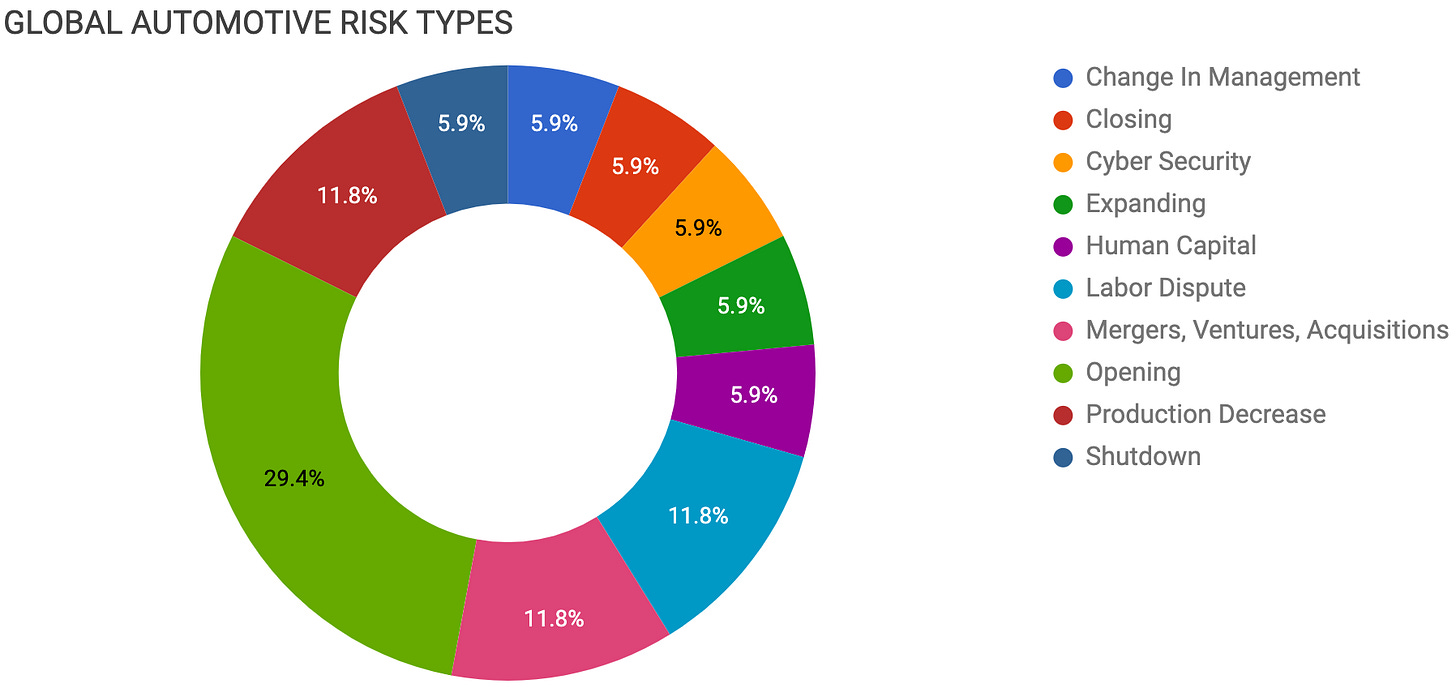

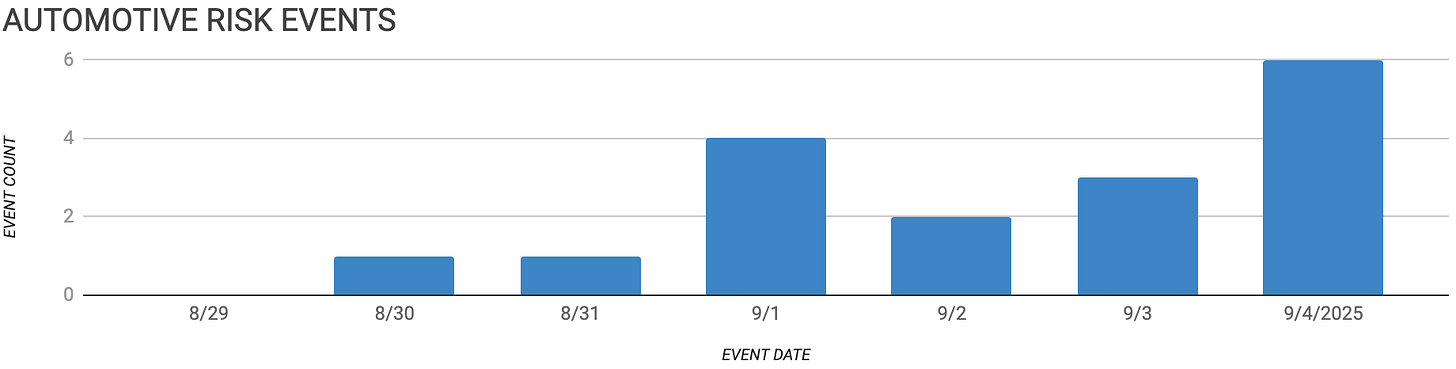

Automotive Supply Chain Risk Digest #446

August 29 - September 4, 2025, by Elm Analytics

Contents

CHANGE IN MANAGEMENT

Lyten appoints former Northvolt COO

CLOSING

Natron closes, canceling sodium-ion gigafactory

CYBER SECURITY

JLR cyberattack halts global production

EXPANDING

Toyota to build EVs in Europe

HUMAN CAPITAL

Rivian layoffs target commercial team

LABOR DISPUTE

Hyundai, GM Korea strike disrupts exports

Unifor re-elects Payne amid tensions

MERGERS, VENTURES, ACQUISITIONS

CATL sells Valmet stake to Finland

Ashok Leyland partners with CALB

OPENING

Proton opens Malaysia’s first EV plant

EVE Energy builds solid-state factory

Valeo opens Shanghai ADAS facility

Astemo builds HQ in Michigan

Virtuoso opens EV parts plant in India

PRODUCTION DECREASE

VW pauses ID.4 output in Tennessee

BYD sees first production decline

GM halts EV production in Tennessee

SHUTDOWN

GM delays shift at Bolt plant

Change In Management

Lyten, the Silicon Valley battery startup that acquired Northvolt’s former assets, has appointed ex-Northvolt COO Matthias Arleth as CEO of Lyten Sweden and brought back key executives to restart operations.

Closing

Natron Energy is shutting down nationwide and canceling its $1.4B plan to build a sodium-ion battery plant in Edgecombe County, North Carolina.

The company is also closing facilities in Holland, Michigan, and Santa Clara, California, after failing to raise enough capital or secure enough customers. Despite strong pre-orders, unexpectedly high equipment and facility costs forced the shutdown.

The plant would have been one of the only sodium-ion gigafactories in the world, making its cancellation a major setback for emerging battery technologies. The collapse highlights the financial and scaling risks in domestic EV supply chains and leaves a gap in planned US battery capacity.

Cyber Security

Jaguar Land Rover (JLR) has faced a cyberattack that began on August 31, 2025, leading to a halt in manufacturing at its Halewood and Solihull plants and other sites worldwide.

Production of models such as the Range Rover, Range Rover Evoque, and Discovery Sport has stopped, delaying thousands of deliveries and orders.

Over a million UK drivers have been unable to get repairs, and dealers are unable to register new cars or order parts because JLR’s internal systems are down.

Suppliers report that their shipments of JLR parts are delayed, and workshops and distributors are unable to process new orders or run diagnostics.

Financial losses are growing throughout JLR’s supply network, with both manufacturing and retail operations heavily affected.

The cybercriminal group Scattered Lapsus$ Hunters, also linked to the cripling Marks & Spencer attack, has claimed responsibility and is reportedly trying to extort the company.

Expanding

Toyota will invest $796M to build its first European EV at its Kolin, Czech plant, adding a battery facility with state support.

Toyota has been cautious about EVs, relying on strong hybrid demand, but plans to introduce nine new BEV models in Europe by 2026.

The Kolin plant, which currently produces the Aygo X and Yaris Hybrid, has an annual capacity of approximately 220k vehicles.

Human Capital

Rivian plans to lay off less than 1.5% of its staff, primarily from the commercial team, as it seeks to reduce expenses ($) ahead of launching its lower-cost R2 SUV in 2026.

These cost-saving measures come as the company reported a $1.1B loss in the second quarter.

Additionally, Rivian faces challenges such as the end of the $7.5k US EV tax credit on September 30 and new policies that will prevent it from receiving $100M in expected compliance credit revenue.

Labor

Hyundai Motor has started a four-day partial strike, its first major walkout since 2018.

GM Korea workers have also stepped up with a three-day partial strike.

These actions could quickly disrupt production and exports, especially since most of GM Korea’s vehicles go to the US.

Tensions are rising as Kia faces tough wage talks, raising worries that labor unrest could spread.

With US tariffs already making exports harder, longer strikes at Korea’s top automakers could sharply cut output and destabilize global supply chains that depend on Korean vehicles.

Lana Payne has been re-elected president of Unifor, Canada’s largest private-sector union.

Her leadership comes at a time when auto jobs face pressure from US-Canada tariffs and trade tensions.

Labor experts say her success depends on how well she supports the auto sector, as Windsor, Ontario, already faces layoffs and supply chain issues.

Mergers, Ventures, Acquisitions

CATL has sold its 20.6% stake in Valmet Automotive to the Finnish government.

With this move, Finland now owns 79% of the company and plans to invest about $140M to help stabilize operations as EV sales slow.

This deal also gives Finland greater control over Valmet and its battery subsidiary, Ioncor, as Europe seeks to secure its own supply chains.

India’s Ashok Leyland will invest $571M in local EV battery production, partnering with China’s CALB, aiming to supply its Switch unit and other automakers.

Opening

Proton has opened Malaysia’s first dedicated EV plant in Tanjung Malim. The facility has an annual capacity of up to 45k units, producing the e.MAS7, e.MAS5, and models for Geely-owned Zeekr.

Notably, Proton broke ground on the plant in February of this year.

EVE Energy has begun constructing a solid-state battery factory in Chengdu, China, with a phased capacity of 100 MWh annually by late 2026. The move pushes next-gen batteries into production, with higher energy density and safer cells.

Valeo has opened a 347k ft² facility in Shanghai’s Waigang Industrial Park to expand production and R&D for ADAS sensors, LiDAR, and controllers that support Level 3 and higher autonomous vehicles.

Astemo, a Japanese supplier connected to Honda, plans to invest $95M in a new 185k ft² regional headquarters in Wixom, Michigan.

The facility, expected to open in fall 2027, will feature test tracks, engineering labs, and space dedicated to developing software focused on autonomous driving and electrification.

Virtuoso Optoelectronics will invest about $96M in a new facility in Nashik, Maharashtra, India, to produce electronics and compressor motors for EVs and other automotive applications.

Production Decrease

VW is pausing ID.4 production in Chattanooga, Tennessee and furloughing 160 workers amid soft EV demand and policy headwinds.

BYD posted its first consecutive monthly production drop since 2020. The company’s rare production pullback highlights intensifying pressure in China’s EV market, raising supply chain risks for the world’s largest EV maker and its global expansion plans.

Shutdown

GM will halt production of the Cadillac Lyriq and Vistiq in Tennessee and defer a shift at the Chevy Bolt EV plant near Kansas City, responding to slower EV demand after the loss of U.S. subsidies.

The decision highlights ongoing production and supply chain volatility as automakers adjust EV and ICE output amid changing US policy.