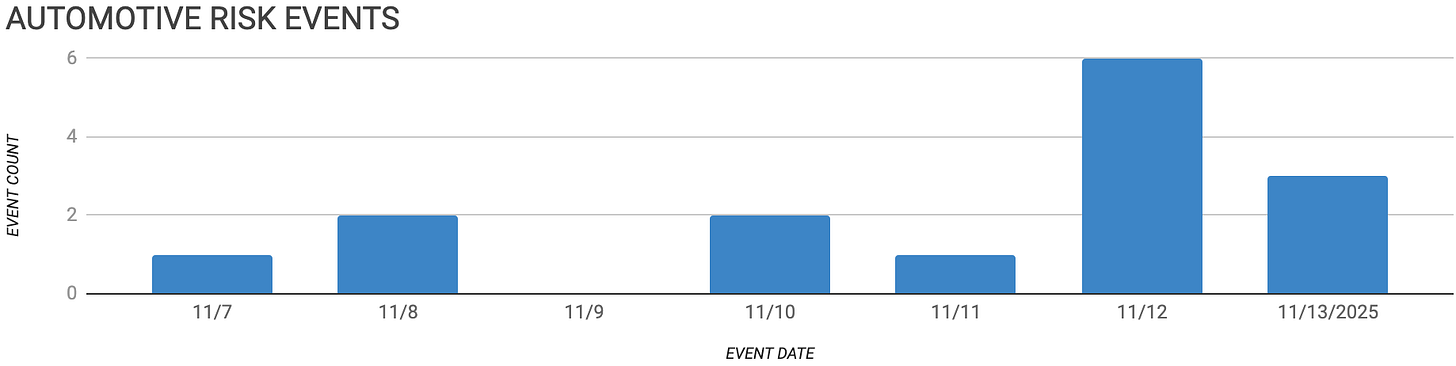

Automotive Supply Chain Risk Digest #456

November 7 - 13, 2025, by Elm Analytics

Dear Reader,

Just a quick note that we’ll be attending the MEMA Original Equipment Suppliers Annual Conference on November 19-20 in Novi, Michigan.

You can find Elm Analytics at Booth 5000; please stop by and say hello.

We’d love to hear what’s top of mind for you.

Warmly,

Nick Gaydos

Editor

Contents

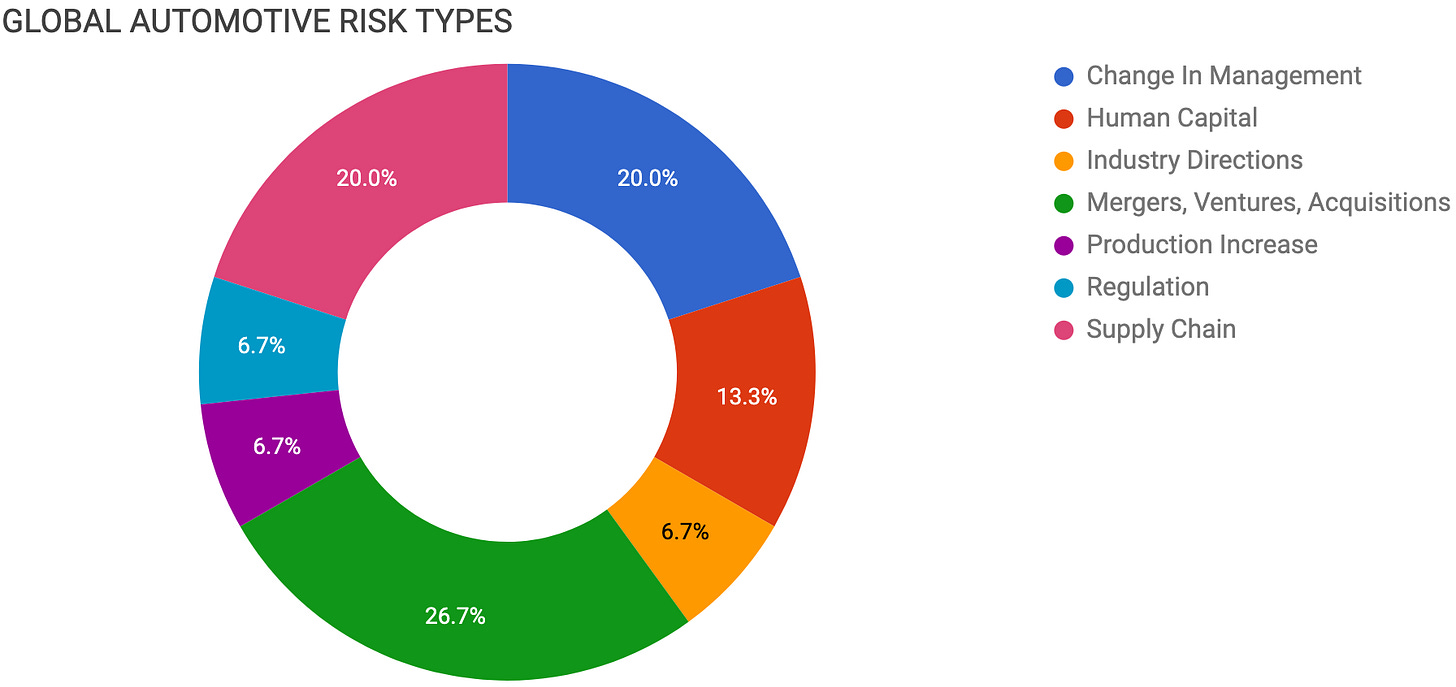

CHANGE IN MANAGEMENT

GM shuffles top leadership roles

Tesla loses two key managers

OPmobility CEO resigns unexpectedly

HUMAN CAPITAL

NSK to close UK factories

Death investigated at Yanfeng plant

INDUSTRY DIRECTIONS

EV sales hit record highs

MERGERS, VENTURES, ACQUISITIONS

Nissan, Honda consider US partnership

Honda delays affordable EV plans

Subaru shifts funds from EVs

Toyota delays battery plant again

PRODUCTION INCREASE

Toyota opens major US battery plant

REGULATION

Supreme Court to decide on tariffs

SUPPLY CHAIN

Nexperia chip split disrupts flow

China permits partial chip exports

GM pushes suppliers off China

Change In Management

GM is reshuffling its senior team in key growth markets.

Cadillac global vice president John Roth will become senior vice president of GM and president of GM China, effective December 1, succeeding Steve Hill.

Hill will lead a new division as senior vice president of Global Export and Retail Innovation.

GM Canada president Kristian Aquilina will take over as global head of Cadillac on January 1.

The shift concentrates leadership focus on China, export markets, and Cadillac’s global strategy, all of which carry significant purchasing and supply chain weight.

Tesla has lost two key vehicle program leaders on the same day: long-time Model Y program manager Emmanuel Lamacchia and Cybertruck and Model 3 program manager Siddhant Awasthi.

Their exits add to a growing list of senior departures in 2025.

Losing the managers of core, high-volume programs heightens execution and continuity risk for Tesla’s product portfolio, with potential impacts on launch timing, manufacturing stability, and long-term supply chain planning for its main EV platforms.

OPmobility CEO Laurent Favre has resigned for personal reasons. Deputy CEO Felicie Burelle will lead the $13.3B body, fuel system, and lighting supplier on an interim basis until 2026. The move creates a leadership transition at a major supplier while maintaining continuity through the founding Burelle family.

Human Capital

NSK plans to close its NSK Bearing and AKS Precision Ball factories in Peterlee, County Durham, UK, by March 2027.

The company cites unprofitable local production, putting around 350 jobs at risk, even though the plants supply bearings to major customers such as Volkswagen and Renault.

The move signals further consolidation in UK component manufacturing, as suppliers continue to reshape their European footprints under pressure from the EV transition and margin squeeze.

An unexplained death in a vehicle at Yanfeng’s Fountain Inn, South Carolina, plant has prompted an active law enforcement and coroner investigation.

Industry Directions

The growth rate of electric vehicle sales in 2025 has slowed compared to earlier industry forecasts, but sales have still reached historic highs this year.

Despite market headwinds and shifting consumer trends, strong global volumes indicate that electrification continues to advance in absolute terms, particularly in key markets such as the US, China, and Europe.

Strong demand, ongoing technological advancements, and sustained momentum continue to drive unprecedented EV adoption.

Mergers, Ventures, Acquisitions

It has been a busy week for Japanese automakers. Nissan is considering joint vehicle and powertrain development with Honda in the US.

The discussions include the option of building Honda pickups in underutilized Nissan factories, even though earlier merger talks have ended.

If the companies move ahead, the partnership could increase Nissan’s plant utilization, support Honda’s US product plans, and shift supplier demand for hybrid powertrains and related components.

Japanese automakers appeared to be reading from the same playbook this week as they pushed the EV goal line out by several years.

Honda is delaying the introduction of a sub-$30k EV for the US until around 2030 and postponing an electric sports car as it shifts investment to next-gen hybrids launching from 2027.

Pushing out affordable BEVs and doubling down on hybrids reshapes Honda’s product and sourcing roadmap. Although dedicated EV supply chains will see softer near-term demand, Honda expects it will find safety in a hybrid platform that avoids rare-earth materials.

Meanwhile, Subaru is reviewing its $9.7B EV budget and redirecting part of the remaining $7.8B into new hybrid and ICE projects.

This shift delays its planned full-scale EV mass production, even as the company maintains plans to launch four EV SUVs by 2026. Of note: All four models are co-developed with Toyota, using Toyota’s platform architecture.

Toyota has postponed its Fukuoka solid-state EV battery plant for at least another year, despite publicly maintaining a 2028 launch target for its first solid-state EV. The growing gap between product roadmap and factory timing increases execution risk for Toyota’s battery strategy in Japan.

Production Increase

On this side of the pond, Toyota has begun production at its $13.9B battery plant in Liberty, North Carolina.

The 30 GWh facility will support hybrid and future BEV programs and is backed by an additional $10B in US manufacturing investment over five years.

It secures large-scale US battery and component sourcing for Toyota’s hybrid-heavy lineup at a time when US policy is favoring hybrids, easing pressures on EV adoption, and loosening fuel economy standards.

Regulation

Automotive News: What the Supreme Court’s upcoming tariff decision could mean for automakers and suppliers

Supply Chain

After the Dutch government seized control of Nexperia due to tech-transfer concerns, the company’s European arm halted wafer shipments to its Dongguan, China, packaging plant, cutting off the flow of key automotive chips.

Large customers are now negotiating a workaround.

They buy wafers directly from Nexperia’s Hamburg fab, ship them to China themselves, and then separately contract the Dongguan plant for packaging. This treats Nexperia Europe and China as two different companies, a move described as a “short-term patch” by one source.

Smaller customers have fewer options. They may need to shift to substitutes from Onsemi or STMicroelectronics or risk shortages.

At the same time, Nexperia’s European unit is exploring packaging options in Malaysia and the Philippines, while its Chinese arm considers sourcing wafers locally.

“A lot of companies are currently negotiating and some already are buying wafers from Nexperia EU and providing them to Nexperia China to get exclusive production for themselves,” a Nexperia product distributor said.

This political and corporate split is already disrupting chip flows to automakers such as Volkswagen, Bosch, and Honda. It forces more complex logistics, dual contracting, and second sourcing, adding cost and increasing the risk of renewed semiconductor shortages across the auto supply chain.

Late last week, China began granting export exemptions, allowing some Nexperia chip shipments to resume. Aumovio, Volkswagen, and Honda all reported initial movement.

Germany praised the “de-escalation” in talks with Beijing, and the Netherlands also voiced support.

The permit-driven restart eases near-term chip shortages for auto plants but leaves the supply chain dependent on political goodwill and exposed to future shocks.

GM has instructed several thousand suppliers to remove Chinese parts from their supply chains for North American production.

Some suppliers have been given a 2027 target to end sourcing from China, as part of a broader push to strengthen supply chain resiliency.

The directive forces large-scale re-sourcing on an aggressive timeline, adding near-term cost and execution risk for suppliers and accelerating a structural shift of automotive supply chains toward North America and other non-restricted regions.