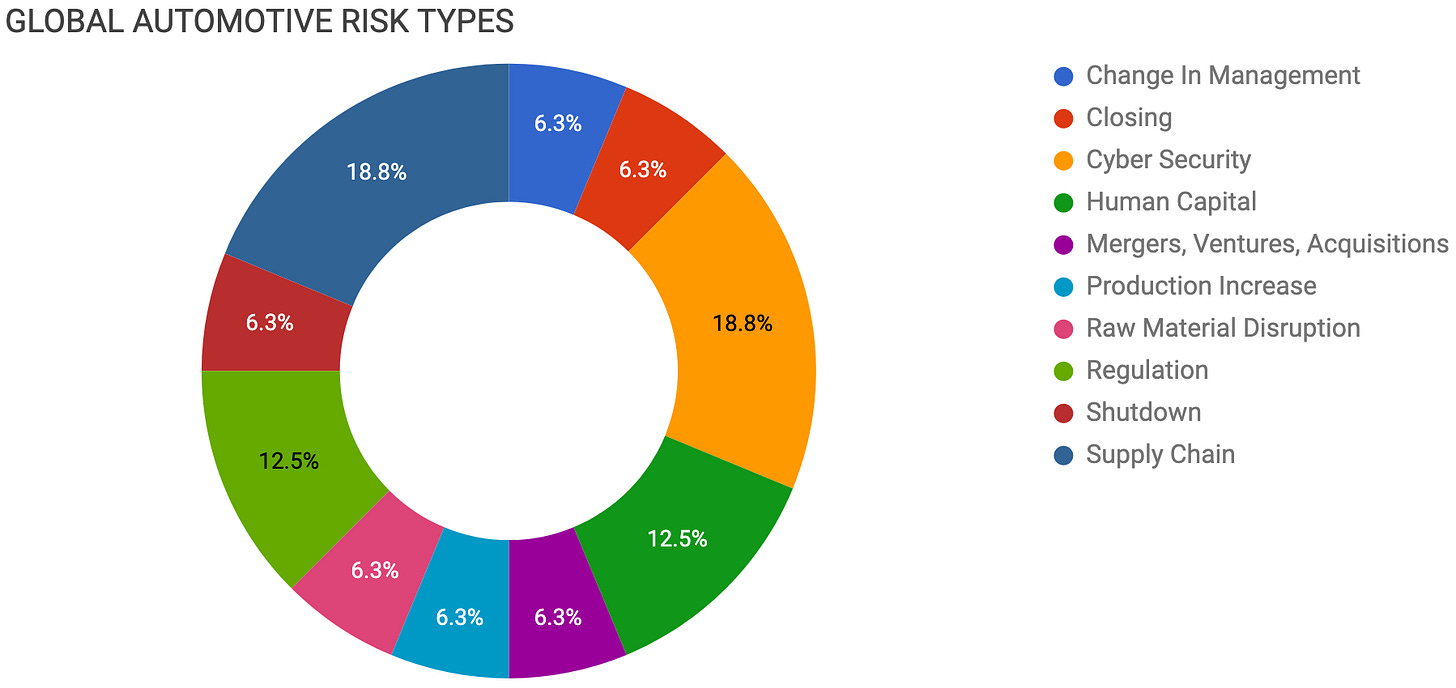

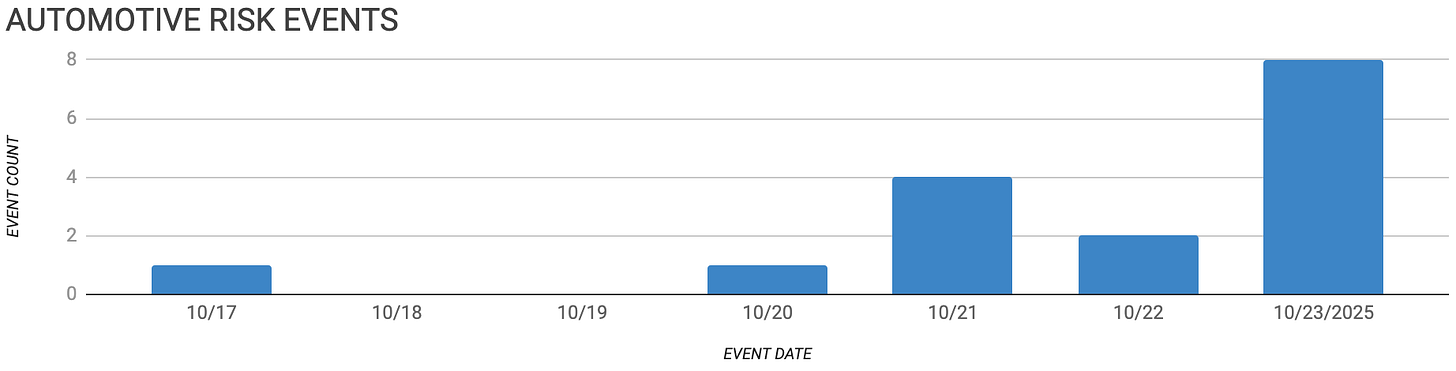

Automotive Supply Chain Risk Digest #453

October 17 - 23, 2025, by Elm Analytics

Contents

CHANGE IN MANAGEMENT

Michael Leiters named next Porsche CEO

CLOSING

Dana closes plant after EV slump

CYBER SECURITY

JLR cyberattack drops UK output

Visteon, OPmobility earnings impacted by JLR

HUMAN CAPITAL

Rivian cuts 600 amid weak demand

IAC Group lays off 246 workers

MERGERS, VENTURES, ACQUISITIONS

Gotion project default ends Michigan deal

PRODUCTION INCREASE

Stellantis hires 400 for Fiat hybrids

RAW MATERIAL DISRUPTION

Automakers race to stock rare earths

REGULATION

Trump extends auto tariff relief

Automakers oppose tariffs on robots

SHUTDOWN

Jeep factory halted after aluminum fire impact

SUPPLY CHAIN

Nexperia seizure disrupts chip supplies

VW finds alternate chip supply chain

Japanese automakers brace for chip shortage

Change In Management

Porsche has named former McLaren CEO Michael Leiters as its next chief executive, effective January 1, 2026. He will succeed Oliver Blume, who remains CEO of Volkswagen Group.

Leiters, a former Ferrari and Porsche executive, will steer the brand through a shift back toward hybrids and combustion models amid weaker EV demand. The move follows a 30% drop in share prices over the past year and investor unease over Blume’s dual roles.

Closing

Dana is closing its Auburn Hills, Michigan, plant and cutting 200 jobs after plunging EV demand left its $54M battery cooling operation unviable.

Cyber Security

The cyberattack that shut down Jaguar Land Rover’s systems and halted production for five weeks drove UK car output to its lowest September level since 1952.

The outage cost an estimated $2.4B, disrupted an estimated 5k suppliers, and cut exports by nearly a quarter. The incident is a stark reminder that as factories become increasingly digital, a single breach can bring the entire industry to a halt.

In recent earnings calls, both Visteon and OPmobility cited the unexpectedly significant impact of the JLR cyberattack on revenue and production.

Human Capital

Rivian will cut about 600 jobs, or 4.5% of its staff, as it works to lower costs and prepare for the launch of its R2 electric SUVs next year.

CEO RJ Scaringe said the layoffs, mainly in marketing, vehicle operations, and sales, reflect weaker demand and the loss of federal EV tax credits under the Trump administration.

The restructuring is meant to help Rivian stay competitive in a more challenging electric vehicle market.

IAC Group will reduce staff by 246 at its Mendon and Alma, Michigan, plants by December 8. The Mendon facility will lose 178 positions, and Alma will lose 68, primarily in molding and finishing roles for interior components. Both sites are unionized.

Mergers, Ventures, Acquisitions

Michigan has declared Gotion in default $ on a $175M grant deal after its Big Rapids EV battery project stalled amid lawsuits and opposition. The state plans to recover $23.6M, ending one of its largest EV investment efforts.

Production Increase

Stellantis will hire 400 workers in Turin to boost hybrid Fiat 500 production, as CEO Antonio Filosa urged the EU to ease its 2035 emissions rules. He warned that strict targets are dampening demand and threatening future battery investments in Italy.

Raw Material Disruption

Automakers are rushing to secure rare earth supplies before China’s new export controls take effect on November 8, amid fears of shortages that could disrupt vehicle production.

China dominates the market, accounting for 70% of mining, 85% of refining, and 90% of magnet production.

Companies such as Toyota, Bosch, and Hyundai are stockpiling materials, while GM, ZF, and BorgWarner develop low- or rare-earth-free EV motors, though large-scale adoption remains years away.

A new US-Australia minerals partnership aims to reduce reliance on China, but new mines face economic challenges amid Beijing’s low-pricing strategy.

China’s tightening controls could accelerate the shift toward alternative motor technologies and raise supply chain risks for EV and electronics components.

Regulation

President Trump extended auto tariff relief through 2030, granting automakers a 3.75% rebate on US-assembled vehicles while adding new tariffs on imported medium- and heavy-duty trucks.

Major automakers, including GM, Toyota, Volkswagen, Hyundai, and Tesla, are urging the Trump administration to scrap planned tariffs on factory robots, warning they would raise costs and delay vehicle production.

The Alliance for Automotive Innovation said auto plants account for 40% of US robotics use and called for exemptions.

Shutdown

Stellantis will keep its Warren, Michigan, Jeep Wagoneer plant idle until early November $ after a fire at Novelis’ New York aluminum facility disrupted production, cutting the supply of hoods and doors.

Ford has also reduced output of F-150 aluminum-bodied models as Novelis repairs are expected to continue into early 2026. The disruption is a reminder of how concentrated material sourcing can cascade into widespread production slowdowns for automakers.

Supply Chain

Nexperia has become a flashpoint in a major semiconductor dispute after the Dutch government seized control of the company under the Goods Availability Act, citing governance failures and supply chain risks.

The takeover led China to block exports from Nexperia’s facilities there, freezing roughly half its global output and triggering an international scramble for automotive and industrial chips.

Automakers, including Volkswagen, and suppliers like LG and Jabil are seeking alternatives amid price spikes of up to 20% and warnings from ACEA and Germany’s VDA that production lines could halt within weeks.

Nexperia’s Chinese arm has resumed domestic sales in yuan but is now operating independently of its Dutch parent.

The standoff has fractured Nexperia’s global operations, disrupted semiconductor supply for automakers across Europe and Asia, and intensified the broader US-China-EU technology and trade conflict, threatening short-term production continuity and long-term industry stability.

Volkswagen said it has secured an alternative semiconductor source to offset disruptions from China’s export ban on Nexperia-produced chips, which had threatened production at its Wolfsburg plant.

The affected components are low-cost chips used in basic vehicle controls, and VW is leveraging its market position to help secure supply for its network of smaller suppliers.

While VW paused Golf and Tiguan output for planned maintenance, ongoing uncertainty means stoppages could extend into the following week.

German officials are monitoring the dispute closely, as chip shortages are expected to hit European automotive suppliers within days and spread across the industry within weeks.

Toyota, Nissan, Honda, Mitsubishi, and Subaru are assessing potential parts disruptions after China halted exports from Nexperia’s Chinese facilities.

The Japan Automobile Manufacturers Association warned the stoppage could seriously affect global vehicle production as suppliers face uncertainty over chip deliveries.

No Japanese plants have shut down, but automakers are reviewing inventories and alternative sourcing options to limit risk.