Automotive Supply Chain Risk Digest #434

May 23 - 29, 2025, by Elm Analytics

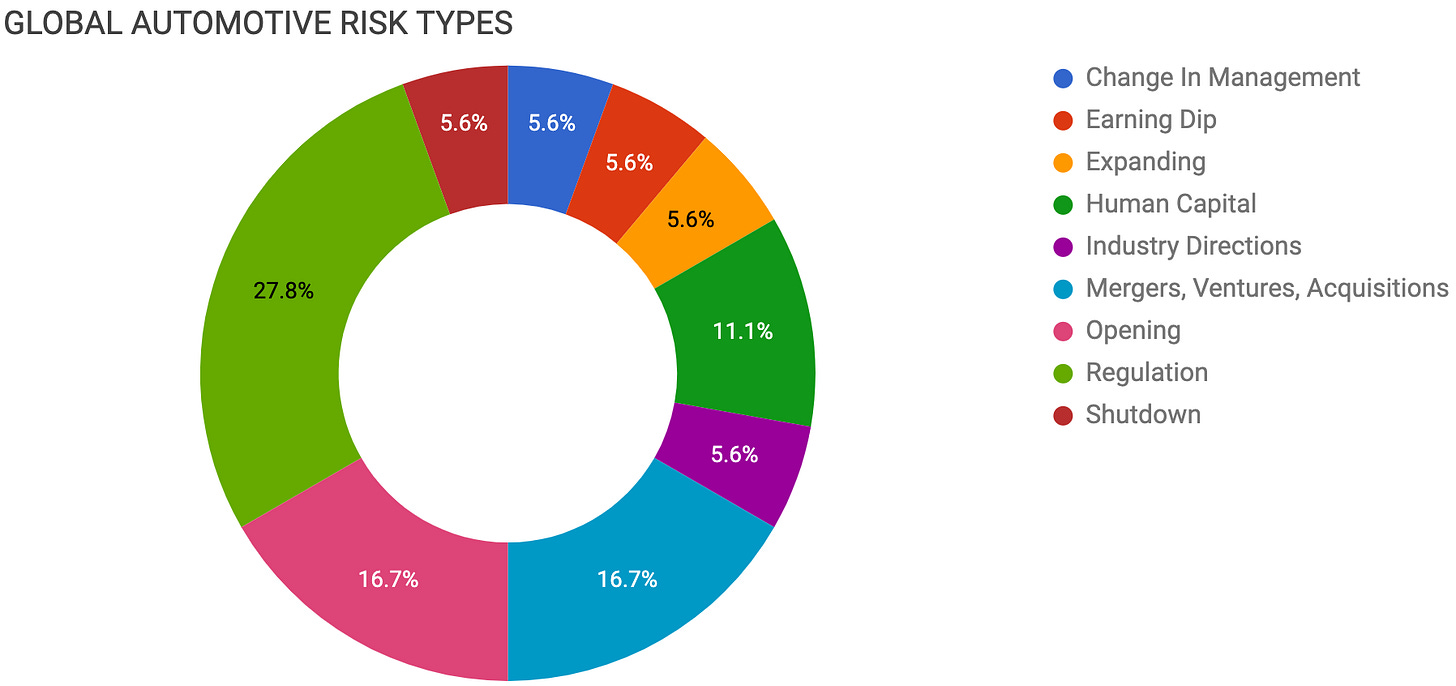

Contents

CHANGE IN MANAGEMENT

Stellantis names Filosa to stabilize operations

EARNING DIP

Porsche cuts forecast amid compounded risks

EXPANDING

Samsung SDI expands Hungarian battery factory

HUMAN CAPITAL

Nissan restructures with buyouts, closures

Juárez maquiladoras lose 30k jobs

INDUSTRY DIRECTIONS

BYD discounts raise China price war

MERGERS, VENTURES, ACQUISITIONS

Autoneum expands China footprint with deal

Foxconn plans second Japanese EV deal

Motherson pursues $1.75B Marelli buyout

OPENING

UK firm builds rare earths plant in France

Schaeffler India opens Tamil Nadu plant

NHK Spring plans India suspension plant

REGULATION

Conflicting rulings cloud auto tariffs

GM defends tariffs, shifts local production

Ford warns funding loss risks battery plant

German automakers seek US tariff deal

EU eases CO2 targets, sparks criticism

SHUTDOWN

Volvo halts US plant over parts shortage

Change In Management

Stellantis named Antonio Filosa as CEO to guide the automaker through falling revenues, tariff pressures, and the EV transition, building on his track record of improving US operations and Jeep's global expansion. His leadership will be pivotal in stabilizing Stellantis' supply chain, dealer relations, and product strategies in a volatile market.

Earning Dip

Under tariff, China, and EV pressures, Porsche's $2.3B forecast cut and factory consolidations expose how compounded supply chain risks force luxury automakers to rethink future production and market strategies.

Expanding

Samsung SDI is investing $1.2B to expand and renovate its Hungarian battery factory in Göd, pivoting to stacked prismatic batteries for Hyundai and Kia's European EVs as EU emissions rules accelerate demand.

Human Capital

Nissan is reportedly offering US buyouts and halting global pay increases as part of a 20k-job, seven-plant global restructuring to address weak profitability, aging products, and trade pressures.

Alongside workforce cuts, Nissan plans to consolidate Mexican and Argentinian pickup truck production, exit its Indian joint venture, and close a Thai plant by June, with $7B in debt and asset sales under consideration.

The sweeping cuts highlight the supply chain and operational risks automakers face as they rush to recalibrate under evolving market demands.

Juárez, Mexico's maquiladoras have lost nearly 30k jobs over the past year due to US tariffs and weak purchase orders, prompting government economic support plans to stabilize the sector. This erosion threatens cross-border supply chain stability for automakers and amplifies regional production risks.

Industry Directions

BYD has launched 10–30% discounts on key NEV models to cut dealer inventories and meet a 5.5M unit sales target, prompting Deutsche Bank warnings of a wider price war as rivals like Dongfeng slash prices too. This sharpens competitive pressures and raises risks across China's already strained mass-market automotive sector.

Mergers, Ventures, Acquisitions

Autoneum is acquiring Chengdu FAW-Sichuan for $19.4M, expanding its Chinese footprint after November's Jiangsu Huanyu deal and strengthening supply ties with major OEMs like FAW Volkswagen, Geely, and Toyota. The purchase marks an acute supply chain strategy to deepen local production, reduce regional risks, and align with China's automotive market demands.

Foxconn's upcoming second Japanese automaker deal deepens its EV diversification, reshaping supply chain alliances as Japanese brands seek to counter Chinese competition.

Motherson is pursuing a $1.75B buyout of struggling Marelli, investing $700.6M in equity and assuming $4.55B in debt. This deal could elevate Motherson into the global top 10 suppliers and expand its reach with key OEMs like Nissan and Stellantis.

However, Marelli's significant debt and post-pandemic challenges raise concerns about merging troubled companies, highlighting the risks of supplier consolidation driven by financial stress and geopolitical factors.

Opening

Less Common Metals, a UK-based company, plans to build a $124 million plant in France to produce rare earth metals and alloys. They will use recycled oxides from Carester to supply the electric vehicle and electronics markets. This initiative seeks to reduce Western reliance on China for rare earth metals, strengthen European supply chains, and mitigate geopolitical risks for the automotive industry.

Schaeffler India has opened its fifth plant in Tamil Nadu, a $205M, 177k sq ft facility boosting hybrid and conventional powertrain production, with full capacity set for Q4-2025.

NHK Spring will construct a new automotive suspension springs plant in Aurangabad, Maharashtra, India, covering 352k sq ft and launching in 2027 with 350 workers.

Regulation

Conflicting US court rulings have created significant uncertainty over the tariff status of imported auto components, as the Court of International Trade initially struck down global reciprocal and drug trafficking tariffs, only for the Court of Appeals to reinstate some levies one day later, temporarily.

While President Trump's 25% tariffs on imported vehicles and major auto parts like powertrain and safety components remain untouched, the court battle affects excluded items such as door handles, hood panels, and electronic control units, which had been subject to broader tariff categories.

"Reprieve from those other tariffs is really what we see here, and that's how it affects the auto industry," - Mitch Zajac, attorney, Butzel, though MEMA's Collin Shaw emphasized the industry remains in a holding pattern as it awaits final outcomes.

The appeals court has set deadlines for responses in early June, leaving suppliers navigating a volatile regulatory environment.

At WSJ's Future of Everything event, GM CEO Mary Barra defended Trump's tariffs as essential to counter foreign subsidies, even as GM faces a $5B tariff bill and shifts production locally, including an $888M revamp of its New York engine plant.

While potentially reflecting the fine line walked between political risk hedging and optics management, these moves show how trade policies and political pressures are reshaping supply chain risks and driving localized manufacturing strategies.

Executive Chair Bill Ford on Thursday warned about the risk of Washington eliminating production tax credits that support EV battery manufacturing, which could jeopardize Ford's investment in Marshall, Michigan:

"If it doesn't stay, it will imperil what we do in Marshall... We made a certain investment based upon a policy that was in place. It's not fair to change policies after all the expenditure has been made."

BMW, Mercedes-Benz, and Volkswagen are reportedly negotiating a US tariff deal using their local production as leverage, with proposals for export credits and plant expansions like Mercedes' Alabama GLC SUV addition from 2027. Amid intensifying US-EU trade tensions, the action reflects how German automakers look to hedge political and supply chain risks.

The European Council approved a regulation letting automakers average CO2 fleet emissions over 2025–2027, reducing short-term compliance risks but drawing criticism for potentially slowing EV adoption. While the flexibility helps stabilize supply chains, it raises long-term uncertainties for Europe's decarbonization path.

Shutdown

A parts shortage has halted production ($) at Volvo Cars' Ridgeville, South Carolina plant, compounding the Swedish automaker's operational challenges amid a sweeping global restructuring.

The under-utilized US plant produces the EX90 and Polestar 3 EVs, and although it has a capacity of 150k units, it made just 12.6k vehicles last year.

The automaker has struggled with sluggish demand, high US tariffs, and heavy import dependence.

However, Volvo's US sales have climbed 6.9% this year, and the company is exploring adding ICE XC90 or XC60 production at the site to localize supply.

Still, the halt underscores the vulnerability of EV production lines to parts disruptions and highlights how global supply dependencies and restructuring pressures amplify supply chain risk.

.