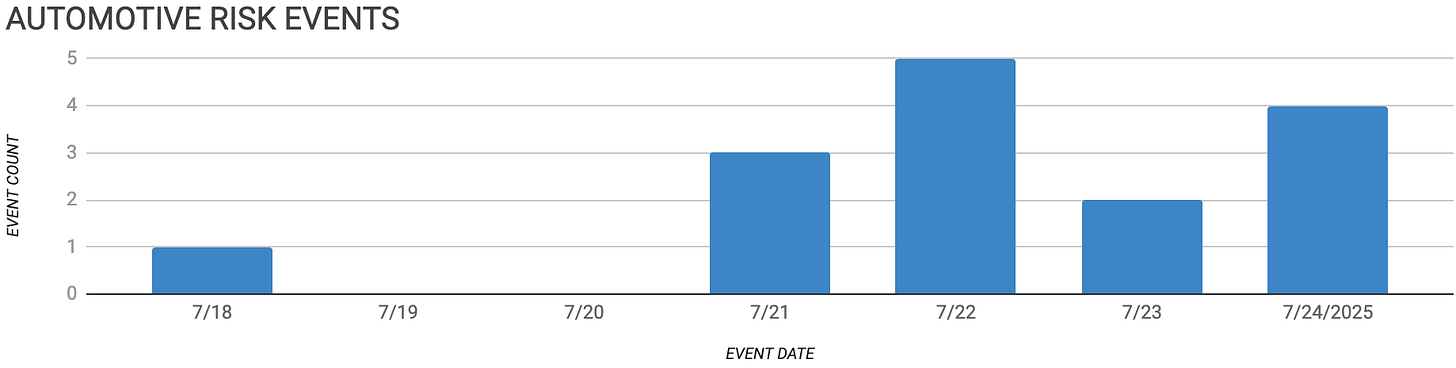

Automotive Supply Chain Risk Digest #440

July 18 - 24, 2025, by Elm Analytics

Contents

CLOSING

Nissan to close two Mexico plants

DISASTER

Fire at JLR plant contained quickly

EARNING DIP

GM, Stellantis profits hit by tariffs

HUMAN CAPITAL

Bosch to cut 1.1k German jobs

Porsche looks for further efficiencies, 1.9k layoffs

INDUSTRY DIRECTIONS

Chinese automakers expand rapidly in Brazil

LABOR DISPUTE

UAW strike looms at GM supplier

MERGERS, VENTURES, ACQUISITIONS

BYD to assemble EVs in Pakistan

OPENING

Adient opens Illinois plant for Rivian

PRODUCTION DECREASE

BYD delays Hungarian plant production

RAW MATERIAL COSTS

US steel prices rise post-tariffs

Tariffs raise costs for EV materials

REGULATION

US-Japan auto tariff deal sparks backlash

South Korea considers $100B investment deal

EV firms inflated sales numbers

Closing

Nissan will shutter its COMPAS plant in 2026 and fully close the historic CIVAC site by 2027, consolidating production in Aguascalientes. The move shrinks Nissan's North American footprint and ends several vehicle lines. CEO Iván Espinosa reportedly warned that he was concerned rivals could move into the vacated facilities and tap the trained workforce.

Disaster

A significant fire at Jaguar Land Rover's Castle Bromwich plant in England on June 24 was quickly contained by eight fire crews, with no injuries reported. JLR confirmed operations were largely unaffected. While limited in scope, the incident highlights the short-term production risks and underscores the importance of contingency planning at OEM sites.

Earning Dip

GM's Q2 profit fell by over 33% due to $1B in tariff costs, with full-year impacts expected to reach $5B, prompting a major US production shift. Stellantis reported a $2.7B loss earlier in the week, also citing tariffs and policy changes as key contributors to the financial strain.

Human Capital

Bosch will cut up to 1.1k jobs at its Reutlingen plant in Germany by 2029 and stop producing electronic control units due to the company's falling competitiveness in the current price-driven European market. The site will pivot to semiconductors as part of a broader response to weakening auto demand and global trade tensions.

Porsche has begun talks on a new savings program to offset falling China sales and 27.5% US import tariffs, following its announcement of 1.9k job cuts by 2029. CEO Oliver Blume warned that the company's traditional business model is no longer sustainable under current global trade conditions.

Industry Directions

Labor

UAW workers at Challenge Manufacturing in Pontiac, Michigan, may strike on July 25 over stalled contract talks and low wages, threatening parts supply for GM and Stellantis models like the Hummer EV and Ram 1500.

Mergers, Ventures, Acquisitions

BYD will begin assembling EVs and PHEVs in Pakistan by mid-2026 at a 25k-unit plant near Karachi in partnership with Mega Motor Company, a subsidiary of Hub Power. The venture aims to capture a 30–35% market share by utilizing imported parts, but faces challenges due to limited localization and export barriers.

Opening

Adient will invest $8M to build a seat assembly plant in Normal, Illinois, creating 75 jobs and supporting Rivian's production ramp-up. The on-site integration is expected to reduce costs and enhance efficiency as Rivian scales up its output.

Production Decrease

BYD will reportedly delay full production at its $4.6B plant in Hungary until 2026 and operate it at below-capacity levels, while ramping up output in Turkey beyond its initial plans. The shift aims to cut costs and secure tariff-free access to the EU.

Raw Material Costs

While overall US steel imports are down 6.2% year-over-year, Cleveland-Cliffs and Steel Dynamics raised Q2 steel prices after US import tariffs increased to 50%. Analysts warn that potential tariffs on pig iron from Brazil could further elevate costs and intensify raw material sourcing risks across the automotive supply chain.

Meanwhile, aluminum prices have risen 30–40%, and a new 50% tariff on imported copper is set to take effect August 1, driving up costs for EVs and vehicle electronics. Automakers like GM and Stellantis are already absorbing billions in tariff-related expenses, while experts warn that US metal capacity is insufficient to localize sourcing entirely. The lack of long-term policy clarity and the looming expansion of steel and aluminum derivative duties further complicate cost planning for suppliers and OEMs.

Regulation

The US-Japan trade deal reduces tariffs on Japanese cars and parts from a planned 25% to 15%. In return, Japan has promised to invest $550 billion in US manufacturing. This lower tariff benefits Japanese automakers by reducing their costs and increasing their access to US exports.

However, the deal has faced criticism from US automakers and labor unions who believe it gives Japan an unfair advantage, especially since North American producers still face a 25% tariff under USMCA rules.

Analysts are concerned that this deal may set a new standard for tariffs, which could complicate future negotiations with the EU and other countries.

The differing tariff rates among trade partners could disrupt cost structures, raise material costs for US original equipment manufacturers (OEMs), and hinder efforts to bring manufacturing jobs back to the US.

South Korea is working to negotiate a US trade deal that may involve at least $100 billion in American project investments by major firms, including Hyundai and Samsung, to avoid a 25% tariff and match Japan's new 15% rate. The outcome could have a significant impact on vehicle import costs and competitive dynamics for Korean automakers.

Neta and Zeekr reportedly inflated EV sales by registering insurance before final vehicle delivery, with Neta overstating more than 64k units from 2023 to 2024 (over half its reported sales).

The scheme highlights the intense competitive pressure in China's EV market and has triggered regulatory scrutiny and reputational risk for OEMs and their affiliated dealer networks.