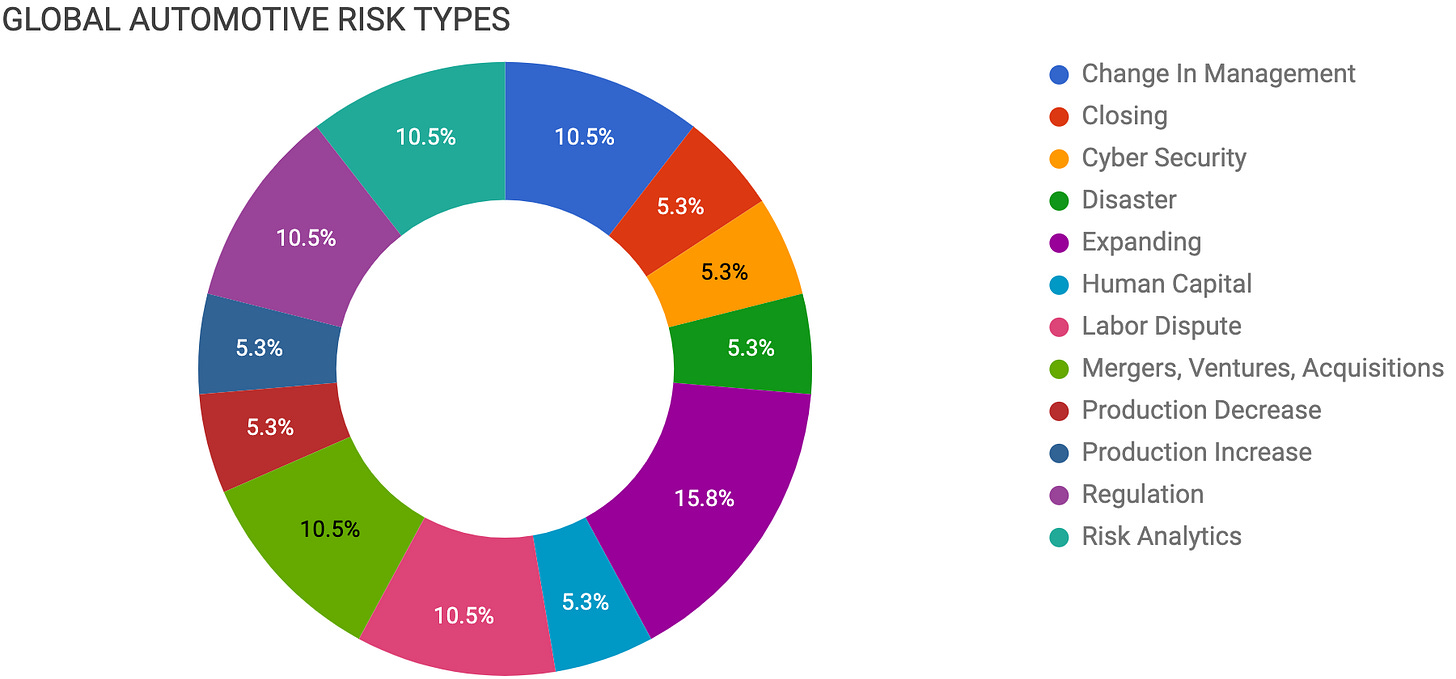

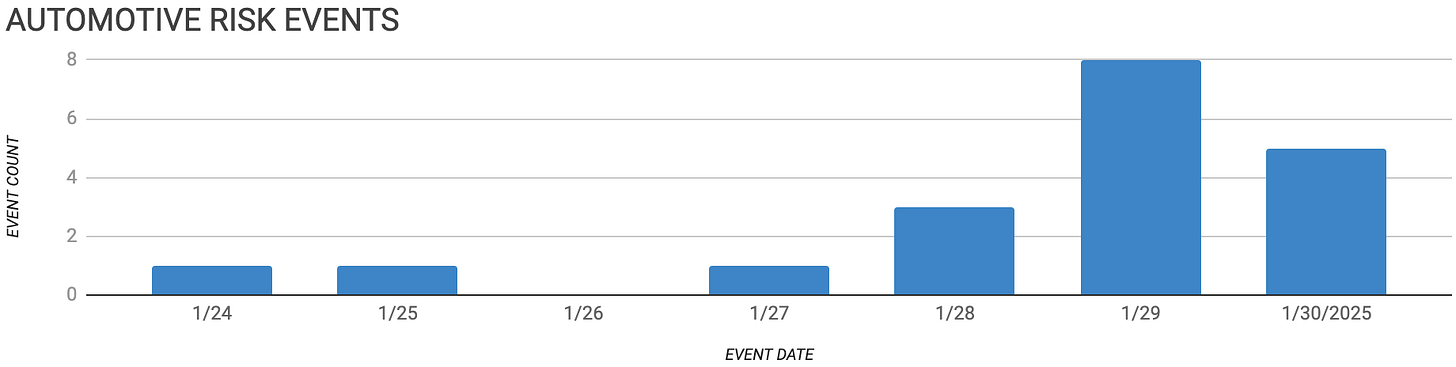

Automotive Supply Chain Risk Digest #417

January 24 - 30, 202, by Elm Analytics

Contents

CHANGE IN MANAGEMENT

Northvolt North America CEO steps down

Honda Canada CEO retirement, successor named

CLOSING

Continental closing multiple German plants

CYBER SECURITY

Stellantis, Yanfeng settle ransomware lawsuit

DISASTER

Fire destroys cars at Mahindra facility

EXPANDING

Honda invests $1B in Ohio plants

Volkswagen may move EV production to US

JLR expands luxury paint facilities

HUMAN CAPITAL

Nissan cutting shifts, offering buyouts

LABOR DISPUTE

BlueOval SK workers file for union vote

Trump fires NLRB appointees, halting cases

MERGERS, VENTURES, ACQUISITIONS

American Axle acquires Dowlais Group for $1.44B

Stellantis takes full control of Punch Powertrain

PRODUCTION DECREASE

UK car production drops to 70-year low

PRODUCTION INCREASE

Toyota remains world’s top automaker

REGULATION

Companies accelerate shipments ahead of tariffs

Mexico’s investment plan offers tax incentives

RISK ANALYTICS

Coping with tariff and supply chain risks

Trump tariffs impact nearly all automakers

Change In Management

Paolo Cerruti, co-founder of Northvolt, is stepping down as CEO of the North American division but will remain chairman of its Canadian entity and involved with the Quebec-based Northvolt Six battery plant. Karen Chang will be the interim CEO.

This change follows the resignation of co-founder Peter Carlsson in November after the company filed for US Chapter 11 bankruptcy. Although Northvolt's Canadian and German operations were not part of the bankruptcy, delays in the Canadian plant timeline and the loss of government funding have contributed to ongoing financial difficulties.

Honda Canada CEO Jean Marc Leclerc will retire🔒 on April 1, after 30 years, with Dave Jamieson, his successor and a veteran of the company, stepping in to lead.

Closing

Continental is set to close several Contitech plants across Germany, impacting around 580 jobs in Thuringia, Lower Saxony, North Rhine-Westphalia, and Saxony due to declining demand in the automotive sector.

While the company plans to reassign some affected employees, labor representatives have criticized these closures as part of a persistent restructuring cycle. Despite these job cuts, Continental recently reported a 63% profit increase, attributed mainly to its automotive supply and tire divisions.

Cyber Security

Stellantis and Yanfeng have settled lawsuits🔒 related to a November 2023 ransomware attack that disrupted production at multiple Stellantis plants. Stellantis initially sought $26M in damages and $300M in lost revenue.

This resolution alleviates a significant legal challenge as the automaker works to stabilize its operations following CEO Carlos Tavares' departure, highlighting the growing cybersecurity risks in automotive supply chains.

Disaster

A fire at a Mahindra facility in Kondapur, Hyderabad, India, destroyed 8 to 10 new cars. Multiple fire departments responded, and the cause is still undetermined.

Expanding

Honda is increasing its investment in three Ohio auto plants to $1B, up from the $700M announced in 2022, to enable flexible production of EVs, hybrids, and gas-powered vehicles on the same assembly lines. The investment is part of its broader $4.4B Honda EV Hub, which includes a joint battery plant with LG Energy Solution.

Volkswagen is reportedly considering moving production of Porsche and Audi EVs to the US in response to potential import tariffs. The company plans to expand its Chattanooga, Tennessee plant or utilize its upcoming facility in South Carolina.

This shift would increase US-based EV production, reduce tariff risks, and strengthen its domestic supply chains as the company aims to remain competitive amid declining global EV sales.

JLR is investing $80M to expand its paint facilities in Castle Bromwich, England, and Nitra, Slovakia. This will enable 17k additional custom paint orders annually and offer unlimited color options while enhancing sustainability. The upgrades aim to significantly reduce carbon emissions and increase profitability from personalized paint options, as the luxury automaker sees growing demand for bespoke vehicles.

Human Capital

Due to poor sales in China and the US, Nissan is cutting production shifts and offering voluntary buyouts at its Smyrna, Tennessee, and Canton, Mississippi plants.

The reductions are part of a global strategy to reduce production capacity by 20% and eliminate 9k jobs worldwide.

While the exact number of affected US employees is unclear, up to 2k may take buyouts. The company aims to avoid layoffs and improve efficiency amid financial difficulties and a pending merger with Honda.

Labor

Workers at BlueOval SK in Kentucky have filed a petition with the National Labor Relations Board (NLRB), marking the first significant union election in the South for 2025.

Soon after, US President Donald Trump fired Democratic appointees from the NLRB, leaving the commission without a quorum and stalling key enforcement actions, including cases against Tesla. The removals consolidate White House control over historically independent agencies, impacting workplace protections and labor rights enforcement.

Mergers, Ventures, Acquisitions

American Axle & Manufacturing (AAM) is set to acquire UK-based Dowlais Group in a $1.44B cash-and-stock deal to enhance its global footprint and diversify its powertrain portfolio. The merger will result in approximately $12B in annual revenue, with AAM shareholders owning 51% of the combined entity.

By expanding its global presence and product offerings while addressing supply chain vulnerabilities, the acquisition positions AAM for long-term stability in a rapidly evolving auto industry.

Stellantis has agreed to fully purchase control of its joint venture with Belgium's Punch Powertrain, enhancing its hybrid vehicle technology and dual-clutch transmission production capabilities. However, it did not disclose the financial terms of the deal.

Production Decrease

British car production dropped to 780k vehicles in 2024, the lowest level in seven decades outside of the pandemic, as manufacturers paused operations to transition to EV production amid weak global demand.

Stellantis shifted to van production at Ellesmere Port, and JLR paused Jaguar manufacturing, which led to a decline in output. Nissan stayed the UK's largest automaker, but Sunderland's production fell 13%.

Leaders warn of disruptions from potential tariffs and stricter EV mandates, predicting production may not surpass one million vehicles until 2028.

Production Increase

Toyota remained the world's top-selling automaker in 2024 for the fifth consecutive year, selling 10.82M vehicles, supported by strong hybrid demand.

Regulation

Businesses across multiple industries, from automakers to food producers, are accelerating shipments to the US in anticipation of President Donald Trump's proposed tariffs, which could include duties on imports from Mexico and Canada as early as Saturday.

Automakers like GM and Toyota have expedited deliveries from their Mexican plants, while steel and commodity buyers have stockpiled inventory, leading to port bottlenecks.

Some companies remain hesitant to overstock without tariff certainty, recalling costly missteps from previous trade disputes. The uncertainty surrounding the scope and impact of potential tariffs has led to supply chain disruptions and concerns over rising costs.

The rush to import goods ahead of possible tariffs underscores trade policy volatility, with significant implications for supply chains, pricing, and industry competitiveness.

President Sheinbaum's Mexico Plan aims to attract local and foreign investment by offering extensive tax incentives, streamlined administrative processes, and targeted support for infrastructure development across key sectors. The plan also encourages the relocation and restructuring of supply chains to enhance manufacturing capabilities.

Risk Analytics

S&P Global Mobility: Trump's automotive tariffs would impact nearly all OEMs