Automotive Supply Chain Risk Digest #414

January 3 - 9, 2025, by Elm Analytics

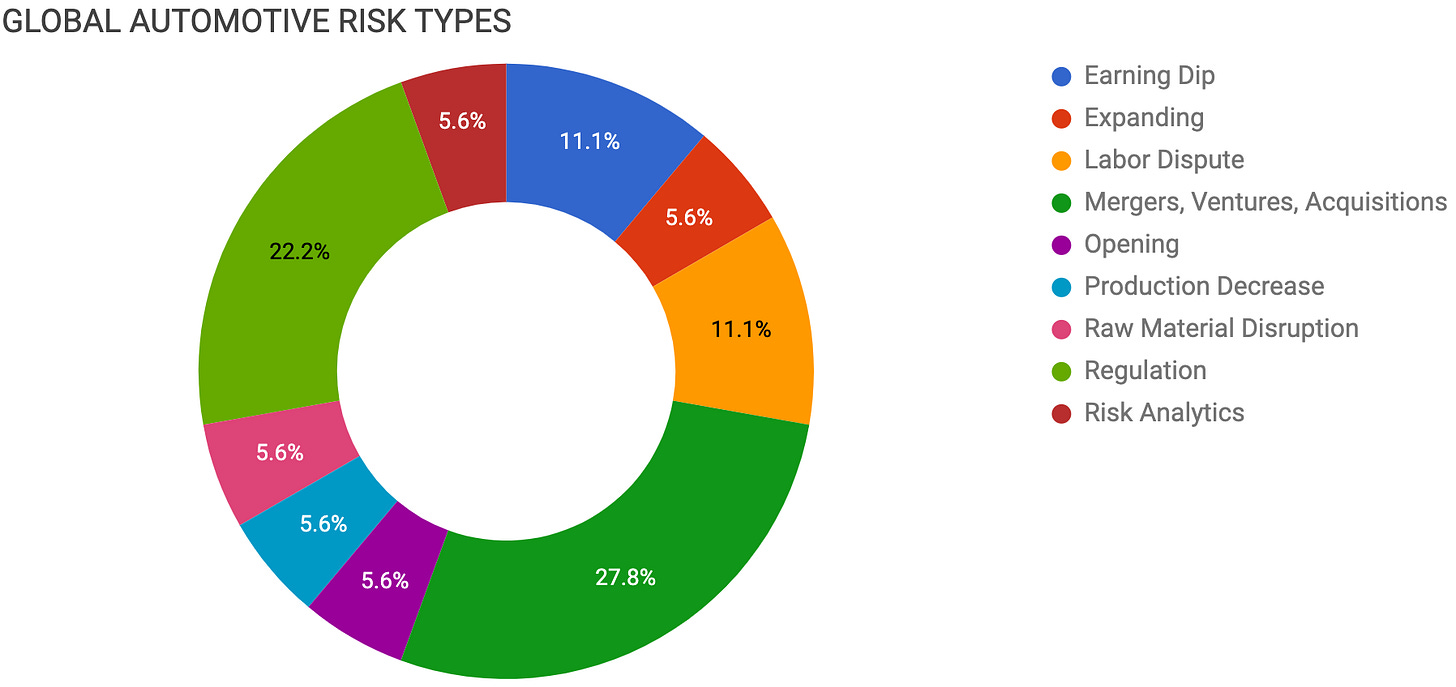

Contents

EARNING DIP

LG Energy faces $154M Q4 loss

Tesla US sales drop 5%

EXPANDING

Hyundai plans $16.7B local investment

LABOR

US dockworkers avert major strike

UAW seeks Ford battery plant union

MERGERS, VENTURES, ACQUISITIONS

Honda-Nissan partnership targets flexibility

Mazda, Panasonic building battery plant

SAIC expands partnership with CATL

Mahle sells US powertrain division

Mexico launches Olinia EV production

OPENING

Doosung Tech opens EV component plant in Mexico

PRODUCTION DECREASE

Stellantis Italian production hits record low

RAW MATERIALS

EV battery prices face stabilization

REGULATION

US blacklists Chinese battery maker CATL

Auto suppliers shift production to avoid tariffs

Trump may roll back emissions standards

Regulatory changes challenge supply chains

RISK ANALYTICS

Trump policies heighten import compliance risks

Earning Dip

LG Energy Solution posted an unexpected $154M operating loss in Q4 2024, its first in three years, due to falling EV demand and a 19% sales drop. Automakers like GM have cut battery orders and scaled back EV production, contributing to a 20% price drop. Competing with Chinese firms like CATL and BYD, LG faces challenges from geopolitical issues and reduced EV incentives under the new Trump administration.

New estimates suggest Tesla's US sales declined by 5% in 2024, despite the launch of the Cybertruck and record incentives, including discounts and subsidized financing. This is a sharper decline than the 1% drop we reported in last week's digest. While Cybertruck added over 30k units to US deliveries, Tesla's overall US sales still fell by more than 34k.

Analysts attribute the drop to slowing demand, inventory adjustments, and potential brand damage from Elon Musk's polarizing public image. Globally, Tesla saw a 10% decline in Europe and 8% growth in China, though growth in China is slowing.

Expanding

Hyundai plans to invest $16.7B in South Korea in 2025, a 19% increase from the previous year, focusing on R&D, EV production, and manufacturing upgrades. The investment includes $7.9B for research into electrification, hydrogen technology, and software-defined vehicles and $8.3B to expand EV and new model production.

Hyundai will introduce "hypercasting" technology at its Ulsan plant, following Tesla's Gigacasting model to streamline production and reduce costs. Hyundai's record investment exemplifies the urgency for global automakers to innovate and localize amid rising international competition, shifting trade policies, and evolving automotive technologies.

Labor

The International Longshoremen's Association (ILA) and the United States Maritime Alliance (USMX) reached a tentative six-year contract agreement, averting a strike at ports along the US East and Gulf Coasts. The deal addresses automation and balancing job protections with port modernization to enhance safety and efficiency.

The agreement prevents disruptions at ports handling over half of US container imports, which had faced backlogs during a three-day strike in October 2024. The resolution prevents significant disruptions to the automotive supply chain, safeguarding the flow of imported components critical for production.

The UAW's request for a union election at Ford's new battery plant in Glendale, Kentucky, a joint venture with SK On, is a significant development. The plant, set to commence production this year, has the union claiming a 'supermajority' of workers supporting unionizing. BlueOval SK has termed the move as premature due to incomplete hiring.

The outcome of this election will be a key test for labor under President Trump, following the UAW's 2024 labor charges against Trump and Elon Musk over alleged worker intimidation. A union win could potentially drive similar efforts at other battery plants and significantly shape labor's role in US EV manufacturing.

Mergers, Ventures, Acquisitions

In its potential merger with Nissan, Honda may seek short-term advantages $ in pickups, SUVs, and production flexibility. Leveraging Nissan's expertise in large vehicles like the Frontier, Armada, and QX80 could help Honda fill gaps in its US lineup, which currently focuses on unibody models like the Pilot and Ridgeline.

Honda may also benefit from Nissan's excess production capacity, alleviating pressure on its fully utilized North American factories. The partnership stems from Honda's push to reduce costs as it transitions to EVs, including developing its 0 Series EVs and $4.4B Ohio production hub.

Mazda is partnering with Panasonic Energy to build an EV battery plant in Yamaguchi Prefecture, Japan, with a capacity of 10 GWh annually. The factory will exclusively supply Mazda's new ground-up EVs, starting with a crossover launching in 2027. The plant will also support R&D, including a future transition to solid-state batteries.

SAIC has announced that it will enhance its partnership with battery manufacturer CATL to focus on the battery aftermarket and expand its overseas operations. CATL will assist SAIC in establishing an overseas after-sales service network and provide goods from nearby production facilities as part of a strategic cooperation agreement.

German auto supplier Mahle Group is selling $ its US automotive powertrain and engineering services business, Mahle Powertrain, to Belgium-based Dumarey Group amid consolidation in the competitive market. The deal, expected to close in Q1-2025, includes Mahle Powertrain's Plymouth Township office in Michigan and 70 employees focused on electric and hybrid powertrains.

The Mexican government announced the creation of Olinia, the country's first national electric vehicle assembly plant. The plant aims to produce affordable EVs designed by Mexican engineers. The project will manufacture three types of EVs on a multipurpose platform, with prices ranging from $4.4k to $7.3k, targeting urban mobility. Production will involve government and private companies collaborating, focusing on localized manufacturing to reduce costs.

Opening

South Korea's Doosung Tech has invested $25M to build a plant in Monclova, Coahuila, Mexico. The facility will begin operations this month and produce EV battery components, with most products destined for the US market.

Production Decrease

Stellantis' vehicle production in Italy fell 37% in 2024, reaching its lowest since 1956. The company produced 475k vehicles across its five Italian plants, down from 751k in 2023. Passenger car production saw the sharpest decline, with plants like Mirafiori and Modena posting drops of over 70% and 79%, respectively. Stellantis plans to invest $2.1B in Italy by 2026, focusing on EV production, including compact Alfa Romeo models and Jeep/Lancia crossovers.

Raw Materials

Lithium-ion EV battery prices have dropped significantly in recent years due to decreasing costs of key materials like cobalt and lithium, with cobalt prices falling from $70k/ton in 2022 to $30k/ton in 2024. The per kWh price of NCM811 cells is lowest in Greater China due to localized supply chains.

However, global prices are expected to stabilize or rise slightly as suppliers address unsustainable profit margins and supply chain constraints. LFP cells, currently 20% cheaper than NCM811, are dominated by Chinese production but are set to expand in Europe with new facilities from CATL and LG Energy Solution.

Despite initial price increases, improvements in manufacturing efficiency are expected to gradually lower costs. This understanding is essential for automakers as they seek cost parity with ICE vehicles and plan for next-generation EV production.

Regulation

The Pentagon has blacklisted China's Contemporary Amperex Technology Company (CATL), one of the largest EV battery manufacturers. This move raises concerns for US businesses working with CATL, which supplies battery technology to Ford's $3.5B EV factory in Michigan. CATL plans to contest the designation, which could lead to increased scrutiny of its partnerships and supply chain role in the US electric vehicle market.

The decision reflects rising tensions between the US and China and highlights worries about Chinese technology in critical industries like automotive. It may also disrupt US EV projects that depend on CATL's battery technology, complicating collaborations between automakers and Chinese companies.

Auto suppliers are strategizing to move production closer to the US in anticipation of the high tariffs promised by President-elect Donald Trump.

Bosch is exploring shifting production from Asia to regions like Mexico or Brazil, while Continental is working with North American suppliers to localize components further.

Panasonic Energy is accelerating efforts to remove Chinese materials from its US-made EV batteries.

Honda may also consider relocating production from Mexico, depending on tariff levels.

These actions reflect an industry-wide effort to mitigate risks of border taxes and supply chain disruptions under the new administration. The looming tariffs could reshape global automotive supply chains, increase costs, and force suppliers to localize production to remain competitive in the US market.

The incoming Trump administration's expected changes to vehicle, engine, and equipment emissions standards could have a significant impact on the industry. The potential rollback of regulations implemented under the Biden administration is anticipated, with possible modifications to EPA standards for 2027 model-year vehicles and California's ability to enforce stricter emissions rules under EPA waivers.

The administration may withdraw pending California waiver requests, such as the Advanced Clean Fleets regulation, and reassess recently approved waivers for key regulations like Advanced Clean Cars II and Heavy-Duty Omnibus Low NOx standards. This could lead to prolonged regulatory uncertainty, affecting compliance, production, and investments in emissions technology and supply chain infrastructure.

S&P Global: US Tariff Changes and Forecast Implications: 2025 Assumptions

Risk Analytics

Multinational companies face significant risks from the incoming Trump administration's focus on tariffs and supply chain issues. Anticipated policies include increased tariffs - potentially up to 100% for specific countries - and stricter enforcement of country-of-origin regulations to counteract tariff avoidance, particularly for goods with Chinese-origin content.

Heightened scrutiny under the UFLPA and other supply chain integrity measures is also expected. Importers face uncertainties around USMCA compliance, potential renegotiations, and expanded Customs audits via ACE data. Companies are advised to strengthen compliance efforts, diversify supply chains, and explore duty-saving strategies to mitigate disruption.

Navigating the evolving trade environment under the Trump administration will be critical for maintaining supply chain resilience and mitigating financial risks from increased tariffs and regulatory enforcement.

More details from Foley in What Every Multinational Company Should Know About … Managing Import Risks Under the New Trump Administration (Part I): Identifying Risks and Opportunities