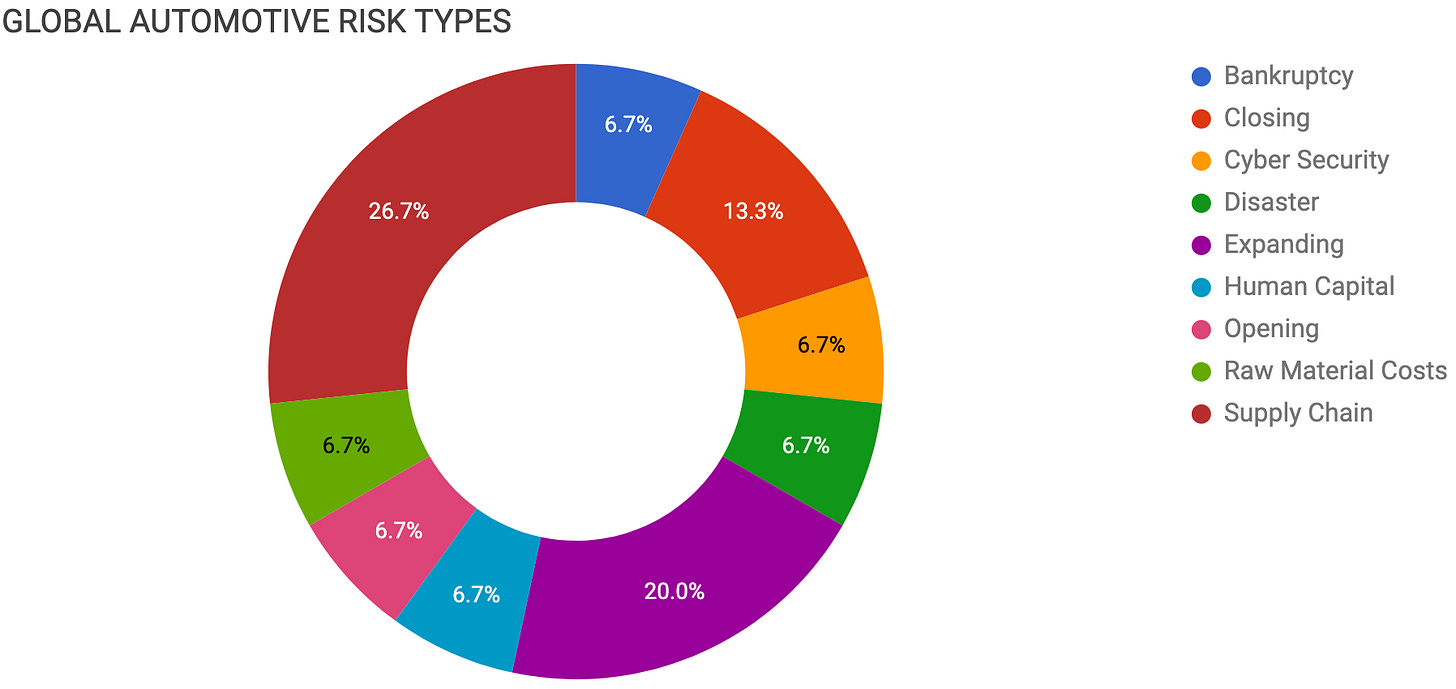

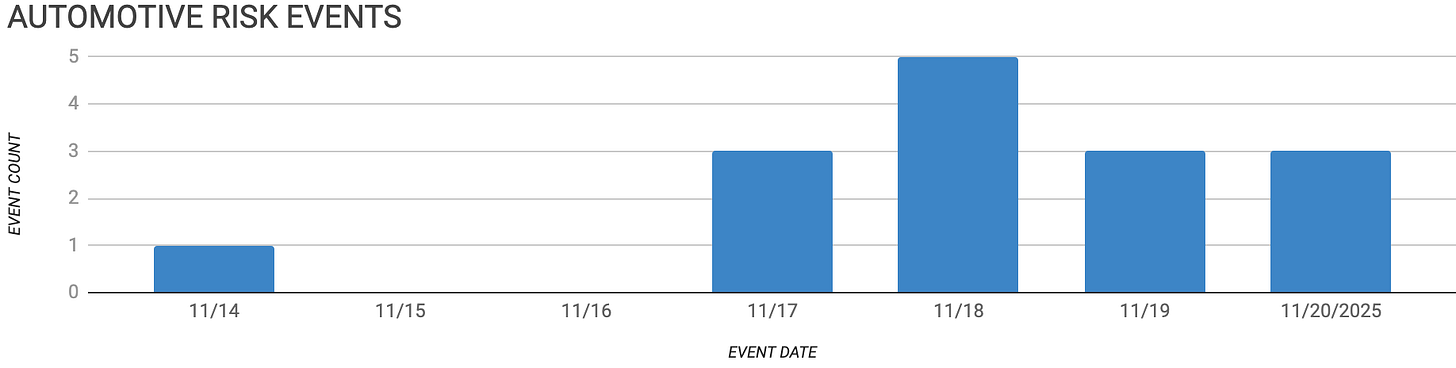

Automotive Supply Chain Risk Digest #457

November 14 - 20, 2025, by Elm Analytics

Contents

BANKRUPTCY

Bollinger hit by lawsuits, deficits

CLOSING

ACC may abandon Italian gigafactory

SFS closing Swiss plant, cutting jobs

CYBER SECURITY

DEF CON reveals major vehicle hacking risks

DISASTER

Second fire hits Novelis aluminum plant

EXPANDING

Hyundai invests $86.5B in Korean EVs

Toyota boosts US hybrid production

Renault, Geely expand in Brazil

HUMAN CAPITAL

GM supplier Avancez cuts 143 jobs

OPENING

Vianode opening $2.3B graphite facility

RAW MATERIAL COSTS

Heavy rare earth supply still tight

SUPPLY CHAIN

Dutch pause Nexperia action, risks persist

OEMs seek China-free chip sources

Suppliers shift to regionally resilient sourcing

Nexperia shortage disrupts global plants

Bankruptcy

Bollinger Innovations is under growing financial pressure.

The EV startup is facing 59 wage-related complaints under state investigation, and at least six suppliers are suing for more than $5M in unpaid bills.

It is also in default on its Michigan incentives agreement after failing to create promised jobs and may have to repay state funds if milestones are not met by May 4.

Bollinger was recently delisted from Nasdaq, reports an accumulated deficit of $2.6B, and has disclosed “substantial doubt” about its ability to continue operating, a clear warning for current and prospective suppliers.

Closing

ACC is reportedly close to abandoning its planned gigafactory in Termoli, Italy, citing technical, strategic, and financial challenges.

The site was intended to be one of three EU hubs, but weak EV demand has already paused the German project, leaving France as ACC’s only operating location.

The joint venture plans to finalize investment decisions for Italy and Germany by the end of the year while focusing on improving competitiveness at its Billy-Berclau plant in France, which has begun supplying cells for roughly 10k vehicles.

For supply chains, canceling Termoli would cap future EU cell capacity, deepen OEM reliance on non-European battery suppliers, and further constrain Stellantis’ long-term EV sourcing options.

SFS, the Swiss cold-formed components manufacturer, will close its Flawil, St. Gallen, plant because of weak European automotive demand.

The move will cut 75 jobs, while remaining roles and the cold-forming business will be shifted to its Heerbrugg headquarters by mid-2027. For customers, production will be consolidated into a single Swiss site, with some transition and logistics risk during the changeover.

Cyber Security

In August, security researchers at DEF CON’s Car Hacking Village highlighted major weaknesses in automaker systems. They showed how weak authentication, poor component security, and overlooked software flaws can allow unauthorized remote control of vehicles and access to sensitive data.

Presenters described key hardware built from the “cheapest components” and demonstrated how simple exploits could redirect infotainment users to malicious sites or unlock broad access to vehicle systems.

Researchers warned that rapid feature rollouts, inconsistent supplier security practices, and the difficulty of patching embedded automotive systems have created “ticking time bombs” across connected-vehicle technology.

While a few automakers run bug bounty or disclosure programs, experts say some basic protections still lag standard tech-industry practices.

These gaps expose automakers and suppliers to operational and data-security risks, as vulnerable embedded systems and connected interfaces may be compromised long before issues are detected or patched.

Disaster

A second fire in two months has hit Novelis’ Scriba, New York, plant.

This latest incident disabled the hot mill and roll shop and triggered a nine-hour, five-alarm response just as the site was preparing to recover from a September blaze.

The first fire had already stopped ingot heating and cut off aluminum sheet supplies to multiple US auto plants.

The September outage impacted Stellantis and Nissan and contributed to an estimated $1B impact at Ford.

Novelis, which produces roughly half of the world’s automotive aluminum sheet, has not yet been able to fully assess the latest damage, increasing the likelihood of a longer outage even with continuous repair work.

For OEMs and Tier-1 stampers, another shutdown at the continent’s most critical aluminum-sheet supplier raises the risk of extended production losses and renewed bottlenecks across North American automotive manufacturing.

Expanding

Hyundai will invest $86.5B in South Korea from 2026 to 2030, backed by a new trade deal that cuts US auto tariffs to 15%.

The plan upgrades domestic plants, adds new EV capacity, and aims to more than double EV exports by 2030, boosting regional sourcing and reshaping demand for Korean suppliers’ EV systems, electronics, and tooling.

Toyota is investing $912M in five US engine, machining, casting, and assembly plants to increase output of hybrid-compatible engines, transaxles, and components as demand for hybrids continues to climb:

Buffalo, West Virginia: $453M to expand hybrid-compatible engines, hybrid transaxles, and motor stators with output starting in 2027.

Georgetown, Kentucky: $204.4M for a new machining line to increase hybrid engine production in 2027.

Blue Springs, Mississippi: $125M to localize hybrid Corolla assembly previously sourced from Japan.

Jackson, Tennessee: $71.4M for three new casting lines to boost hybrid transaxle case, housing, and engine block capacity by 500k units a year.

Troy, Missouri: $57.1M for a new line expanding cylinder head output by about 10%.

These moves increase Toyota’s hybrid localization and reduce import exposure, lowering logistics risk and stabilizing the regional supply of engines, castings, and transaxles for multiple Toyota programs.

Renault and Geely plan to invest $712.4M in Brazil to launch two Geely-based models starting in late 2026. The program gives Renault access to larger vehicles and improves utilization of its Curitiba plant.

The partners also plan a new zero-emission platform that will support an additional Renault model in 2027, expanding the brand’s EV and hybrid footprint in Latin America.

In return, Geely gains access to Renault’s plant and dealer network, while Renault uses the partnership to counter rising Chinese competition and rebalance away from a sluggish European market.

Human Capital

Avancez, a value-add assembler for GM’s EV trucks and SUVs, is cutting 143 jobs at its Hazel Park, Michigan, facility after GM canceled a second shift tied to Factory Zero amid a broader EV production slowdown.

The cutbacks show how GM’s reduced EV output is quickly hitting upstream suppliers and signal ongoing volatility in near-term EV demand and production planning.

Opening

Vianode will invest $2.3B in a synthetic graphite facility in St. Thomas, Ontario, creating a large-scale North American source of a material that currently comes almost entirely from China.

Starting in 2027 and ramping up to 150k tonnes/year, the plant will supply enough anode material for up to 2M EVs annually, giving cell and pack manufacturers in Canada and the US a regional, hydro-powered, and more predictable input.

Backed by a $475.5M loan from Ontario and located beside Volkswagen’s PowerCo complex, the project anchors a growing battery hub and helps reduce both geopolitical and logistics risk across the North American EV supply chain.

Raw Material Costs

US and EU efforts to build a non-China rare-earth magnet supply chain remain constrained by severe shortages of heavy rare-earth elements, especially dysprosium and terbium.

These elements are critical to helping magnets retain their magnetic properties at high temperatures in EV motors.

US-based MP Materials is expanding processing capacity, but its mines contain only trace heavy rare earths, forcing it to source feedstock from Brazil, Malaysia, and emerging Australian projects that are still years from meaningful output.

Prices for dysprosium oxide outside China have tripled to about $900/kg, and Western supply is expected to meet only a small fraction of future demand as Chinese export controls continue to pressure auto production.

Magnet makers such as VAC are locking in long-term supply.

Even so, analysts warn that, given cost, permitting, and environmental hurdles, the West will remain heavily dependent on China through at least 2030, keeping EV motor materials and pricing exposed to policy risk.

Supply Chain

For European automakers, the immediate political tension around Nexperia has eased, but the core chip supply risk has not.

The Netherlands has paused direct intervention in the company as a goodwill gesture toward China.

Carmakers and suppliers, including BMW, Bosch, and Aumovio, have welcomed the step, but many say it is too early to judge the impact. Germany’s VDA still warns that production risks remain.

The standoff between Nexperia’s European and Chinese entities continues, with wafer shipments from Europe still halted.

Chinese units are drawing down existing stockpiles, which offers only a short-term buffer. Without a longer-term supply chain solution, that buffer will fade as talks between Dutch and Chinese officials continue.

The sudden halt at Chinese-owned Nexperia has exposed how dependent European automakers are on low-tech semiconductors from China.

In response, OEMs such as GM and Tesla are pushing suppliers to find “China-free” alternatives and new sourcing routes. Analysts frame this as a structural geopolitical risk, not a one-off disruption.

European suppliers estimate that shifting chip, rare-earth, and battery dependencies away from China could take 3 to 7 years. During that period, pricing and allocation pressures are likely to stay elevated.

For automotive suppliers, the message from OEMs is clear: priorities are shifting from globally optimized supply chains to regionally resilient ones. Automakers are pressing suppliers to cut their exposure to China.

Bosch executive Paul Thomas said the company is validating multiple non-China chip sources in the wake of the Nexperia crisis. He added that Bosch has built up to 85% local content in North America to avoid single-region bottlenecks.

Lear CEO Ray Scott said the company is designing parts with multiple validated configurations so sourcing can move quickly between suppliers and regions, although replacing Chinese materials such as rare earths remains difficult.

Both executives stressed that reshoring and redesigning globalized supply chains built over 25 years will take time, even as rising geopolitical risk keeps the pressure on.

The Nexperia chip shortage is still hitting German and global auto suppliers, keeping production risk very visible on the shop floor.

The disruption is affecting output at key European suppliers, triggering furloughs, and forcing Japanese automakers to adjust output.

Bosch is experiencing chip-related disruptions at plants in Ansbach and Salzgitter in Germany and in Braga in Portugal. The company is prioritizing customer deliveries and using state-backed furloughs for 300-400 of 1.3k workers in Salzgitter, about 650 of 2.5k in Ansbach, and around 2.5k of 3.3k in Braga through reduced hours or furloughs, with workers sometimes sent home when production slows.

Aumovio is seeking alternative semiconductor suppliers amid supply constraints that are affecting operations.

ZF Friedrichshafen currently has a secure chip supply only until the middle of next week, is exploring alternative suppliers, and has warned that furloughs may be required afterward.

Nissan plans to cut production at its Kyushu plant by about 1.4k vehicles next week due to chip shortages.

Honda, by contrast, is preparing to resume regular output at its North American plants as supply conditions improve.

Nexperia is a lesson all categories of supply should learn from.

But... two fires at a huge bottleneck aluminium plant in a few months... that is a rare oddity worthy of close inspection !