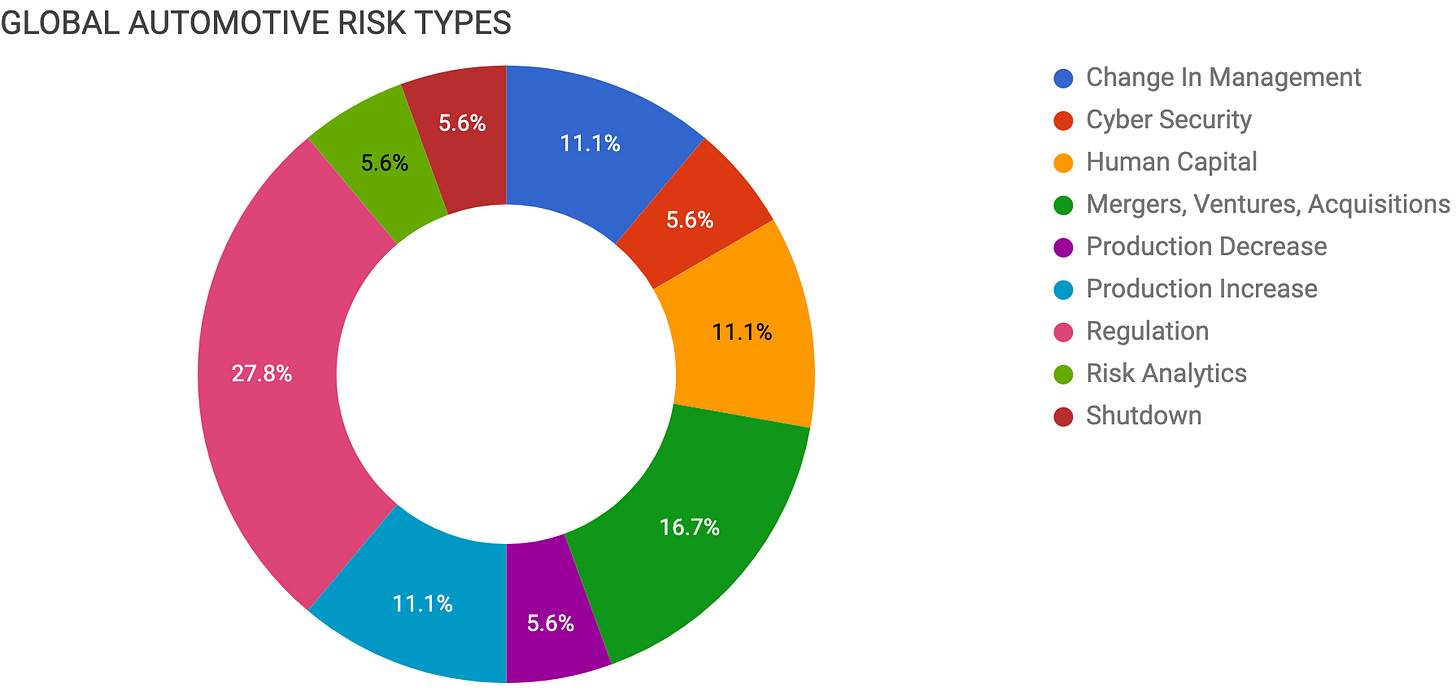

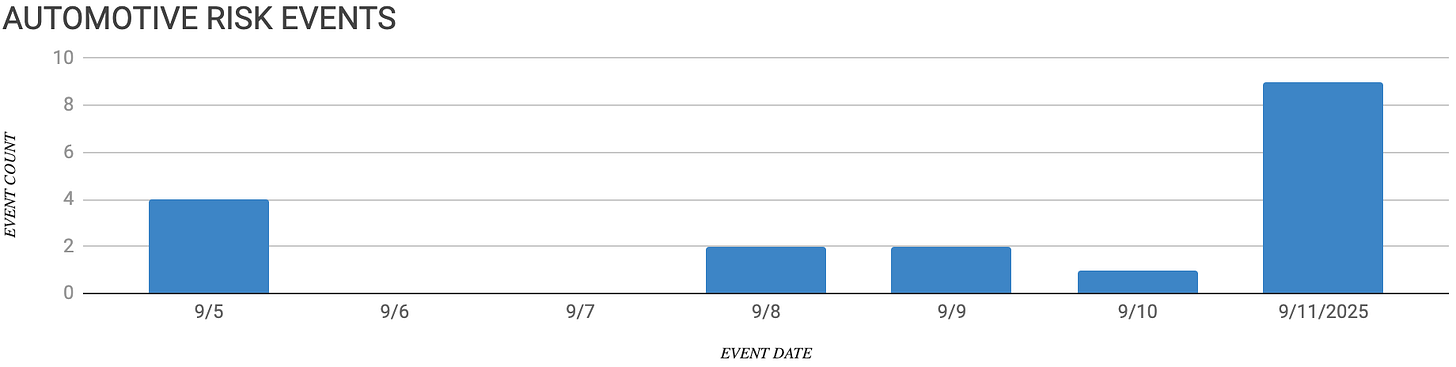

Automotive Supply Chain Risk Digest #447

September 5 - 11, 2025, by Elm Analytics

Contents

CHANGE IN MANAGEMENT

ZF leadership reshuffle amid restructuring

Magna appoints Philip Fracassa CFO

CYBER SECURITY

JLR shutdown continues after cyberattack

HUMAN CAPITAL

Oshawa plant job cuts looming

Akebono to lay off 53 workers

MERGERS, VENTURES, ACQUISITIONS

Stellantis sells VM Motori engine plant

ITB Auto revives Lear plant

Fortescue scraps Detroit battery project

PRODUCTION DECREASE

Hyundai battery plant delayed post-raid

PRODUCTION INCREASE

CAMI plant restarts BrightDrop production

BYD Hungary plant back to launching in 2025

REGULATION

Mexico hikes tariffs on Chinese imports

Tariff policy uncertainty strains industry

US rolls back EV and emissions rules

Supply chain risks from political instability

RISK ANALYTICS

Auto loan delinquencies signal stress

SHUTDOWN

GM Warren facility closed over Legionnaires’

Change In Management

ZF CEO Holger Klein and commercial vehicle chief Peter Laier will exit in September, with Mathias Miedreich, head of powertrain, stepping in as CEO.

The leadership shake-up at ZF comes at a critical moment as Europe’s second-largest supplier pursues deep restructuring and cost cuts, raising supply chain uncertainty for automakers reliant on its transmissions and commercial vehicle systems.

Magna International has named Philip Fracassa as its new CFO, taking over from Patrick McCann. The change comes as the company continues to shrink budgets in response to US tariffs. Fracassa previously served as CFO at Timken and has held finance positions at Visteon, GM, and PwC.

Cyber Security

Jaguar Land Rover will keep its UK factories in Solihull, Halewood, and Wolverhampton closed until at least Wednesday, after a cyberattack forced production offline since September 1.

The shutdown has already wiped out over two weeks of output, roughly 1k vehicles per day, and suppliers and dealerships have faced major disruptions. JLR confirmed that "some data has been affected" and has notified the relevant regulators.

Human Capital

GM’s Oshawa Assembly plant will keep building Chevy Silverado pickups on three shifts through the end of 2025, but will move to two shifts by January 30, 2026.

TFT Global, a contractor that supports the facility, has already laid off 250 workers. Additionally, up to 750 GM jobs and 1,500 supply chain positions are at risk due to new US tariffs and the change to two shifts.

Despite these changes, GM Canada has confirmed the next-generation Silverado will launch in Oshawa for 2027.

Akebono will cut 48 jobs at its Farmington Hills, Michigan, engineering center and five more at other US plants, citing a decline in business. The layoffs reflect supplier strain from slowing auto production and shifting EV policies.

Mergers, Ventures, Acquisitions

Stellantis has sold its VM Motori engine plant in Cento, Italy, to the investor group behind Marval, shifting focus from traditional engines to EVs. The buyers will keep 350 jobs and expand industrial engine production.

ITB Auto will invest $117M to revive Lear’s closed Grugliasco plant near Turin, Italy. The company plans to produce 20k Chinese Desner electric minicars per year from 2026 and re-employ up to 250 workers. Unions welcome the recovery, but want stronger assurances regarding job security and investor stability.

Fortescue canceled its $210M Detroit EV battery plant due to changes in US policy and the loss of tax credits. Recent rollbacks on EV incentives in the US have made it harder for battery projects in Michigan to succeed, causing delays and uncertainty amid the EV supply chain.

Production Decrease

The construction of Hyundai’s Georgia battery plant, co-owned with partner LG Energy Solution, was delayed by at least two to three months following an immigration raid that targeted specialized foreign workers.

This disruption poses significant risks to the automotive supply chain, threatening battery supplies essential for Hyundai and Kia’s EV launches, which could lead to manufacturing slowdowns and widespread production delays.

The situation highlights the instability of US regulatory policy and labor vulnerabilities for global manufacturers investing in US operations and may prompt reassessment of supply chain strategies and future investments.

Production Increase

GM’s CAMI assembly plant in Ingersoll, Ontario, Canada, is set to restart BrightDrop EV van production on November 17 after being shut down for seven months.

The plant will operate with only one shift, leaving about 650 workers still laid off, and the battery line will not reopen yet. GM is making these changes in response to slow sales and high inventory.

Union leader Mike Van Boekel said members are upset and suggested that bringing in batteries from the US could be a political move to avoid trade issues.

GM sold just 1.9k BrightDrop vans in the US and Canada in 2024, which is much lower than expected.

BYD will begin production at its new EV plant in Hungary by late 2025, reversing earlier reports of possible delays into 2026. The company’s on-time launch strengthens its foothold in Europe’s EV market, intensifying competition with established automakers and reinforcing supply chain localization in the region.

Regulation

Mexico plans to increase tariffs on cars and auto parts from China and other Asian countries, raising them from 20% to 50%. The goal is to protect local industry and match US trade policy before the 2026 USMCA review.

This change covers more than 1.4k product categories and focuses on imports sold below certain prices to help protect Mexican jobs.

Since Mexico is now the top importer of Chinese vehicles, this decision creates new hurdles for Chinese automakers, though their size may help them stay competitive.

Auto suppliers and automakers remain in limbo as US trade policy and tariffs shift under the Trump administration, with no clarity expected for several months to come.

Panelists at the Automotive News Congress in Detroit warned that suppliers face financial strain and OEMs have absorbed billions in costs without passing them on to consumers, a stance seen as unsustainable.

Stephanie Brinley of S&P Global Mobility said of tariffs, “The bottom line is, it’s going to be higher. The question is going to be, how high? Stability is a thing the industry needs the most... We’re not going to get it in the next three months.”

Prolonged tariff uncertainty is freezing supply chain investment decisions, raising costs across OEMs, suppliers, and consumers, and leaving the industry unable to plan effectively.

However, the Trump Administration’s rollback of emissions rules and EV credits could save Detroit automakers billions, with GM, Ford, and Stellantis pivoting back toward gas vehicles.

The shift slashes compliance costs, but hurts EV-focused rivals like Tesla and Rivian, as EV credits have been a significant source of prior revenue.

Foley: The Effects of Government Change and Political Instability on Supply Chain Management:

Risk Analytics

US auto loan "Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession," according to a new report from the Consumer Federation of America.

Often seen as a leading economic indicator, it signals growing consumer financial stress and increasing risk from reduced demand, production adjustments, and tighter credit conditions that ripple across the automotive supply chain.

Shutdown

GM closed the Cole Engineering Center within the Warren Technical Center Campus in Michigan, after two employees contracted Legionnaires’ disease (a severe form of pneumonia linked to inhaling water droplets with Legionella pneumophila bacteria).

The facility will stay closed with testing underway until September 22.

The shutdown interrupts operations at a major engineering hub, potentially creating delays that could affect product timelines and supply chain coordination.

What a sobering thought...!!!

US auto loan "Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession," according to a new report from the Consumer Federation of America