Automotive Supply Chain Risk Digest #409

November 29 - December 5, 2024, by Elm Analytics

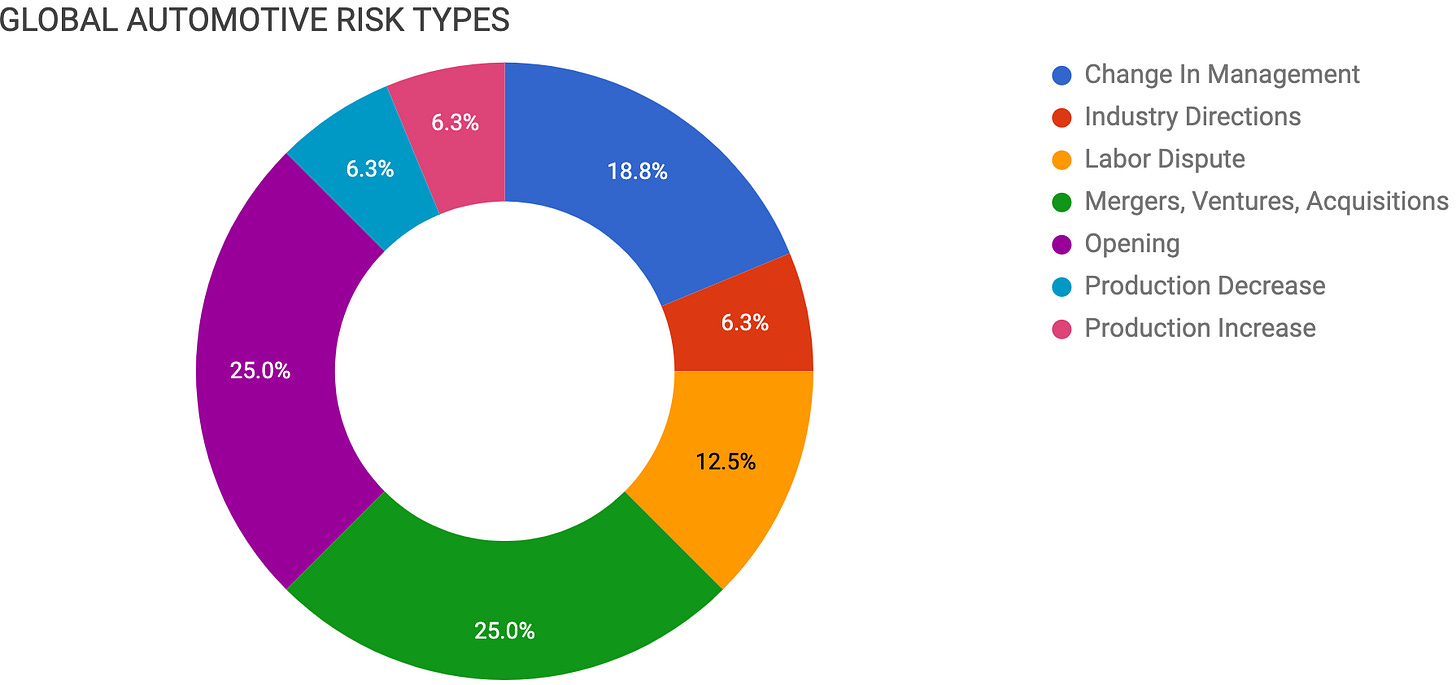

Contents

CHANGE IN MANAGEMENT

Stellantis CEO resigns amid US struggles

Nissan CEO faces pressure amid turmoil

Forvia appoints Martin Fischer as CEO

INDUSTRY DIRECTIONS

Supply chains adjust for geopolitical risks

LABOR DISPUTE

Volkswagen workers strike over job security

UAW workers strike at Missouri factory

MERGERS, VENTURES, ACQUISITIONS

Stellantis, Zeta Energy to develop batteries

Shanghai JV focuses on camera systems

VW resumes car production in Kenya

GM sells battery plant stake to LG

OPENING

Ford invests in Indonesia for EV growth

Shanghai Electric constructs Spanish factory

Audi Mexico builds battery plant in Puebla

ZF opens advanced e-mobility plant in China

PRODUCTION DECREASE

Opel reduces shifts at Rüsselsheim plant

PRODUCTION INCREASE

Lucid begins Gravity SUV production

Change In Management

Stellantis CEO Carlos Tavares has resigned immediately due to differences with the board as the company faces declining sales and profitability in the U.S.

Tavares, who oversaw the 2021 merger of Fiat Chrysler and Peugeot, was under pressure from shareholders and dealers and had planned to retire in 2026.

Stellantis has reported a steep drop in US sales, resulting in layoffs and a 50% decline in stock price this year.

Until a new CEO is appointed, Chairman John Elkann will manage operations while the company continues its transition to electric vehicles and works to stabilize its North American operations.

This leadership change comes at a challenging time for Stellantis amid sluggish US sales and slow EV adoption.

In an October meeting with managers, Nissan CEO Makoto Uchida reportedly painted a grim picture of the company’s financial health, citing weak sales in North America and China.

Managers questioned the absence of hybrids in the US market and broader strategic missteps, which Uchida attributed to management failures and a rapidly shifting business environment.

Nissan has been forced to cut jobs, scale back production, and implement $2.6B in cost reductions as part of a recovery plan. Critics, including analysts, have described Nissan’s struggles as a “man-made disaster,” with Uchida under pressure to avoid further declines.

Like Stellantis’ Carlos Tavares, Uchida’s ability to weather this storm will determine whether he can retain his leadership in a turbulent industry.

France’s Forvia has appointed Martin Fischer as its new CEO, effective March 1, 2025. Fischer, formerly on ZF Group’s management board, will initially join Forvia as deputy CEO today to facilitate a transition from outgoing CEO Patrick Koller.

Fischer brings extensive experience in automotive safety, electronics, and regional leadership roles, including North and South America, during his tenure at ZF and prior roles at BorgWarner and Siemens VDO. Koller will remain on Forvia’s board until May 2025 to support the transition.

Industry Directions

Geopolitical tensions between the US and China are prompting developers of lidar and advanced driving technologies to restructure their supply chains $, emphasizing regional diversification.

Luminar Technologies, for example, has created distinct supply chains for North America and China to mitigate geopolitical risks, CEO Austin Russell revealed during a December 3 panel at the Alliance for Automotive Innovation conference.

These adjustments come amid US restrictions on Chinese hardware and software and anticipated new tariffs on imports. Automakers face additional challenges balancing the need for rapid, cost-effective deployment of advanced driver assistance systems with reliance on specialized suppliers.

“If you want to go fast, it’s going to be more expensive for a while,” said Jim Adler of Toyota Ventures, underscoring the long-term cost pressures on the supply chain.

Labor

Nearly 100k workers at nine Volkswagen factories in Germany went on short strikes, demanding job security as ongoing wage negotiations with the union, IG Metall, continue.

The union rejected Volkswagen’s proposed 10% wage cuts and warned of more protracted strikes if no agreement is reached. Volkswagen has cited declining European demand and competition from Chinese automakers for the cuts.

This is the company’s first labor strike since 2018, as tensions rise over concerns about job security and living standards.

Over 70 UAW members have united in a strike at the Faurecia auto parts factory in Dexter, Missouri, on December 3. This collective action was taken due to safety concerns, ergonomic issues, and demands for fair wages.

It marks the first strike at the facility, driven by frustrations over stalled contract negotiations and attempts by the company to alter seniority and overtime rules.

Mergers, Ventures, Acquisitions

Stellantis has teamed up with Zeta Energy to develop lithium-sulfur batteries for electric vehicles, aiming for implementation by 2030.

This new technology avoids costly materials like nickel and cobalt, potentially reducing costs by over 50% per kWh. The batteries are lighter, offer similar energy capacity, and charge faster.

Pre-production is already underway, with plans to manufacture them using existing gigafactory technology and a local supply chain in Europe or North America.

Based in Shanghai, Voyager Tech has partnered with Shanghai MEKRA Lang Vehicle Mirror Co to establish a joint venture focusing on the research, development, production, and sales of camera monitor systems.

Volkswagen has announced plans to resume car production in Kenya by the end of 2024, scaling up operations in collaboration with Kenya Vehicle Manufacturers. The expansion includes producing five additional models driven by market demand and positioning Kenya as the hub for VW’s East African operations.

This marks VW’s return to Kenyan manufacturing, following earlier efforts in 2016 and a four-decade hiatus since the 1970s.

General Motors will sell its stake in the nearly completed Ultium Cells battery plant in Lansing, Michigan, to LG Energy Solution, citing an adjusted capital strategy.

LG Energy will repurpose the facility to produce batteries for another automaker, though the customer has yet to be disclosed. Initially expected to create 1,700 jobs, the plant will remain under LG Energy’s operation, with equipment installation beginning immediately.

Despite this sale, GM continues to operate Ultium battery plants in Ohio and Tennessee and will focus on integrating new prismatic cell technology under its extended partnership with LG Energy.

The sale reflects GM’s strategic prioritization of capital efficiency and ability to meet EV demand with existing facilities while adapting its battery technology portfolio to remain competitive.

Opening

Ford is set to open an EV manufacturing plant in Indonesia, capitalizing on the country’s abundant nickel reserves and increasing demand. This move follows a $4.5B investment in a nickel processing project in Sulawesi, slated to start in 2026.

By investing in Indonesia, Ford aims to secure essential materials for EV batteries while tapping into a strategic market with a young workforce and significant growth potential.

Shanghai Electric has begun constructing a second automotive fastener factory in Tarragona, Spain, through its subsidiary Nedschroef. The facility, part of a three-year action plan to optimize production and enhance efficiency in the European automotive market, follows its acquisition by Shanghai Electric a decade ago.

Audi Mexico has broken ground on a High Voltage Battery Assembly Facility in Puebla, marking the first Audi plant outside Germany to produce high-voltage batteries and modules. The facility spans approximately 362k sq ft and will have a daily production capacity of over 300 batteries.

ZF has opened its third e-mobility plant in Shenyang, China, to produce advanced three-in-one electric drive axles for new energy vehicles. The plant is preparing for mass production in 2025 and fine-tuning assembly and testing lines. In 2022, ZF expanded its Hangzhou and Shenyang facilities, focusing on 800V drive axles and electric motor systems.

Production Decrease

Opel has reduced operations at its Rüsselsheim plant in Germany to a single shift until the end of January, citing weaker-than-expected sales of the DS 4, a sister model to the successful Astra. The plant, which employs approximately 1.6k workers, faces challenges amid a strained automotive market.

This decision comes just months after Opel introduced new electric vehicle models, including updates to the Mokka Electric and the launch of the Frontera electric SUV. The production slowdown highlights automakers’ challenges in balancing electric vehicle rollouts with fluctuating market demand, straining operational capacity.

Production Increase

Lucid Motors has begun production of its first Gravity electric SUVs at its Casa Grande, Arizona plant, with initial customer-ready units rolling off the line. The Gravity is the second model to enter production after the Air sedan, which faced slower-than-expected sales despite recent delivery records.

Lucid began pre-production of the Gravity in July and now transitions to full-scale manufacturing as it works to expand its capacity and meet growing demand. The company’s ability to efficiently scale the production of new models like the Gravity will be critical in addressing operational challenges and competing in the growing EV market.