines.

Instead, the proposal would require a 90% cut in tailpipe emissions and allow hybrids and some ICE vehicles to remain on the market. Automakers could close the remaining gap with measures like low-carbon steel, e-fuels, and biofuels.

The plan would also give manufacturers more flexibility for light commercial vehicles and add incentives for small, affordable EVs.

Industry groups largely support the shift toward technology neutrality, while environmental groups warn it could slow electrification. Some automaker associations also argue that the changes do not go far enough to ease cost and competitiveness pressures.

Overall, easing the rules reduces short-term compliance risk and supports hybrid and ICE supply chains in Europe, but it also increases uncertainty for long-term EV investment, sourcing, and planning.

China is proposing tighter oversight of below-cost vehicle pricing and other “unfair” practices to rein in the ongoing price war. The proposed rules could also target suppliers accused of unjustified price hikes, adding a new compliance burden and margin pressure across the auto supply chain.

Wanxiang Group has agreed to pay $53M to resolve DOJ claims that it underpaid customs and antidumping duties by misclassifying wheel hub assemblies and other parts imported from China.