🎂 Automotive Supply Chain Risk Digest #418

January 31 - February 6, 2025, by Elm Analytics

8 Years Strong: Thank You for the Journey

Dear Reader,

This issue marks the 8th anniversary of the Automotive Supply Chain Risk Digest, and we couldn’t have done it without you. Your engagement, insights, and support have been the driving force behind our work, helping us navigate an ever-changing industry together.

From supply chain disruptions to the chaos of shifting trade policies, we’ve tackled the challenges head-on, and your trust in us has made every edition worthwhile. Whether you’ve been with us from the start or just joined, we are grateful for every read, share, and piece of feedback that helps us grow.

A special thanks to those who recommend us to colleagues or take a moment to click that heart icon (especially Mark!… but seriously, it’s ok to take a week off!).

Here’s to another year of resilience, insight, and success. We’re honored to be on this journey with you.

Warmly,

Nick Gaydos

Editor, Automotive Supply Chain Risk Digest

One more quick item of note:

Yesterday, Elm Analytics published our latest whitepaper, “Tariffs & Trade: What Manufacturers & Suppliers Need to Know”—which reveals how you can:

Collaborate for Resilience – Build strong supplier relationships that lower risk and cost.

Leverage Real-Time Insights – Use data-driven decisions to stay ahead, even under political pressure.

Diversify Your Sourcing – Expand geographically and strategically to handle sudden trade shifts.

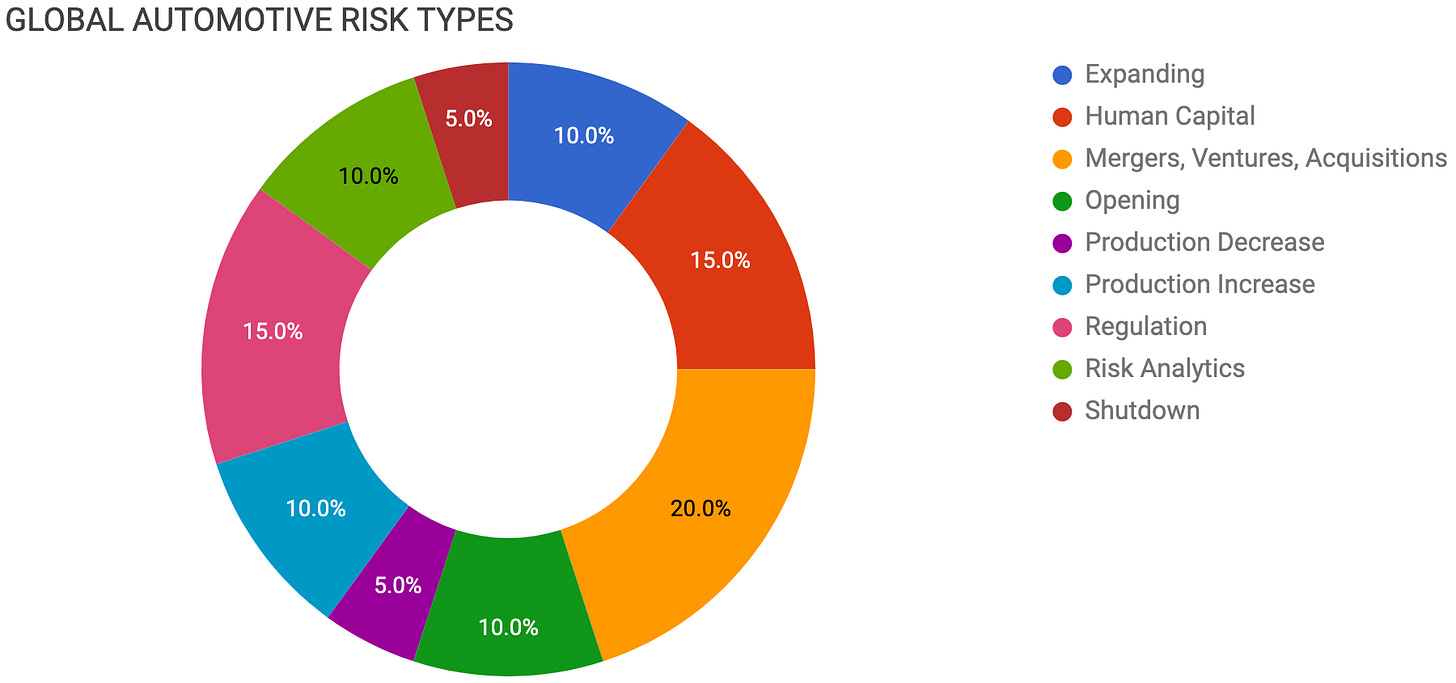

Contents

EXPANDING

Exo-s invests $14.6M in Querétaro expansion

KTMex expands Aguascalientes plant with $14.2M

HUMAN CAPITAL

BYD hiring 20k in Zhengzhou

Lear cuts 15k jobs, plans more

Goodyear cutting 850 jobs in Virginia

MERGERS, VENTURES, ACQUISITIONS

Nissan seeks partners after Honda talks collapse

KORE Power cancels $1B Arizona factory

Toyota launching Lexus EV unit in China

Europe funds Envision AESC battery gigafactory

OPENING

ArcelorMittal building $1.2B steel plant

Piston Automotive investing $55M in Detroit

PRODUCTION DECREASE

GM cutting third shift in Mexico

PRODUCTION INCREASE

Toyota's $14B EV battery plant operational

Xpeng aims to double EV deliveries

REGULATION

Volkswagen fighting India's $1.4B tax demand

India accuses Kia of $155M tax evasion

Auto suppliers warn of tariff impact

RISK ANALYTICS

US automakers face $40B tariff costs

Auto industry ranked most disrupted

SHUTDOWN

Infiniti ending QX50, QX55 production

Expanding

Canada's Exo-s will invest $14.6M to expand its plastic injection molding plant in San Juan del Río, Querétaro, Mexico. The expansion includes additional equipment to improve production capacity.

KTMex will invest approximately $14.2M to expand its automotive acoustics component plant in Aguascalientes, Mexico, including constructing a new facility. The French-Japanese company is a key supplier for major automotive manufacturers like Nissan, Honda, General Motors, Ford, and Stellantis.

Human Capital

BYD plans to hire 20k employees in Zhengzhou, China, in the first quarter, focusing on R&D and manufacturing. The facility, which currently has about 60k workers, aims to boost production capacity after producing 545k vehicles last year, a 169% increase.

Lear eliminated 15k jobs globally in 2024 and plans similar reductions in 2025 $ as part of its automation-driven cost-cutting strategy. The Michigan-based supplier is consolidating its manufacturing operations by closing or selling 18 factories while shifting labor-intensive wire harness production to lower-cost regions in Africa and Eastern Europe.

Goodyear intends to cut about 850 jobs at its Danville, Virginia, tire plant as part of a global restructuring plan announced in January. However, the facility will still produce tires and maintain its mixing operations.

Mergers, Ventures, Acquisitions

Nissan is seeking new partnerships following the collapse of merger talks with Honda. The talks ended after Honda proposed making Nissan a subsidiary, which Nissan rejected.

Among the potential candidates is Taiwan's Foxconn, which has shown interest in expanding its EV manufacturing business. As Nissan prepares to formalize its withdrawal from the Honda discussions at an upcoming board meeting, concerns mount about its ability to implement its turnaround strategy, which includes significant job cuts and capacity reductions.

KORE Power has canceled its $1 billion KOREPlex lithium-ion battery factory in Buckeye, Arizona, and is now selling the site due to corporate restructuring. The factory was projected to create 3k jobs and produce nickel manganese cobalt (NMC) and lithium-ion iron phosphate (LFP) battery cells for EVs.

Toyota will establish a wholly owned company in Shanghai, China, to develop and produce Lexus EVs and batteries. Production will start in 2027 with an initial capacity of 100k vehicles annually, creating approximately 1k jobs.

The European Commission has approved a $50M grant to support Envision AESC's second gigafactory in France, which will supply Renault's EV production in Douai. The facility, backed by $467M in European Investment Bank funding, aims for an initial capacity of 9 GWh, supplying up to 200k EVs, including the Renault 5, through Renault's Ampere subsidiary.

Opening

ArcelorMittal will invest $1.2B in a new electrical steel manufacturing facility in Calvert, Alabama, creating over 200 jobs. The plant will produce 150k metric tons of non-grain-oriented electrical steel annually, starting construction in late 2025 and production in 2027.

Piston Automotive is set to invest $55M to lease and renovate a 200k sq ft warehouse at the former Michigan State Fairgrounds in Detroit, where it will reportedly manufacture hydrogen fuel cells for General Motors.

Production Decrease

General Motors is reducing the third shift at its Ramos Arizpe plant in Mexico, impacting 800 workers. This decision was prompted by Honda's adjustments to the production of the Prologue EV, built by GM, to better align with market demand. Both companies have confirmed that this shift reduction is unrelated to the fluctuating 25% tariffs on Mexican imports.

Production Increase

Toyota's $14B EV battery plant in North Carolina is now operational and will begin shipping batteries for Toyota's EVs, plug-in hybrids (PHEVs), and hybrids in April. The plant, Toyota's first in-house battery facility outside Japan, spans over seven million square feet and is expected to reach an annual production capacity of over 30 GWh.

Xpeng plans to double its EV deliveries, totaling about 380k vehicles in 2025. In January, it delivered 30.3k cars, a 268% year-over-year increase, and aims to enter over 60 countries by year-end.

Regulation

Volkswagen is embroiled in a legal battle with Indian authorities over a $1.4B tax demand, which the automaker calls "impossibly enormous." The dispute hinges on allegations that Volkswagen misclassified completely knocked-down vehicle imports as separate parts to pay lower customs duties, a claim the company denies.

Volkswagen argues its import model was transparent and supported by prior government clarifications, asserting that the tax notice undermines India's "ease of doing business" policy. A loss in court could double Volkswagen's liability to $2.8B, raising concerns about India's investment climate for foreign automakers.

Like Volkswagen's case, Kia is also facing accusations of tax evasion in India. Authorities allege that Kia avoided $155 million in taxes by misclassifying component imports for its Carnival minivan, mirroring the strategy Volkswagen is accused of using. Kia denies any wrongdoing and claims to have provided evidence of its compliance.

Kia's potential exposure, including penalties, could reach $310 million if found liable. These cases highlight increasing tax scrutiny faced by foreign automakers in India, potentially impacting manufacturers relying on complex import structures within the country's high-tariff environment.

As the US, Canada, and Mexico delay tariffs and retaliatory measures until March 4, automotive suppliers have been vocal $ about the potential damage tariffs could cause, while automakers have taken a more measured approach.

Suppliers, already struggling with thin margins and lingering supply chain disruptions, warn that tariffs could lead to job losses, production shutdowns, and financial strain. "Nobody can absorb this kind of cost," said Linda Hasenfratz, chairperson of Linamar Corp.

In contrast, automakers and trade groups like the Alliance for Automotive Innovation have emphasized their willingness to work with the Trump administration while raising concerns about supply chain stability.

The uncertainty has prompted both sides to closely examine supply contracts, as tariffs could push some suppliers toward insolvency. Industry experts predict that even with temporary delays, trade unpredictability will persist, particularly with the USMCA set for review in 2026.

Risk Analytics

According to Bernstein analysts, US automakers could face up to $110M in added costs per day and as much as $40B annually due to proposed import tariffs.

Stellantis, GM, and Ford are among the most exposed, with 39%, 36%, and 18% of their North American production based in Mexico or Canada, respectively.

Volkswagen is even more reliant, producing about 75% of its North American fleet in Mexico, including popular models like the Jetta, Tiguan, and Taos.

This points to the interconnectedness of the industry, as US-built vehicles contain significant foreign content, with up to 40% of parts coming from Mexico and over 20% from Canada. Without significant shifts in production, these tariffs could have widespread cost implications across the industry.

The automotive industry has been ranked as the most disrupted major sector in the 2025 AlixPartners Disruption Index, surpassing healthcare, technology, and financial services.

Despite easing pandemic-related constraints and the temporary pause on new tariffs, supply chain vulnerabilities remain the biggest challenge for OEMs and suppliers.

"A lack of real-time visibility into supply chains remains a big problem and makes it tough for executives to prioritize action," said Dan Hearsch, Americas leader of the automotive and industrial practice at AlixPartners. "And that's why companies today need a deep and thorough understanding of their true current states and the options before them more than ever before."

Additionally, more than two-thirds of auto executives are adjusting growth strategies due to U.S.-China trade tensions, while inflation and high interest rates continue to affect pricing and demand.

A shortage of skilled talent has also emerged as a significant concern, with over half of respondents questioning their company's ability to attract top talent.

Meanwhile, AI and software-driven advancements are seen as key opportunities for revenue growth, though regulatory and compliance risks remain a concern.

Shutdown

Infiniti will discontinue the QX50 and QX55 production at the COMPAS plant in Aguascalientes, Mexico, raising uncertainty about the facility's future.

The plant, a joint venture between Nissan and Daimler, was established in 2017 to produce premium models for both companies. The move follows a challenging 2024 for Infiniti, with a 10.2% decline in US sales.

The QX50, its second best-selling model, saw 10,722 units delivered but will be phased out along with the QX55. Infiniti plans to shift focus toward higher-margin vehicles, including the refreshed QX60 and the new QX65, launching in 2026.

It remains unclear whether these new models will be built in Mexico. The company and the union initiated a worker "separation plan" in mid-2024 to manage job reductions in response to production cuts.

Whilst I often wonder why the recognition button had to be a red love heart, and being of an age where emoji's in general strike me as an oddity, I have grown accustomed to pressing it when I read great articles. Thanks for the mention ☺️

Again, great work 💚