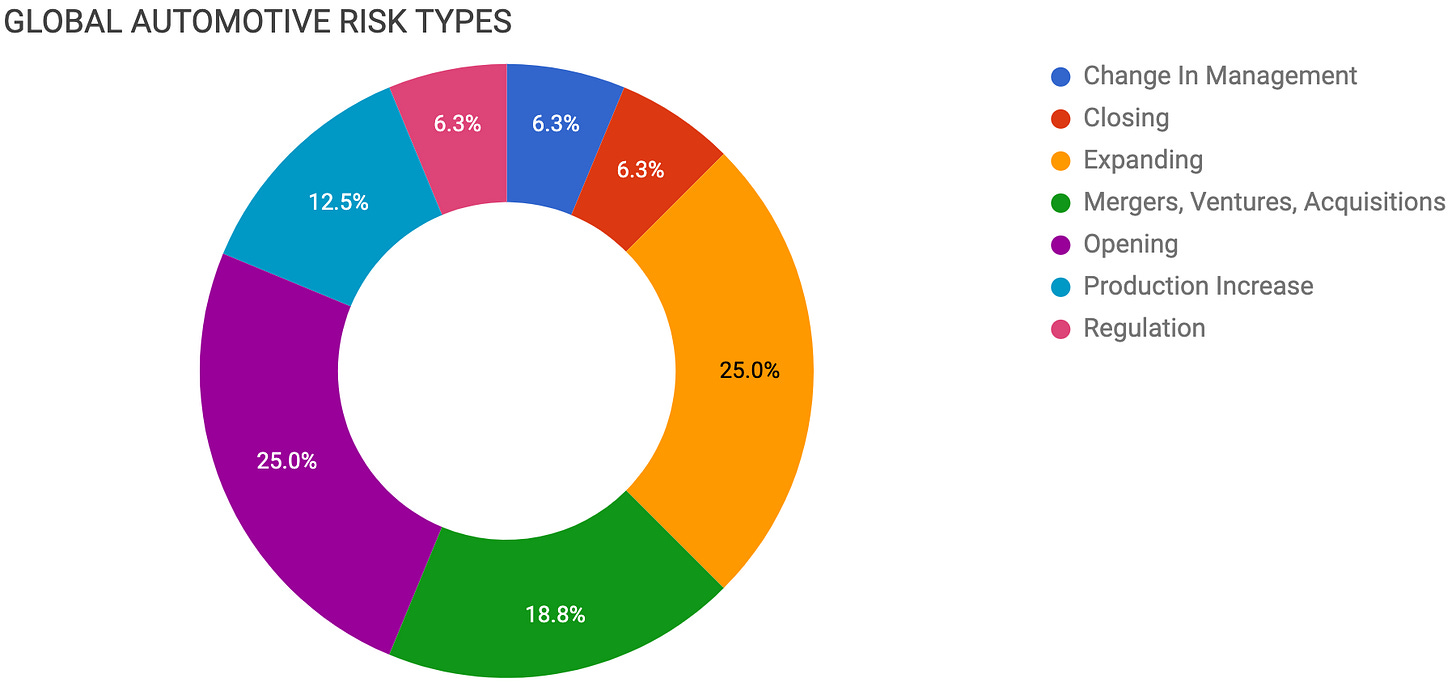

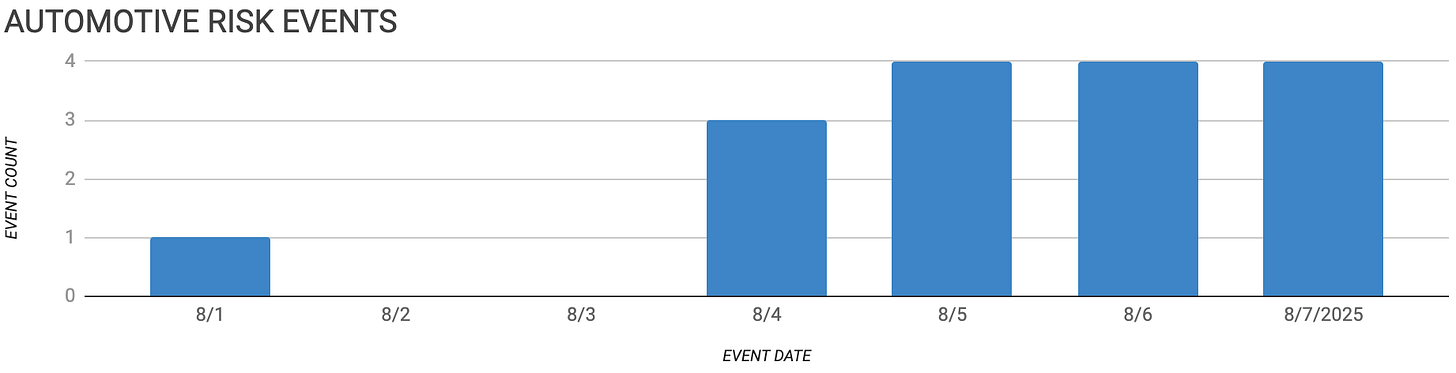

Automotive Supply Chain Risk Digest #442

August 1 - 7, 2025, by Elm Analytics

Contents

CHANGE IN MANAGEMENT

Elizabeth Krear named CAR CEO

CLOSING

ZF shutting Slovak Detva plant

EXPANDING

Rivian expands Illinois plant for R2

Tokaikogyo expands Mexico trim line

Freudenberg converts plant to EV gaskets

Toyo Tire boosts Georgia SUV capacity

MERGERS, VENTURES, ACQUISITIONS

Lyten acquires Northvolt EU assets

GM, Hyundai to co-develop vehicles

Foxconn sells Lordstown EV factory

OPENING

Toyota plans new plant in Japan

VinFast opens $500M India EV factory

Audi considers Chattanooga twin plant

Kuntai invests in Moroccan parts plant

PRODUCTION INCREASE

Great Wall begins Brazil SUV production

Honda mulls three-shift US schedule

REGULATION

China cracks down on EV overproduction

Change In Management

Elizabeth Krear, former JD Power executive and Stellantis program director, has been named CEO of the Center for Automotive Research to lead its next phase of industry-focused thought leadership. Her appointment comes as CAR sharpens its focus on electrification, automation, and sustainability policy.

Closing

Germany's ZF will shut down its Detva plant in Slovakia by mid-2026. This decision arrives after the closure of a major supplier, Punch Precision, which impacted profitability. As a result, ZF will move the production of steering and suspension components to Levice.

Expanding

Rivian has nearly finished expanding its Illinois plant to support the R2 SUV launch, with equipment testing set for Q3 and production still on track for 2026. However, changing trade policy and regulatory shifts could complicate its push to scale affordable EV production.

Japan's Tokaikogyo is investing $5.3M to expand its Aguascalientes, Mexico, plant, adding a new trim production line that is expected to increase capacity by 30%.

Freudenberg is investing tens of millions to convert its Manchester, New Hampshire, plant from ICE to EV gasket production, aiming to produce over 100M seals annually by 2029.

Toyo Tire will invest $200M in its White, Georgia, factory by 2030, to boost tire production capacity for SUVs and other large vehicles and offset tariff risks.

Mergers, Ventures, Acquisitions

California's Lyten will acquire Northvolt's Swedish and German assets, restarting lithium-ion battery production and planning a shift to lithium-sulfur technology that avoids key critical minerals. The move positions Lyten to pursue European EV battery supply contracts but introduces execution risks tied to manufacturing scale-up and OEM validation.

GM and Hyundai will co-develop five vehicles, including four ICE and hybrid models for Latin America and one EV van for North America, targeting over 800k units annually starting in 2028. The partnership includes shared sourcing, logistics, and materials strategies to reduce costs and support regional production.

Foxconn has sold its Lordstown, Ohio EV factory to a relatively unknown newly formed entity after failing to scale production with multiple EV startup partners that later went bankrupt. The site, once pitched as a central EV hub, may now shift to AI server production, reflecting deeper risks in supply chains tied to unstable OEMs.

Opening

Toyota will build its first new domestic vehicle plant since 2012 in Toyota City, aiming to start production in the early 2030s to maintain Japan's 3 million unit annual production capacity. The move supports export continuity amid declining domestic demand and rising global trade tensions.

VinFast has opened a $500M EV plant in Tamil Nadu, India, as part of a $2B expansion strategy focused on Asia, with an initial capacity of 50k vehicles and plans to export to South Asia, the Middle East, and Africa. The site also brings localized production in a tariff-heavy market, challenging entrenched domestic players like Tata Motors.

Audi is exploring a new factory next to VW's Chattanooga site to hedge against rising US tariffs on EU and Mexican vehicle imports, potentially producing up to 200k units annually. The move offset rising import costs, signaling a shift toward local production and regionalized supplier networks.

China's Kuntai will invest $13.7M in a Moroccan factory to produce automotive carpet and floor mats, leveraging duty-free EU access and reduced exposure to Chinese-origin anti-dumping measures.

Production Increase

China's Great Wall Motor will begin producing the Haval H6 SUV at its Iracemápolis, Brazil, plant on August 15 with an initial capacity of 30k units, targeting 50k by 2028. The company plans to reach 35% local sourcing by its second year, as it builds out its regional supply chain.

Honda may move to three shifts and weekend production at US factories to offset $2.4B in projected tariffs and reduce reliance on imports from Mexico, Canada, and Japan. OEMs and suppliers face broader realignment pressures amid rising trade uncertainty.

Regulation

The Chinese government has escalated regulatory pressure on EV makers like BYD to reduce production and end price wars, citing economic harm from overcapacity and deflation. A draft pricing law and high-level political messaging suggest more active intervention, increasing near-term risk for supply chain partners.