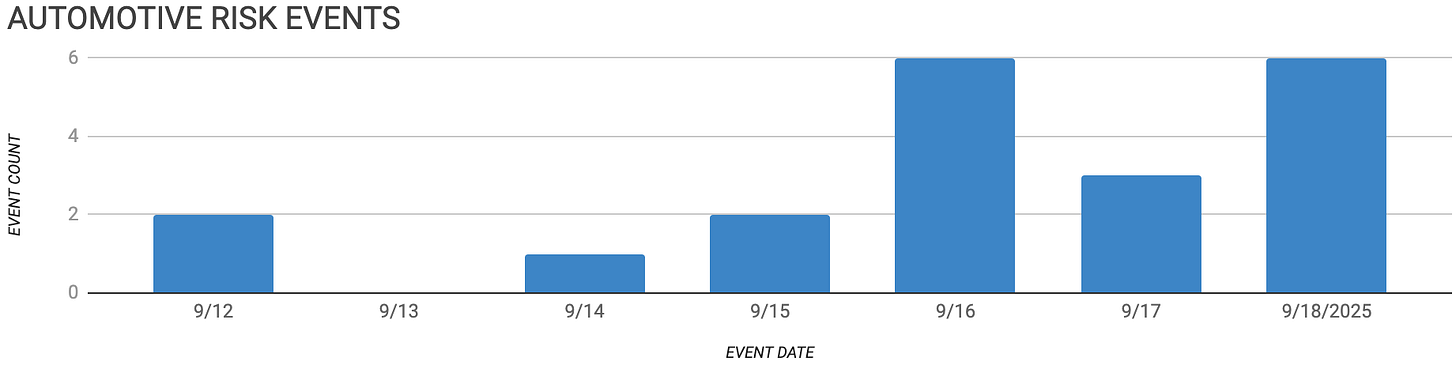

Automotive Supply Chain Risk Digest #448

September 12 - 18, 2025, by Elm Analytics

Contents

CYBER SECURITY

JLR global shutdown costs exceed $1B

Suppliers lay off 6k amid JLR outage

EXPANDING

Scout Motors opens $300M supplier park

HUMAN CAPITAL

Ford trims Cologne EV jobs, cuts shift

Immigration raid halts Hyundai battery setup

Bosch cuts costs amid auto slowdown

INDUSTRY DIRECTIONS

Chinese carmakers commit to 60-day payments

MERGERS, VENTURES, ACQUISITIONS

SAIC cuts JSW stake, halts investments

GM eyes renewed China JV with SAIC

Stellantis to build Leapmotor in Spain

OPENING

Rivian breaks ground on Georgia plant

PRODUCTION DECREASE

Nissan halves Leaf EV output

PRODUCTION INCREASE

Hyundai targets 5.55M sales by 2030

BMW to build iX3 in Hungary

Xpeng assembles EVs in Austria

Tesla expands Gruenheide plant output

MG4 surge prompts 3-shift ramp-up

REGULATION

US mulls broader tariffs on auto parts

SHUTDOWN

VW halts ID. Buzz due to demand drop

GM idles Wentzville plant over shortages

Cyber Security

Jaguar Land Rover continues to struggle with the fallout from its recent cyberattack. The company remains shut down worldwide through at least September 24.

Over 33k employees are still unable to work while system recovery efforts continue. Industry experts now peg production losses at 1k vehicles per day, with estimated daily losses of $6M-$13M, and total losses of over $1B.

JLR's assembly plants in Halewood, Solihull, Wolverhampton, and more overseas have yet to resume operations.

JLR's supplier companies, such as Evtec, WHS Plastics, SurTec, OPmobility, and Autins Group, have temporarily laid off 6k workers, deepening the strain on its UK supply base, which supports 100k jobs. Industry leaders are calling for emergency government support to help stabilize the sector.

Expanding

Scout Motors is adding a $300M supplier park in Blythewood, South Carolina, with battery assembly and just-in-time logistics facilities to support its 2027 EV production.

Human Capital

Ford plans to cut 1k jobs at its electric vehicle plant in Cologne, Germany, and will move to a single shift starting in January 2026 due to lower demand. This is in addition to 4k job cuts already set for Europe by 2027.

The reduced production and layoffs indicate slower EV adoption in Europe, as well as supply chain and labor challenges, alongside increased competition from China and higher US tariffs.

The September 4 US immigration raid at Hyundai-LG's Georgia battery plant detained 475 (mostly South Korean) workers, halting equipment setup and disrupting construction.

Korean suppliers like Woowon Technology and SK On have pulled their engineers on temporary visas from US sites, pausing critical training needed to launch new EV plants.

Hyundai says the raid has already delayed its Savannah project by several months, while industry leaders warn that the visa crackdown could deter Korean investment.

Bosch announced that its Mobility unit is dealing with a $2.95 billion yearly cost gap, mainly because of slow car sales, delays in EV and AV adoption, and higher input costs.

To address this, the company plans to further reduce costs by downsizing its staff, adjusting its portfolio, and cutting expenses on logistics, materials, and capital.

Suppliers have faced significant challenges as they attempt to invest in EV tech while navigating tighter profit margins.

Industry Directions

BYD and other Chinese carmakers have promised to follow new rules that require them to pay suppliers within 60 days.

These rules also introduce tighter checks on payment procedures.

The goal is to ease cash flow problems for suppliers as the industry deals with lower demand and tougher competition.

Mergers, Ventures, Acquisitions

SAIC plans to reduce its 49% stake in JSW MG Motor India and will pause new investments, as regulatory issues and disagreements over valuation have slowed progress.

At the same time, JSW is exploring a deal with its competitor, Chery, highlighting the growing challenges of localizing EV supply chains in India.

Meanwhile, GM is reportedly negotiating with SAIC to renew its China joint venture, with discussions centered on future models and factory plans.

Last year, GM absorbed $4.4B in losses in China; however, the company has rebounded in 2025 with a 20% increase and $116M in profits.

Significantly, Buick, Cadillac, and Wuling all posted strong growth, despite market price wars and overcapacity.

Renewing the deal would boost GM's local production and efficiency, which is seen as crucial to competing with BYD and other Chinese brands.

Stellantis will allocate factory space in Spain for Leapmotor production, likely starting with the B10 SUV in 2026.

Local Spanish production gives Stellantis and Leapmotor a cost advantage in Europe's EV market, while stabilizing supply chains against tariff risks and expanding affordable EV offerings.

Opening

Rivian has officially broken ground on its delayed Georgia plant, which is now set to begin production in 2028 with a capacity for 400k vehicles across two phases.

The factory will build the R2 and R3 models, though initial R2 output will start at Rivian's Illinois plant to save $2B in near-term costs.

Production Decrease

Nissan is cutting production of the Leaf EV by more than half because of battery shortages from suppliers. This will delay deliveries in the US and Japan. Although the launch is still on schedule, fewer cars will be available when it begins.

Production Increase

Hyundai targets 5.55M global sales by 2030, with 60% electrified, backed by expanded hybrid and EV lineups and US production ramp-up at the Georgia Metaplant.

Hyundai's long-term strategy leans heavily on local production and supplier investment to hedge tariff risks and stabilize EV and hybrid supply chains.

BMW plans to start iX3 EV production at its new plant in Debrecen, Hungary, next month. The company aims to ramp up production and gain ground against its Chinese competitors, who also have new factories in the region.

Xpeng has begun assembling its G6 and G9 EVs at Magna Steyr in Austria, utilizing semi-knocked-down kits to circumvent steep EU tariffs on Chinese-built vehicles.

The move provides Magna with new volume as other contracts wind down and supports Xpeng's European expansion.

Tesla will boost production at its Gruenheide, Germany, plant after the company saw stronger sales in over 30 export markets, despite a 58% drop in sales in Germany this year.

MG's new MG4 drew 26k orders in 15 days, outpacing its estimate of 15k units. SAIC has now moved to three-shift production and a delivery-delay compensation program. The rapid ramp-up signals near-term pressure on suppliers and logistics while SAIC races to increase MG4 output.

Regulation

The US Commerce Department is considering expanding national security tariffs to cover more auto parts.

It has already imposed tariffs on $240B worth of imports, including materials used in electric vehicles. Automakers and suppliers say this uncertainty is driving up costs and making supply chains riskier.

Shutdown

VW will pause Hannover ID. Buzz output as slowing EV and van demand drives a 21k unit production cut for 2025.

GM will temporarily idle its Wentzville, Missouri, plant for three weeks due to persistent parts shortages, laying off 3.8k workers, and halting production of Colorado, Canyon, and van models. The decision highlights broader production cuts across GM's US network.