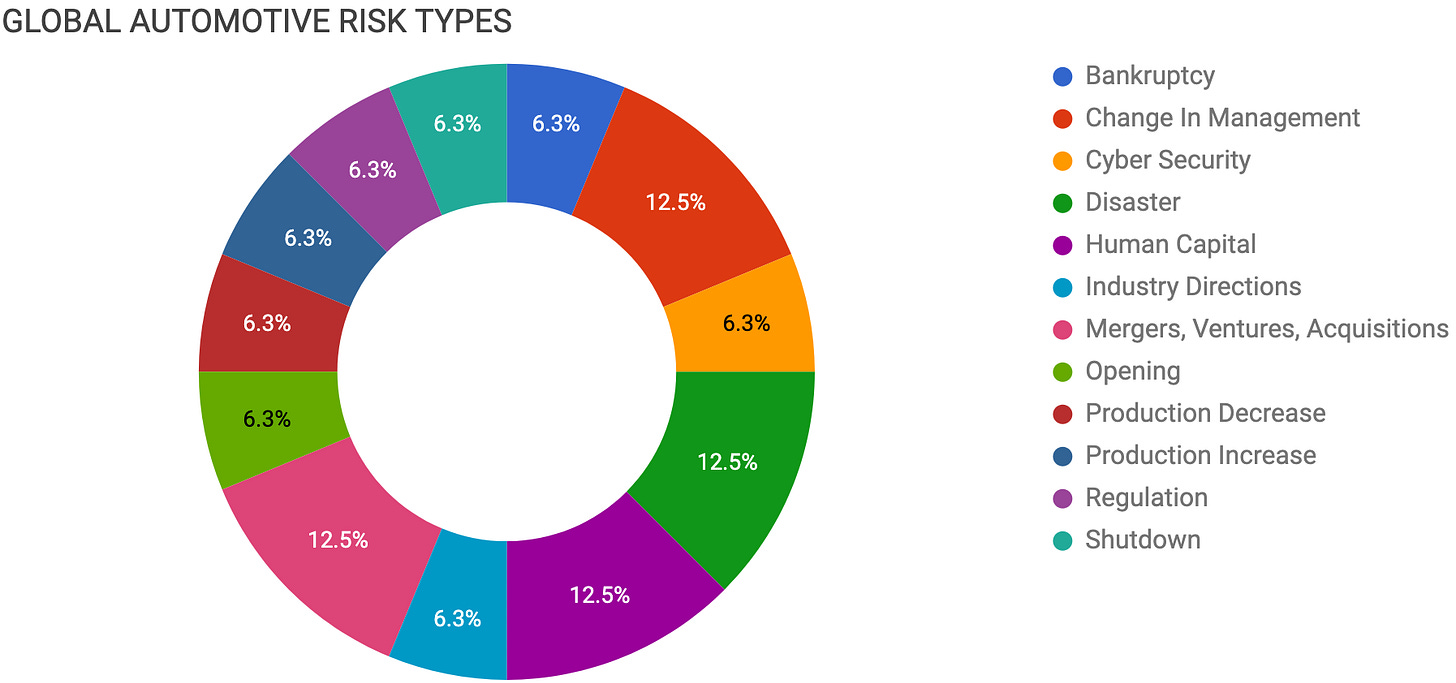

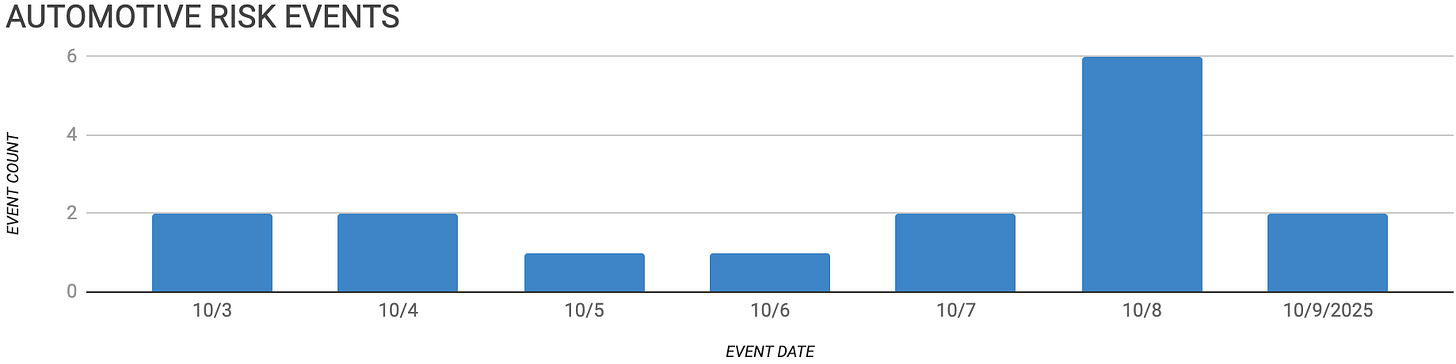

Automotive Supply Chain Risk Digest #451

October 3 - 9, 2025, by Elm Analytics

Contents

BANKRUPTCY

Lenders rush $1.1B rescue amid opacity

CHANGE IN MANAGEMENT

Stellantis reshuffles global executive ranks

Nio AV leadership exits amid AI overhaul

CYBER SECURITY

JLR restarts UK plants after cyberattack

DISASTER

Fire halts Novelis aluminum production

Toyota resumes Brazil output after storm

HUMAN CAPITAL

Renault plans 3k global job reductions

OPmobility cuts 82 Spring Hill jobs

INDUSTRY DIRECTIONS

GM adds unilateral supplier pricing clause

MERGERS, VENTURES, ACQUISITIONS

Stellantis plans $10B US investment drive

Autoliv, Hangsheng form safety tech venture

OPENING

ArcelorMittal adds new Ontario plant

PRODUCTION DECREASE

Tally of canceled US EV programs

PRODUCTION INCREASE

Mercedes boosts Hungary output, trims Germany

REGULATION

US adds 25% tariff on truck imports

SHUTDOWN

Ford halts F-150 Lightning amid shortages

Bankruptcy

Court records show that lenders to bankrupt First Brands Group, which owns Trico and Fram, rushed to provide a $1.1B emergency loan. During the process, the company revealed $2.3B in off-balance-sheet financing, which is now under investigation.

The funding was finalized in under a month, with only 10% to 20% of the usual due diligence. Advisers repeatedly raised the estimated cash needed to keep the supplier running, increasing it from $600M to $1.1B in just ten days.

Lenders called the deal “a true rescue facility negotiated under extreme pressure.” They warned they were funding “effectively a black box.”

This case illustrates that complex off-balance-sheet financing can obscure a supplier’s true financial health. Such situations put lenders and OEM customers at risk of sudden liquidity problems and rushed, high-risk bailouts.

Change In Management

Stellantis CEO Antonio Filosa has reorganized the company’s top management to help the business recover after two years of falling sales and profits. This comes as the company prepares for a strategy update in 2026.

Emanuele Cappellano will now lead Europe and European brands, while retaining his role at Stellantis Pro One. Jean-Philippe Imparato will take charge of Maserati, and Francesco Ciancia is returning from Mercedes-Benz to oversee global manufacturing. Ralph Gilles has been named global head of design, and Gregoire Olivier will lead the China and Asia-Pacific region.

Several senior leaders from Nio’s smart driving division, including its head of AI platform, head of world model, and smart driving product lead, have recently left the company, according to Chinese media reports.

Nio said the departures are part of a broader reorganization aimed at accelerating the development of its World Model 2.0, the AI architecture underlying its autonomous driving system. The shakeup highlights pressure to advance AI capabilities in China’s crowded EV market.

Cyber Security

Jaguar Land Rover is gradually restarting its UK production after a cyber-attack on August 31 forced factories and retail systems to close for over a month.

Production lines for engines, batteries, stamping, and assembly are running again at Wolverhampton, Hams Hall, Solihull, Castle Bromwich, and Halewood. The Nitra plant in Slovakia will follow.

To help suppliers, JLR has started a short-term financing program with upfront payments. However, a nearly $2B UK loan guarantee has not yet been distributed, so some suppliers are still facing cash flow challenges.

Disaster

A three-alarm fire broke out on September 16, destroying the hot mill at Novelis’ Oswego, New York, aluminum plant, which supplies approximately 40% of the US automotive aluminum sheet $.

Production will be halted until early next year, disrupting supplies to Ford, its largest customer, as well as Toyota, Stellantis, Hyundai, and Volkswagen.

Ford said it has “a full team... dedicated to addressing the situation and exploring all possible alternatives” to minimize production impacts. (see Shutdown ↓)

Following last month’s storm damage, Toyota will resume vehicle production on November 3 at its Indaiatuba and Sorocaba plants in Brazil.

Severe weather damaged the Porto Feliz engine plant, which remains closed while the company assesses the damage from a collapsed roof and other structural issues.

To restart production, Toyota will utilize imported engines and parts, initially focusing on the hybrid Corolla and Corolla Cross models.

Human Capital

Renault is considering trimming 3k jobs worldwide, aiming to reduce support roles (HR, finance, and marketing) by 15%. Most of these cuts would likely impact its headquarters in Boulogne-Billancourt, France.

The company is under ongoing financial pressure and is restructuring as carmakers contend with weaker demand in Europe, higher costs for electric vehicles, and increased competition from China.

France’s OPmobility will lay off 82 workers at its Spring Hill, Tennessee, plant on November 21 as EV demand softens, reversing a recent expansion tied to electric vehicle programs.

Industry Directions

GM added a clause that allows it to extend supplier contracts indefinitely and set pricing unilaterally, sparking backlash from parts makers concerned about planning and cost risk. The change marks a tougher approach to sourcing as tariffs and EV delays hit margins.

Mergers, Ventures, Acquisitions

Stellantis is preparing a $10B US investment push, including the retooling of Belvidere, Illinois, for a mid-size Ram pickup, in part to align with President Trump’s manufacturing agenda. The plan could boost supplier demand in North America as European production slows.

Autoliv plans to establish a 40%-owned joint venture with Hangsheng Electric to develop safety electronics for China’s automotive market, commencing in 2026.

Opening

ArcelorMittal Tailored Blanks is adding a 154k ft² plant in Ingersoll, Ontario, to expand regional production of lightweight automotive blanks by late 2026.

Production Decrease

Automotive News: Unplugged: These EVs have been canceled or postponed in the US

Acura

ZDX: Canceled after one model year (production ended September 2025).

Built in collaboration with GM at Spring Hill, Tennessee.

Ford

Full-size electric pickup (BlueOval City): Delayed to 2028 (from 2027).

Next-generation E-Transit (Ohio): Delayed to 2028 (from 2026).

Two three-row electric crossovers (Oakville, Ontario): Canceled in 2024.

Jaguar Land Rover (JLR)

Range Rover Electric: Postponed to 2026 (from end of 2025).

Next-generation Jaguar EV: Postponed for testing and demand recovery.

Nissan

Ariya (US model): Paused for 2026 model year; future uncertain.

Next-generation EVs (Canton, Mississippi): Frozen indefinitely.

Porsche

Unnamed crossover above Cayenne: Changed from EV to ICE and PHEV.

718 Boxster and Cayman (next gen): Shifted to include ICE option.

Next-generation EV platform (2030s): Rescheduled or delayed for redesign.

Stellantis

Maserati MC20 Folgore (EV): Canceled (March 2025).

Ram 1500 EV pickup: Canceled (September 2025).

Dodge Charger R/T EV trim: Canceled (May 2025, due to tariffs).

Dodge Charger Daytona SRT Banshee (900 hp EV): Canceled (October 2025).

Jeep Gladiator plug-in hybrid: Canceled (September 2025).

Toyota

Highlander EV (Indiana): Delayed to H2-2026.

Second three-row EV (Georgetown, Kentucky): Delayed to 2027 or later.

Volkswagen

ID7 electric sedan (US market): Canceled (January 2025).

Launch had previously been delayed indefinitely in May 2024.

Production Increase

Mercedes will double its output in Hungary to 30% of its European total, adding 3k jobs and launching new EV and hybrid models under a $5.8B cost-cutting plan. The shift trims German capacity and boosts lower-cost production.

Regulation

President Donald Trump announced a 25% tariff on all medium- and heavy-duty trucks imported into the United States, effective November 1, to protect domestic manufacturers.

Mexico, the largest exporter, has tripled shipments since 2019 to about 340k units.

The tariff could impact automakers such as Stellantis, which manufactures Ram trucks and vans in Mexico and has lobbied against it.

Shutdown

Ford is halting F-150 Lightning production next week in Dearborn, Michigan, due to aluminum shortages resulting from the fire at Novelis in New York.

This disruption could cost the company $1B and put pressure on EV supply.