Automotive Supply Chain Risk Digest #444

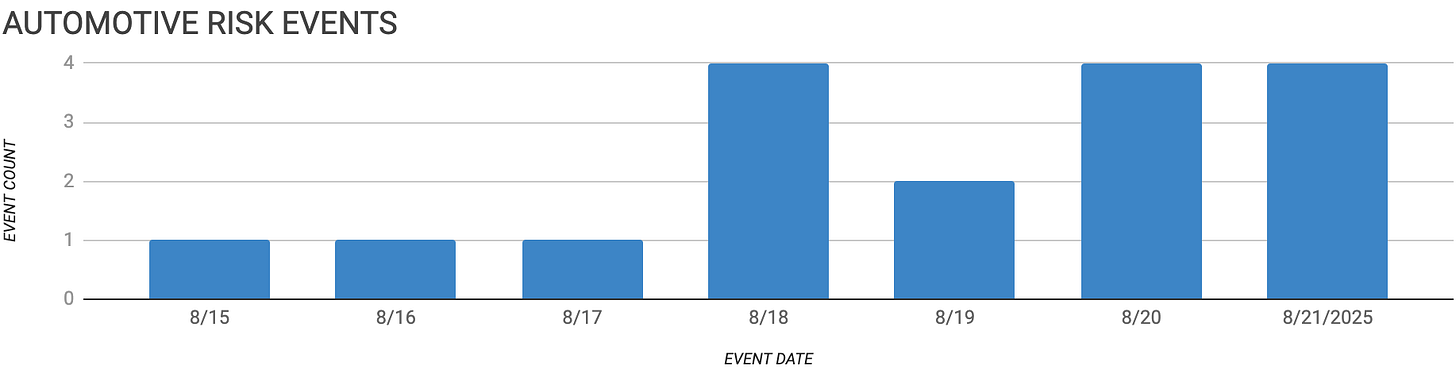

August 15 - 21, 2025, by Elm Analytics

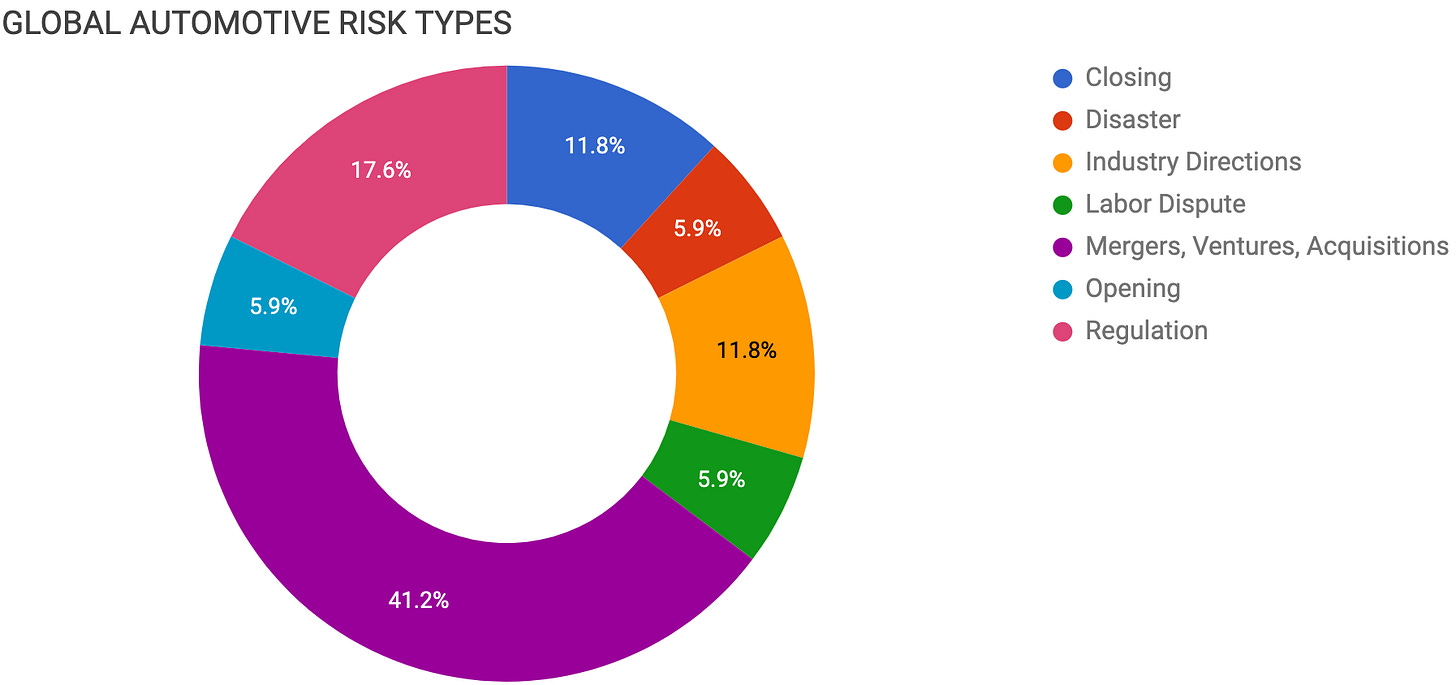

Contents

CLOSING

Polytec closing German plant, 250 jobs

NPR closing Michigan plant, 64 jobs

DISASTER

Tesla Grünheide battery fire evacuation

INDUSTRY DIRECTIONS

Chinese EV makers shift overseas investment

Suppliers show lowest confidence index

LABOR DISPUTE

VW Mexico, union agree 4% raise

MERGERS, VENTURES, ACQUISITIONS

FAW buying 10% Leapmotor stake

Honda, Helm.ai co-develop autopilot system

Group14 raises $463M, expands plants

India’s Epsilon builds US graphite plant

Dongfeng selling stake in Honda Engine

VW, Xpeng expand software to hybrids

Cleveland-Cliffs inks multiyear steel deals

OPENING

Taiwanese HCMF opens Mexico roof plant

REGULATION

US expands tariffs on metals, EV parts

US tariffs hit Canadian, Mexican parts

EU seeks retroactive US tariff cuts

Closing

Austrian supplier Polytec will shutter its Idar-Oberstein, Germany, plant by the end of 2026, cutting about 250 jobs, or nearly 7% of its workforce.

The site, acquired from insolvent Wayand in 2019, makes painted plastic exterior parts, but Polytec cited falling demand, expiring projects, and market uncertainty for the closure.

NPR of America (Nippon Piston Ring) will close its Grand Haven, Michigan, plant by 2027, eliminating 64 jobs, most by late 2025. The closure, detailed in a WARN notice, is permanent and leaves NPR with only one US facility in Kentucky.

Disaster

A fire in Tesla's Grünheide battery pack production area forced a complete evacuation after dropped cells ignited, with emergency teams taking hours to contain it.

The incident spotlights fire risks in EV battery manufacturing and potential disruption at Tesla's sole European plant.

Industry Directions

Chinese EV makers invested more in overseas factories than at home in 2024, the first time since records began in 2014.

Most of this spending went to battery plants, while domestic investment plunged to $15B from a $90B peak in 2022 as firms faced tariffs, competition, and EU regulatory pressure.

The shift shows how automakers are localizing abroad to bypass trade barriers, secure market access, and reshape global EV supply chains.

Auto suppliers scored 51.3 in Automotive News’ new confidence index, the lowest of any sector, as tariffs and shifting EV strategies fuel uncertainty.

One-third expect performance to worsen in the next six months, compared to just a quarter who expect improvement, underscoring a gloomier outlook than that of automakers.

With OEMs delaying decisions and trade policy in flux, many suppliers have paused growth plans, leaving the sector in a state of paralysis.

Labor

Volkswagen Mexico and SITIAVW agreed to a 4% wage hike for 2025 after workers initially demanded 14%. The deal defuses strike threats at the Puebla plant, preventing production halts and supply chain disruptions.

Mergers, Ventures, Acquisitions

FAW Group, China's oldest state-owned automaker, is reportedly finalizing a 10% stake in EV startup Leapmotor, which already counts Stellantis as a 20% shareholder.

The deal would mark the first state-owned investment in a Chinese EV startup and targets joint model development, supply chain collaboration, and overseas expansion.

The investment highlights shifting alliances in China's EV race as state-owned giants turn to startups to accelerate electrification.

Honda and Helm.ai are co-developing Navigate on Autopilot, a partially automated driving system slated for 2027 that uses Helm's AI models.

Honda, which invested $30 million in Helm in 2021, sees the partnership as a way to accelerate its AI-driven autonomy strategy.

The move positions Honda alongside rivals like Tesla's Autopilot and GM's Super Cruise.

Group14 raised $463M, led by SK, and as part of its growth strategy, acquired SK's 75% stake in its South Korea joint venture, taking full ownership of the 10GWh battery active materials (BAM) plant in Sangju.

The funding will be used to scale production of SCC55, Group14's silicon anode material, which is positioned as an alternative to graphite, much of which is sourced from China.

Group14 now operates three BAM plants: two in Washington State and one in Sangju, South Korea, and is also constructing a silane gas facility in Germany to support its European operations.

In other anode news, US tariffs of 93.5% on Chinese graphite imports have opened space for India's Epsilon, which is finalizing contracts with Asian battery makers in the US and building a $650M plant in North Carolina by 2027.

Dongfeng Motor is selling its 50% stake in Dongfeng Honda Engine after the unit posted a $31M loss in 2024.

With $752M in assets and $459M in debt, the move signals financial pressure at the joint venture and may reshape how Honda sources and builds engines in China.

Volkswagen and Xpeng will roll out their Centralized Electronic Architecture to gasoline and hybrid vehicles in China starting in 2027, extending advanced driver-assistance and over-the-air updates beyond EVs.

The plan is designed to scale digital features across all powertrains while improving cost efficiency. For VW, the venture helps defend its profitable combustion lineup as it pushes deeper into software-driven services.

Cleveland-Cliffs has signed two- and three-year fixed-price steel contracts with US automakers, including GM, departing from its usual one-year deals.

The longer terms are meant to hedge against cost swings tied to Trump's 50% steel tariffs.

For automakers, the contracts also lock in supply amid policy-driven uncertainty.

Opening

Taiwanese supplier HCMF has opened a $17.3M plant in Ramos Arizpe, Coahuila, Mexico, to produce sunroofs and sliding roofs for cars. The facility will employ more than 300 people, expanding HCMF's North American footprint.

Regulation

The US has expanded steel and aluminum tariffs to 407 new product categories, affecting the equivalent of over $200B in 2024 imports.

A 50% tariff now applies to metal content, plus country-specific duties. The list adds EV-grade electrical steel and auto exhaust components.

Automakers like Tesla opposed the move, citing limited US supply, while steelmakers backed it.

The hike raises costs and supply risks for EV and parts makers, potentially increasing prices and disrupting production.

New US tariffs now apply to Canadian and Mexican auto parts, overriding USMCA protections and imposing 50% duties on items containing steel or aluminum classified as derivative products.

"If you had a USMCA-compliant auto part that was not previously subject to steel and aluminum, it was coming in free. Now it's going to get tariffed because the steel and aluminum tariffs do not honor USMCA."

– Dr. Jason Miller, Professor of Supply Chain Management, Michigan State University

The change undermines a key USMCA safeguard and significantly increases costs for North American auto part producers.

The EU is pushing to make US car tariff cuts retroactive to August 1, with relief possible within weeks once Brussels introduces reciprocal legislation.

The change would lower the current 27.5% tariff to 15% on European cars and parts, easing costs for EU automakers shipping to the US.